The 2000s in accounting was hit by appalling scandals that shook the global finance world at multiple levels. The scams were ripping, incessant and they were breaking trust. As the list stretched with names like Worldcom, Tyco, and Enron, adding to it, the lawmakers got pressured to pin the accountability. The post-trauma scrutiny of these infractions birthed the Sarbanes-Oxley law of 2002. While the law seemed impeccable since the beginning, its execution kept leaders in a fix for almost two decades.

Among many other developments that followed, the most prominent was the American Accounting Association’s (AAA) suggestion of merging CFO and COO roles. The idea was readily hailed by frontrunners.

"Executives, particularly those who recognized [Sarbanes-Oxley’s] advantages from the beginning, have figured out how to leverage the new law so that … plans for improvement can be realized,"-Harvard Business Review

But for the CFOs the news wasn’t something new. Accustomed to towering expectations, CFOs, over the years, have stretched themselves at many ends to meet the ever-expanding responsibilities. Here’s what their role looked like in 2017:

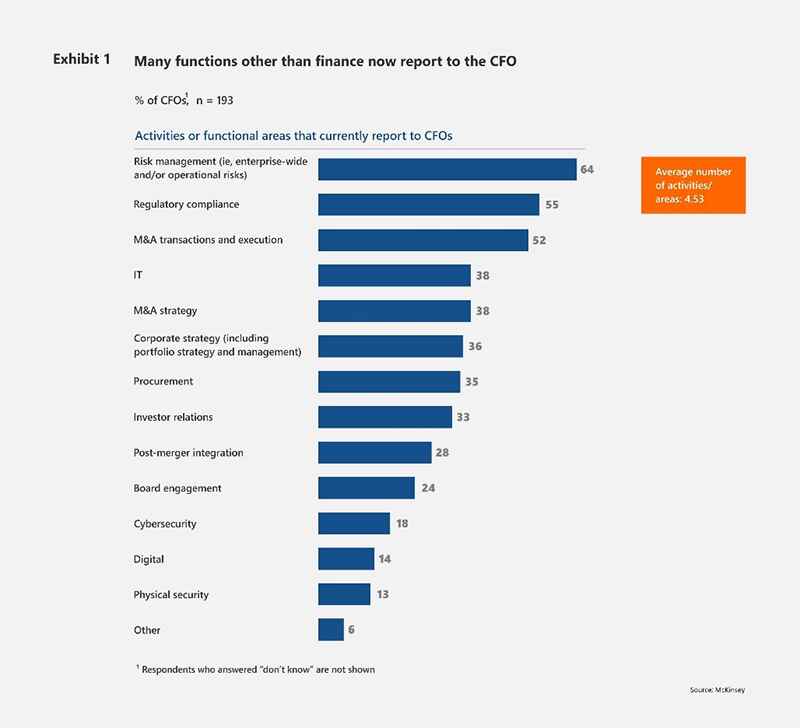

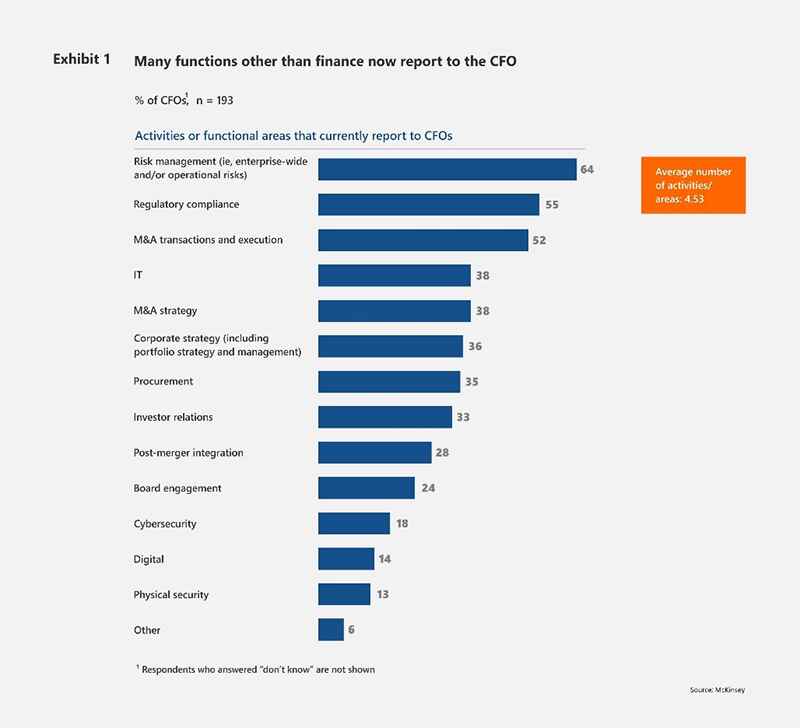

“More than half of CFOs say their companies’ risk, regulatory compliance, and M&A transactions and execution report directly to them, and 38 percent of CFOs are responsible for IT. Some CFOs even manage cybersecurity and digitization.”-McKinsey

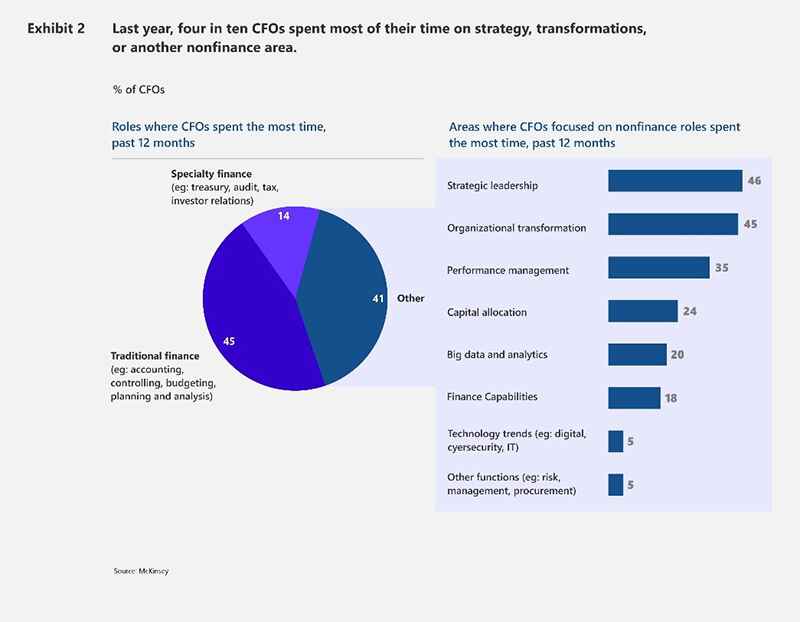

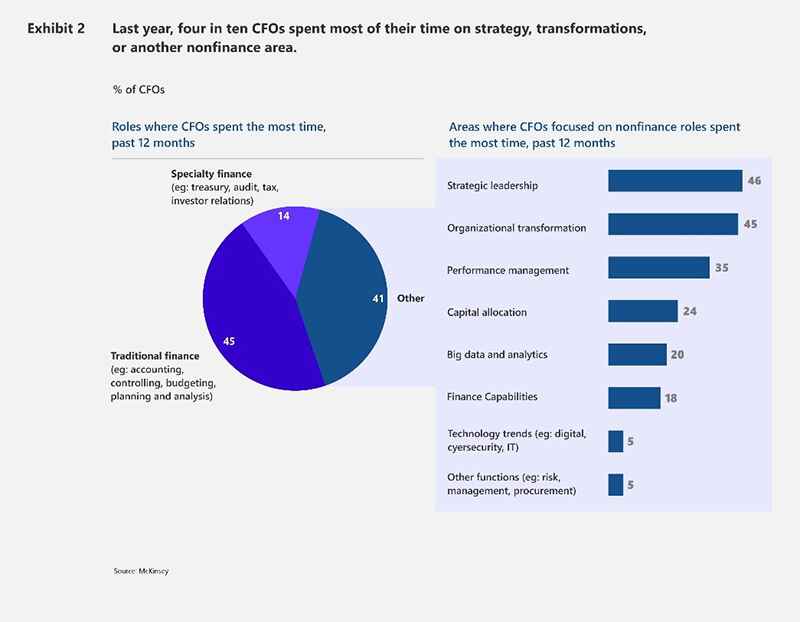

And their efforts brought results. In McKinsey’s 2017 survey only 18 percent of CFOs said they created value with finance work while 22 percent of CFOs said they created value through strategic leadership. But both the CFOs and the visionaries knew that more was to be done.

Two-Thirds of CFOs said they need to spend more time on strategic leadership.

“CFOs can play an active role in extending the organizational financial planning and analysis capabilities to the IT function, ensuring better planning and forecasting, with long-term investment requirements in mind.”- Cognizant

“Almost all of [PepsiCo’s] CFOs — divisional, country, and so forth — come from the planning or strategy and business development side rather than the accounting teams,”- Andreas Schulmeyer, CFO of Better Choice

4 Reasons Why CFOs are Better Rooted for Strategic Leadership

CFO’s role has been continuously expanding. From behind-the-scene managing of books and records, financial reporting, statutory compliances to strategy, and decision-making.

“Today’s CFOs must break away from the number-cruncher stereotype and think of themselves as more of a strategic player in the company. CFOs today need to be creative, understand best practices, and know how to create more value for the company. There will always be a need for someone to balance the books, crunch the numbers, and perform critical routine tasks but the CFO role is much more dynamic today.” – Bill Tobia, LLR Partners’ Managing Director of Strategic Finance

#1 Insight into Actual Performance

CFOs are familiar with many business activities and initiatives and have organization-wide reliability for measuring value creation. They have a history of sponsoring transformations backing them.

To an untrained non-finance oriented eye, a USD 250 million uptick in the company’s earning may appear a remarkable achievement but it could be at the same rate at which the market would have grown. A transformation that resulted in a 5 percent slump in earnings might look like a failed effort but the overall market share may have fallen by 15 percent. Only CFOs can discern this. Hence they are better placed to lead.

#2 Vision and Focus

Manager driven transformations are most likely to lean to “the fat looking pie” or one that grabs most attention. But CFOs can accurately evaluate the worth of subtle transformations that bring greater and lasting value and percolate to the bottom line.

Managers are pressured to display accounting profits. This shifts their focus from long term benefits to yearly or quarterly earnings. CFOs can easily pull non-value creating activities from the P&L statements.

# 3 Holistic picture

CFO’s technical skills and sound judgment can help in establishing the valid baselines for analyzing the true improvements. Numbers are sound footings to communicate with investors and to float performance internally.

Managers often depend on the common assumption that improving sales will improve performance. However, while landing at this assumption they often miss a reality check of discounting the rising operating costs or the shrinking product margins. The relationship between fixed costs, variable costs and revenue is dynamic. CFOs can present a holistic picture here.

# 4 Organization-wide Reach

CFOs can create organization-wide objectives. They can create a space for transformation priorities in the formal budget. When CFOs are directly involved in decision-making, they can cut-down approval layers and unnecessary reports.

The Upshot

The C-suite acknowledges the growing influence and impact of the CFO’s role. While there have been no two opinions about the latter’s involvement in finance, a lot more is expected from them on the strategic front.

“72 percent of CFOs say they are significantly involved or the most involved executives in allocating employees and financial resources. Yet only 29 percent of other C-level executives say the same about their CFO peers.”-McKinsey

A KPMG/ Forbes survey conducted in 2015 incorporating feedback from 549 top executives said “Almost one in three CEOs worry that their CFO isn’t prepared for the challenges ahead.”

Though much has been achieved since then, CFOs need to gear up their efforts on the following fronts:

Get more insights!