| DM# |

Essential Knowledge Dimensions |

Application in Analysis & Decision-Making |

Frameworks & Techniques |

Concepts and Principles |

| A |

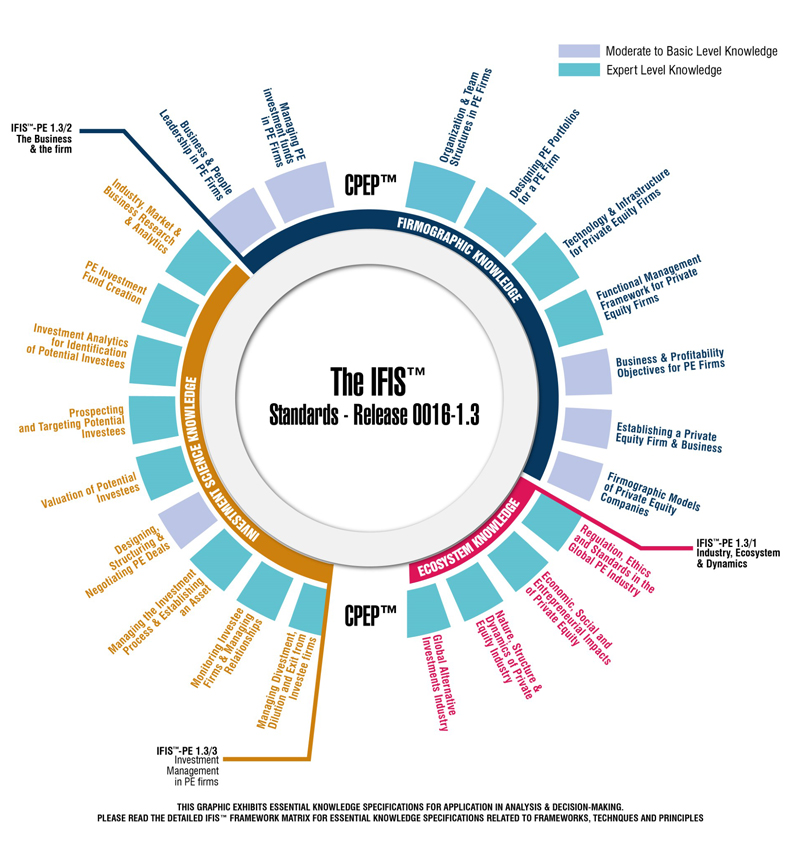

IFIS™-PE-1.3/1: INDUSTRY, ECOSYSTEM & DYNAMICS |

| MA-1 |

Global Alternative Investments Industry |

Expert Level |

Expert Level |

Expert Level |

| MA-2 |

Nature, Structure & Dynamics of Private Equity Industry |

Expert Level |

Expert Level |

Expert Level |

| MA-3 |

Economic, Social and Entrepreneurial Impacts of Private Equity |

Expert Level |

Expert Level |

Expert Level |

| MA-4 |

Regulation, Ethics and Standards in the Global PE Industry |

Expert Level |

Expert Level |

Expert Level |

| B |

IFIS™-PE-1.3/2: THE BUSINESS & THE FIRM |

| MB-1 |

Firmographic Models of Private Equity Companies |

Basic Understanding |

Moderate/ Functional Level |

Moderate/ Functional Level |

| MB-2 |

Establishing a Private Equity Firm & Business |

Basic Understanding |

Moderate/ Functional Level |

Moderate/ Functional Level |

| MB-3 |

Business & Profitability Objectives for PE Firms |

Basic Understanding |

Moderate/ Functional Level |

Moderate/ Functional Level |

| MB-4 |

Functional Management Framework for Private Equity Firms |

Moderate/ Functional Level |

Moderate/ Functional Level |

Expert Level |

| MB-5 |

Technology & Infrastructure for Private Equity Firms |

Moderate/ Functional Level |

Moderate/ Functional Level |

Expert Level |

| MB-6 |

Designing PE Portfolios for a PE Firm |

Moderate/ Functional Level |

Moderate/ Functional Level |

Expert Level |

| MB-7 |

Organization & Team Structures in PE Firms |

Moderate/ Functional Level |

Moderate/ Functional Level |

Expert Level |

| MB-8 |

Managing PE investment funds in PE Firms |

Basic Understanding |

Moderate/ Functional Level |

Moderate/ Functional Level |

| MB-9 |

Business & People Leadership in PE Firms |

Basic Understanding |

Moderate/ Functional Level |

Moderate/ Functional Level |

| C |

IFIS™-PE-1.3/3: INVESTMENT MANAGEMENT IN PE FIRMS |

| MC-1 |

Industry, Market & Business Research & Analytics |

Expert Level |

Expert Level |

Expert Level |

| MC-2 |

PE Investment Fund Creation |

Moderate/ Functional Level |

Moderate/ Functional Level |

Expert Level |

| MC-3 |

Investment Analytics for Identification of Potential Investees |

Expert Level |

Expert Level |

Expert Level |

| MC-4 |

Prospecting and Targeting Potential Investees |

Moderate/ Functional Level |

Moderate/ Functional Level |

Expert Level |

| MC-5 |

Valuation of Potential Investees |

Expert Level |

Expert Level |

Expert Level |

| MC-6 |

Designing, Structuring & Negotiating PE Deals |

Basic Understanding |

Moderate/ Functional Level |

Moderate/ Functional Level |

| MC-7 |

Managing the Investment Process & Establishing an Asset |

Basic Understanding |

Moderate/ Functional Level |

Expert Level |

| MC-8 |

Monitoring Investee Firms & Managing Relationships |

Basic Understanding |

Moderate/ Functional Level |

Expert Level |

| MC-9 |

Managing Divestment, Dilution and Exit from Investee firms |

Basic Understanding |

Moderate/ Functional Level |

Expert Level |