Introduction

The internal rate of return (IRR) is an important investment appraisal technique used to determine the feasibility of an investment proposal. Understanding this concept is crucial because, in corporate finance or investment analysis, IRR assists in decision making— evaluating whether the expected rates of return of a project or investment have been met. It is a very popular technique used by various business firms, investors, and even analysts to evaluate different investment prospects and the survivability of projects in the long run.

What is the Internal Rate of Return (IRR)?

Financial management uses the internal rate of return (IRR) to determine returns on internal investments. The discount rate makes the net present value (NPV) of cash flows equal to zero. In other words, the IRR is the rate of return that makes the present value of cash inflows equal to the present value of cash outflows.

The following are some of the significant aspects of the IRR:

-

Calculation Basis: IRR estimates cash flows, which are calculated for the future alongside initial investment expenses.

-

Investment decision: An investment is generally considered favorable when the IRR is greater than the required rate of return.

-

Time Value of Money: Unlike the other metrics, IRR considers the timing of cash flows, making this tool more flexible in performance measurement.

-

Multiple IRRs: When the internal rate of return is computed for a project with uneven cash flow, it is likely to have more than one IRR, making it challenging to analyze.

-

Common Usage: IRR measures the relative rates of return on different projects in capital budgeting, private equity, and corporate finance.

The Formula Behind Internal Rate of Return (IRR)

The IRR is defined as an internal rate of discount that will result in the project's net present value being equal to zero. It is obtained from previous attempts and consecutive estimation techniques instead of a single formula.

Formula and Key Components:

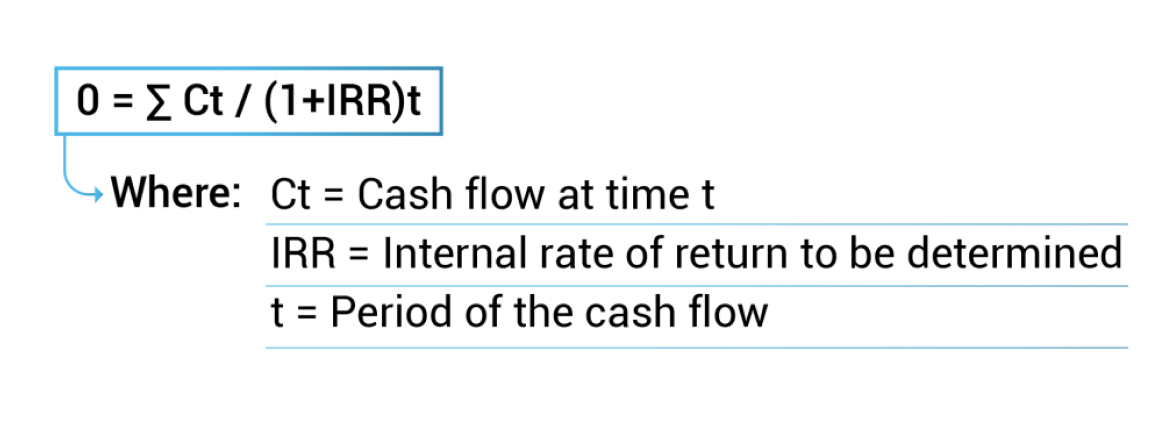

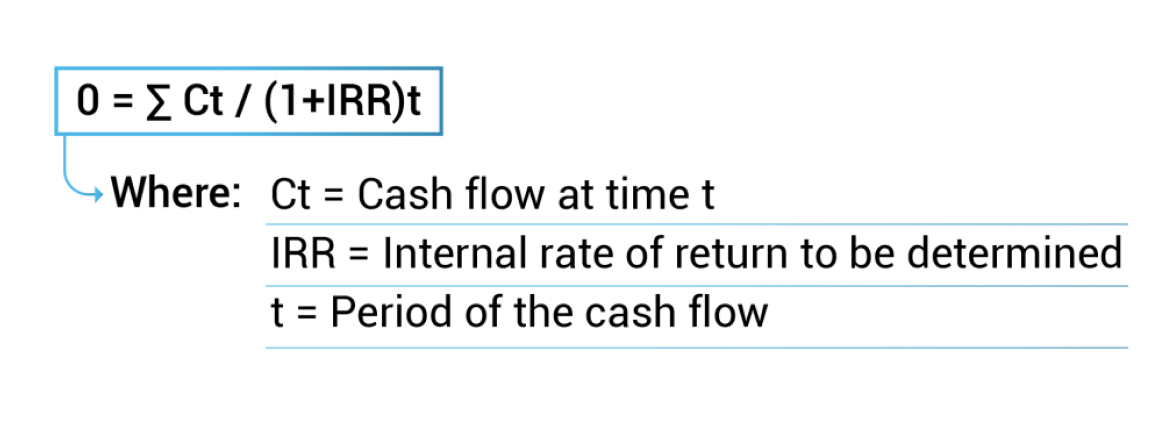

The standard formula for IRR is:

Step-by-Step Calculation Process:

-

It will focus on identifying all cash inflows and outflows that may occur during the entire investment period.

-

Use the above equation and try various IRRs if the NPV is equal to zero.

-

To get high accuracy, prefer numerical solutions like Newton Raphson or other software solutions to solve the equations.

Interpretation of Results:

-

A higher IRR means a better investment because it offers a better rate of return on investment.

-

The general rule is that a project is considered acceptable whenever its IRR exceeds the required rate of return.

-

In certain situations of non-conventional cash flow patterns, more than one IRR may exist, which merits further scrutiny.

How to Interpret Internal Rate of Return (IRR) in Investment Analysis

IRR is a significant measure of the internal performance of an investment since it always indicates whether a particular investment will be profitable or not. IRR interpretation assists investors understand if an investment will at least make the threshold return expected by the investors.

Key Interpretations of IRR:

-

Positive IRR: Their IRR is greater than the required rate of return hence likely to generate positive value. For example, if the IRR of a project equals 15% while the required return is 10%, then the investment is feasible.

-

Negative IRR: It shows that the total value of the investment is expected to decline in future, if the investment is initiated. If the IRR is below the required return or gives negative value, then it is better to reject or drop the project.

-

Comparison to Required Return: This rate of return can then be compared to the investor’s expected rate of return;, cost of capital or benchmark return rate. Therefore, if IRR is above this rate, it is an indication of a good investment opportunity.

Example

Suppose a project has an initial investment of US$ 100,000, required annual returns of US$ 30,000 for 5 years. If the IRR is 12% while the required return for the company is 8% that implies that the project will generate a return higher than the expected return hence is good for the company.

Practical Application of Internal Rate of Return (IRR) in Financial Decision-Making

IRR is widely used by organizations to determine the profitability of investment or specific projects. Here you can provide examples what major companies using IRR in making decisions:

-

Blackstone's Acquisition of Hilton Hotels: In 2007 Blackstone Group purchased Hilton Hotels through an LBO agreement that valued it at US$ 26 billion. This acquisition organized through a large amount of debt was initially controversial because of the economic crisis. However, following the listing on public offer in 2013, Blackstone majorly entered into an excessive profit, gaining an IRR of 19% on its stakes investment.

-

Berkshire Hathaway's Purchase of Dominion Energy's Gas Assets: In 2020, Berkshire Hathaway Energy bought Dominion Energy’s natural gas transmission and storage business for UD$ 4 billion cash plus an assumption of about US$ 5.7 billion of Dominion Energy debt amounting the total transaction value to nearly US$ 10 billion. This acquisition allowed Berkshire Hathaway to diversify into the energy sector for guaranteed long-term revenues apt for its improving investment management services.

Role of Internal Rate of Return (IRR) in Risk Assessment

The internal rate of return is used to compare profitability levels and evaluate risk factors of particular investment choices. Knowing how IRR works with the risks allows the target market to make the right choices when investing and managing possible losses.

How IRR Helps in Risk Evaluation:

-

Risk-adjusted return evaluation: IRR gives the rate at which the investment is expected to recover. When the risks associated with each investment are determined, investors can evaluate which project has a better return ratio. A higher IRR is usually preferred to a lower one, but it must be considered with the risk factor nearby.

-

Sensitivity to changes in assumptions: Since IRR factors in the timing and amount of cash inflows and outflows, any alterations therein will affect the value. For instance, scenario analysis means evaluating an investment with different scenarios, such as cash flows or cost changes, which provides a more stable or less volatile investment return.

-

Assessing the cost of capital: This is important because the IRR, compared to the company's Weighted Average Cost of Capital (WACC), helps in risk analysis. When the IRR exceeds the WACC, the investment is considered a risk-adjusted return over the required rate, reducing the perceived risk.

Common Misunderstandings of Internal Rate of Return

Despite being a widely used financial metric, the internal rate of return (IRR) is often misunderstood or misapplied, leading to incorrect investment decisions. Investors and analysts must recognize these limitations to avoid costly mistakes.

-

Assuming IRR is the Only Metric Needed:

Many investors use IRR as the only tool for making investment decisions. However, IRR alone may be misleading, especially when the cash flows are unequal, or the project lasts a year or more. Calculating NPV, risk assessment, and other parameters might also be necessary.

This means that if an investment has abnormal cash flows, for instance, flows that can be positive and negative at different times, then the investment will have more than one IRR. This leads to confusion and complicates the decision-making exercises that must be carried out daily. In such situations, the investment should be evaluated using other techniques, such as NPV or MIRR.

-

Overestimating the Reinvestment Rate:

IRR requires the intermediate cash flows to be reinvested at the same rate, which may not often be true. This assumption can inflate the projected returns, making investments seem more attractive than they are.

Conclusion

The IRR is widely used in various industries to measure investment profitability and make decisions about financial strategies. It has advantages in giving an outlook of possible returns, though it should not be used exclusively. Compared to NPV, ROI, and the payback period, such an evaluation provides a more comprehensive analysis. Combined with other financial ratios, IRR offers investors significant opportunities to achieve better strategic performance and mitigate risks.