Start-ups are risky pursuits. Most entrepreneurial successes are against-all-odds successes and are almost impossible to predict. Data suggests 9 out of 10 startups fail. For every one startup success like Uber, there are countless fickle failures all over the globe. This risk disposition puts them at odds with banks that are customarily risk-averse institutions restricted by usury laws to limit interests. Banks invest in hard assets. The new IT and disruptive technology businesses don’t need much of them. Moreover, to access the investment banks or public market, a company needs to show sales of around USD 15 million, assets of around USD 10 million and justifiable profit history.

So how does a new-age entrepreneur with little hard assets and skimpy revenue history find funds for her ideas? Here’s where Private Equity investors and Venture Capitalists come into the picture. Startups fail but sometimes they evolve into Google, Apple, Amazon too and one the glimmer of a single success washes out countless failures piled-up in the background. It’s a clean slate again to rewrite history.

Venture Capitalists:

Venture Capital investors invest in startups and small business that show exceptional potential. We can say they are another glamour name alternative for early days’ cowboy sidekicks; The entrepreneur’s personal cheerleader to boost morale and action. Venture capital investments benefit most when the innovation is being commercialized. 80% of their investments are used in building the necessary infrastructure or fixed assets and working capital. They do not invest for long term. The bottom line is to nurture and feed the company until it reaches substantial size and credibility and then to sell it to the investment bankers. Wealthy investors, banks and other financial institutions fall in this category. The investments can also be managerial or technical in nature. Venture capital investments are popular in companies with 2 years of less experience.

Private Equity Investors:

Private equity investors are high net worth individuals and companies who own or show interest in non-public or trading companies. These individuals buy shares in private companies or acquire control over public companies. The private equity fund has Limited Partners and General Partners. Limited Partners have limited liability and usually own 99 percent of shares. General Partners have full liability and own one percent of shares. General partners are responsible for the day-to-day operations of the firm. The capital can be used to establish new technology, acquire other setups, beef-up the working capital and enhance the balance sheet. Large institutional investors monopolize the private equity sphere.

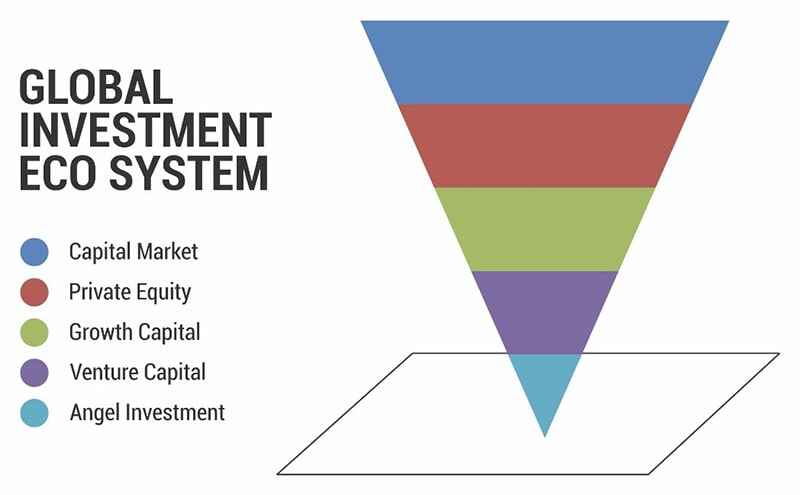

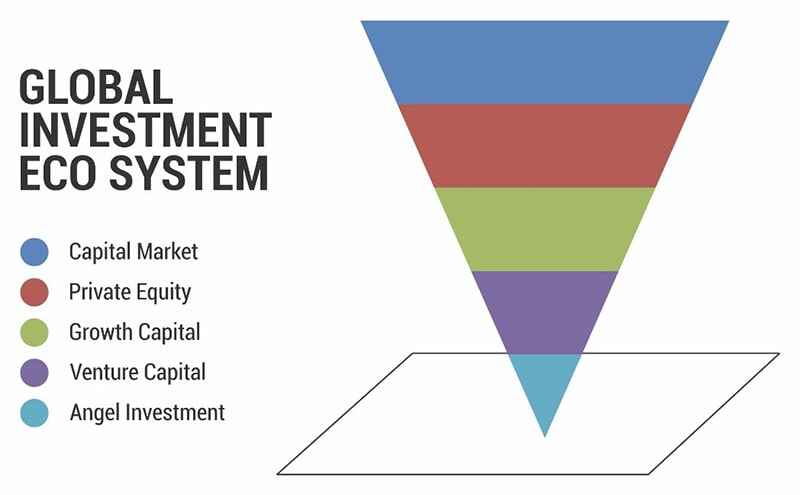

The Inverted cone of Global Investment Ecosystem:

Top Private Equity Employers:

- Apollo Global Management LLC

- Blackstone Group LP

- Carlyle Group

- KKR & Company LP

- Ares Management LP

- Oaktree Capital Management LP

- Fortress Investment Group LLC

- Bain Capital LLC

- TPG Capital LP

- Ardian

Top 10 Venture Capital Employers:

- Accel

- Andreessen Horowitz

- Benchmark

- Index Ventures

- Sequoia Capital

- Bessemer Venture Partners

- Founders Fund

- GGV Capital

- IVP

- Bond

Both Venture capitalists and Private Equity investors play a significant role in the large-scale success of any organization. Though their major contribution lies on the money front, they are partners in the organizations success and without them, great ideas would remain mere ideas.

Help build a promising business. Start your exquisite investment journey today. Get USPEC certified!