Introduction

The sources and uses of funds are paramount in financial management because they are responsible for maintaining the liquidity of the resource, by providing an idea of how to generate more income. Sources define where the money comes from—., equity, loans, or retained earnings, while uses define where the money goes— cash to operation or capital investments. Sources and uses analysis balances business decisions, cash flow, and growth. In this article, the framework of sources and uses table is explored, and, through examples, ideas are given for creating a complete source and uses table.

The Fundamentals of Sources and Uses of Funds

The sources and uses of funds framework are essential for analyzing how a business makes and allocates its financial resources. This framework allows organizations to maintain healthy cash flows, make sound financial decisions, and use available resources efficiently. A Balance Sheet is a guide for internal management and external stakeholders on where the financial inflows and outflows within a company occur.

Sources of funds refer to the origins of capital or financial resources that a business can use, such as:

-

Equity financing (e.g., stock issuance)

-

Debt financing (e.g., loans, bonds)

-

Internal cash flow (e.g., retained earnings, depreciation)

Uses of funds are the areas where a company allocates its financial resources, including:

-

Operational expenses (e.g., salaries, utilities)

-

Capital expenditures (e.g., purchasing equipment, property)

-

Debt repayment and interest obligations

A company's financial structure is crucial to understand and allows stakeholders to weigh its ability to pay obligations, invest in its growth, and manage risks. Maintaining a balance between sources and uses is critical to financial sustainability and long-term success.

Diverse Sources of Funds for Financial Growth

Funds can be gained from internal or external sources in any organization. Knowing where the sources of the funds come from is essential to sound financial planning so that the funds can be used to maintain liquidity, expand operations, and invest strategically. Below is an overview of the critical categories of funding sources:

Internal Sources:

-

Retained Earnings: Profits that go into the business rather than the shareholder's pocket. It is a low-risk and cost-effective source.

-

Depreciation Funds: Depreciation produces cash flow that can be reallocated to reinvest in new or better assets.

-

Working Capital Adjustments: Cash can be freed up without external financing if management efficiently manages current assets and liabilities.

External Sources:

-

Equity Financing: Raising capital by issuing new shares (common or preferred stock) dilutes ownership control.

-

Debt Financing: Businesses can borrow funds with loans, bonds, and credit lines, but interest is due.

-

Venture Capital and Crowdfunding: Investors are typically attracted to startups and innovative projects that they forecast will achieve high growth at the cost of equity or future returns.

Strategically combining these sources of funds can balance a business fund structure to support current and future needs. Each has advantages and disadvantages or risks, and each must be carefully scrutinized based on good fit and capacity to spend for the company in question.

Strategic and Operational Applications of Funds

Any organization's success depends on the proper allocation of funds. Financial resources in a business need to be strategically directed to run effortlessly and for growth and profitability. Here are the critical uses of funds across different business activities:

-

Operational Expenses: Businesses must consistently rely on funding to operate smoothly on a day-to-day basis. Salaries, utilities, rent, and inventory purchases fall into this category. Businesses without proper allocation to operational needs run the risk of disruptions.

-

Capital Expenditures (CapEx): Capital expenditures are investments in long-term assets like property, machinery, and technology. Without exception, expansion or modernization of infrastructure requires this and is directly related to future profitability.

-

Debt Repayment: Funds must be allocated to service debts, such as payment of interest and principal. This is important because it helps us contribute to a good credit profile and avoid default risks.

-

Dividend Payments: Companies with shareholders pay dividends out of their funds. This return on investment keeps shareholders engaged and can even increase the company's market value.

-

Strategic Investments: Businesses also use funds for growth-oriented activities (mergers and acquisitions, market expansion, product development, etc.). Investments like these are needed to sustain competitive advantage and pursue new revenue streams.

An organization's financial strategies can be adjusted to support ongoing operating requirements and future development plans, achieving a well-balanced and sustainable picture through deliberate control of the various uses of funds.

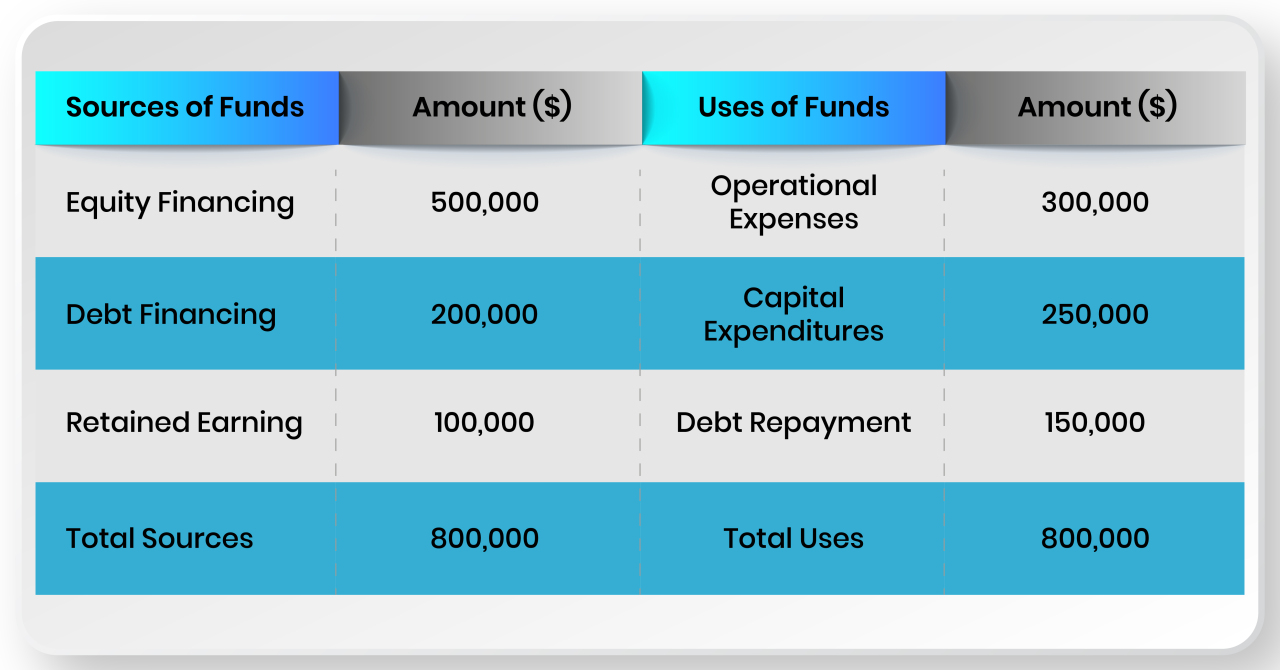

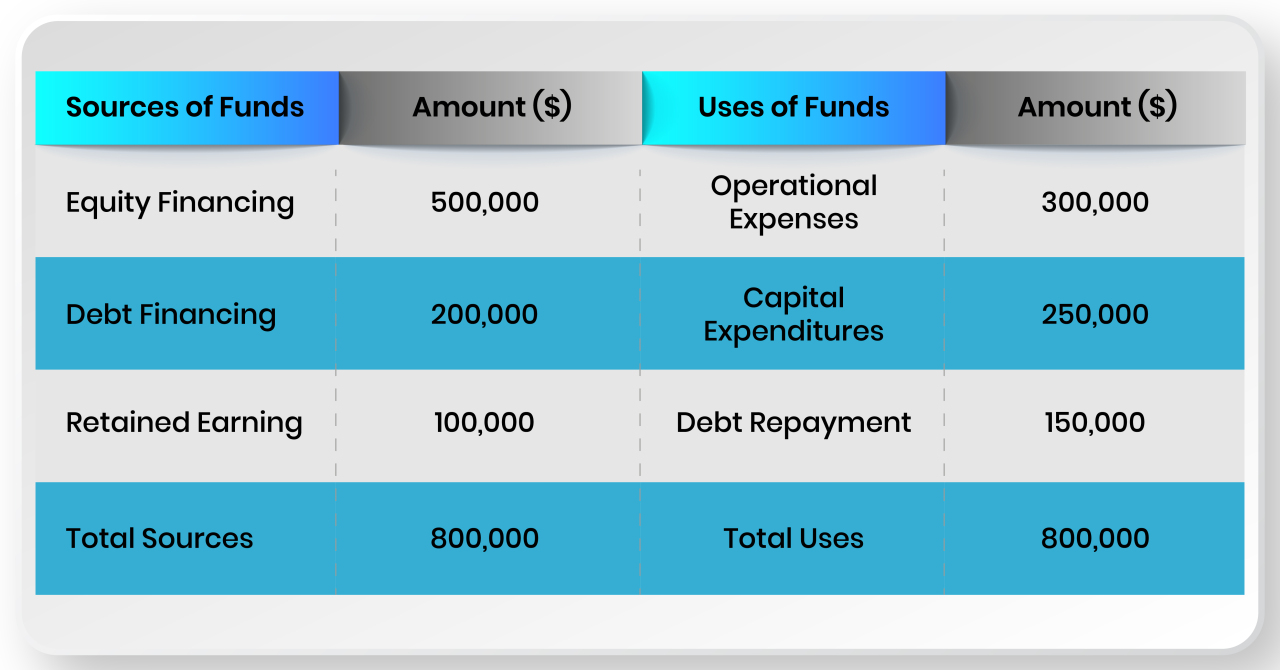

Creating and Analyzing a Sources and Uses of Funds Table

A structured table breaks down the sources and uses of funds to help visualize and understand the financial dynamics of a given business. A good sources and uses table can help show organizations where funds are coming from and where they're going, and it is essential to financial planning and strategic decision-making.

The Sources and Uses Table Structure

A typical source and uses table include the following components:

-

Sources of Funds: This section contains all the sources of funds. Common entries include:

-

Equity Financing: Sale of a corporation's shares bonds.

-

Debt Financing: Securing capital by loans and bonds.

-

Retained Earnings: Part of profits returned to business.

-

Uses of Funds: This section discusses how the funds will be spent. Key categories typically include:

-

Operational Expenses: Salaries and inventory costs associated with day-to-day business operations.

-

Capital Expenditures: Funds for long-term assets such as machinery or real estate.

-

Debt Repayment: Payments to decrease present obligations.

Practical Example

For illustration, consider a company planning its finances for the upcoming year. Simplified sources and uses table might look like this:

In essence, this table provides a balanced source and uses a table that allows stakeholders to evaluate an organization's financial health and sustainability. Regular updates and evaluations enable businesses to adjust their strategy depending on the current state of their finances, resulting in better liquidity management and operational efficiency.

The Importance of Balancing Sources and Uses

A company's financial stability and operational efficiency are based on the sources and uses of funds. Enabling businesses to streamline their cash flow, minimize financial pressure, and promote long-term sustainability when their funding sources match their ongoing expenditure needs. This balance is vital for several reasons:

-

Cash Flow Management: The right balance enables companies to predict their cash inflow and outflow and plan their budgets appropriately. It helps avoid liquidity issues caused by misaligned funding and spending.

-

Investment Opportunities: Aligning sources and uses frees organizations to pursue new investment opportunities confidently. This alignment ensures that essential projects have funding and adequate reserves in case of unexpected expenses.

-

Risk Mitigation: By sources and uses, the risk of financial distress is minimized. Knowing how much capital is required for different needs can help businesses avoid high-cost debt or the short-term approach to financing.

-

Strategic Growth: Sustaining long–term growth strategies involve a harmonious relationship between sources and uses. Those who manage their funds well can invest in innovation and widen their market range and competitive positioning.

Balancing both sources and uses of funds is critical to maintaining a healthy financial footing, enabling effective operational practices, and supporting sustainable growth in an ever-evolving business environment.

Conclusion

Sources and uses of funds must be understood for effective financial management and strategic planning. The sources and uses table have a solid structure that sheds light on a company's financial health and helps stakeholders make valuable decisions. Selecting sources carefully about their corresponding uses helps businesses improve cash flow, utilize resources more efficiently, and reduce monetary risks. In addition to assisting organizations in determining funding requirements, this framework acts as a course for sustainable growth whereby organizations can continue to be agile and competitive in an ever-changing marketplace.