Introduction

A private equity roll-up is a robust private equity strategy that focuses on consolidating negligently dispersed industries regarding firm size. It helps firms create larger, integrated organizations with more scale economies, achieve higher productivity, and be less likely to compete. Roll-ups are significant to private equity investment, particularly amongst firms developing strategic acquisitions and integrating multiple small businesses into crucial market players.

What does the term Roll-up Strategy mean?

A roll-up strategy is a business approach that involves transforming multiple small companies in the same or similar industries into larger, more competitive enterprises. Operating synergies and economies of scale are the primary sources of added value from roll-up activities.

Essential components of a roll-up strategy include:

-

Identification of Target Companies: Effective roll-ups require proper research to determine the regions that are still very much fragmented and then find attractive targets to acquire. Private equity firms evaluate potential acquisition candidates based on their financial viability and strategic fit with the existing business.

-

Integration and Synergies: When acquiring companies, the objective is to align the obtained units within an organization. This integration can involve combining operational processes, exchanging best practices, and efficiently utilizing central assets.

-

Value Creation and Exit Strategy: The ideal outcome of a roll-up is the formation of an organization with enhanced value, which can be disposed of by another acquirer or taken public. Private equity firms pursue high returns by leveraging growth opportunities and leadership in markets that come with consolidation.

The Role of Roll-ups in Private Equity Strategy

Roll-up strategies are central to the framework of private equity strategy and are frequently used as a principal means of attaining growth and market control. Private equity firms combine one large firm with several other small firms within that industry to establish companies with larger scales of competitiveness. This approach not only improves operational effectiveness but also delivers excellent value.

Critical Aspects of Roll-ups in Private Equity Strategy:

-

Market Consolidation: Roll-ups benefit private equity firms by optimizing the effects of consolidating fragmented industries, decreasing competition while achieving market dominance.

-

Economies of Scale: Operational integration leads to expense rationalization, process integration, and improved operating margins, which grow the bottom line.

-

Synergy Realization: The idea is that acquired companies will provide synergy in procurement, marketing, and IT, to name a few, resulting in better operational performance and revenues.

-

Exit Opportunities: The roll-ups also present various exit possibilities to private equity investors. They can sell to strategic buyers or make public offerings, thus gaining the most value.

In this way, roll-ups are a way of expansion and are a pure model key to long-term success in private equity investment.

Industry Suitability for Roll-ups: Where They Work Best

Roll-up strategies are helpful when numerous small establishments are involved in similar businesses that can be merged to improve performance and control the market. Here are vital sectors where private equity roll-ups tend to thrive:

-

Healthcare Services: The healthcare industry stands out for having significant levels of fragmentation, with many independent clinics and practices creating ample room for consolidation. Roll-ups in this context enhance patient care because organizations will implement similar best practices and pool their resources.

-

Economies of Scale: Operational integration leads to expense rationalization, process integration, and improved operating margins, which grow the bottom line.

-

Consumer Services: The beauty, fitness, and home service industries usually contain many small business ventures. These can be combined to create a more extensive and familiar name that reap benefits in advertising and organization.

-

Logistics and Transportation: Due to the large number of small freight and delivery service providers, roll-ups successfully increase operational efficiency and add value to the services segment, thus expanding operating margins.

-

Technology and IT Services: The highly specialized technology sector enables private equity firms to coordinate broad service solution portfolios by acquiring synergistic companies, addressing a wide range of clients’ needs.

Industries with high regulatory entry barriers or significant technological heterogeneity might present roll-up problems. Understanding this private equity strategy will be vital, so each sector and its characteristics must be closely and specifically analyzed.

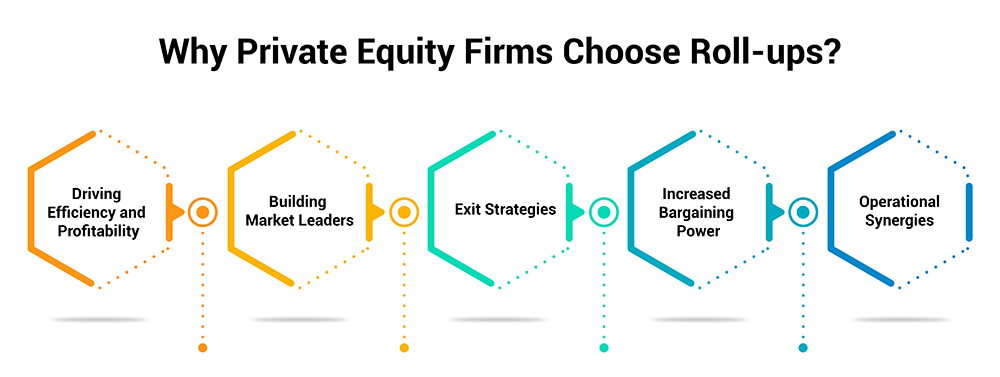

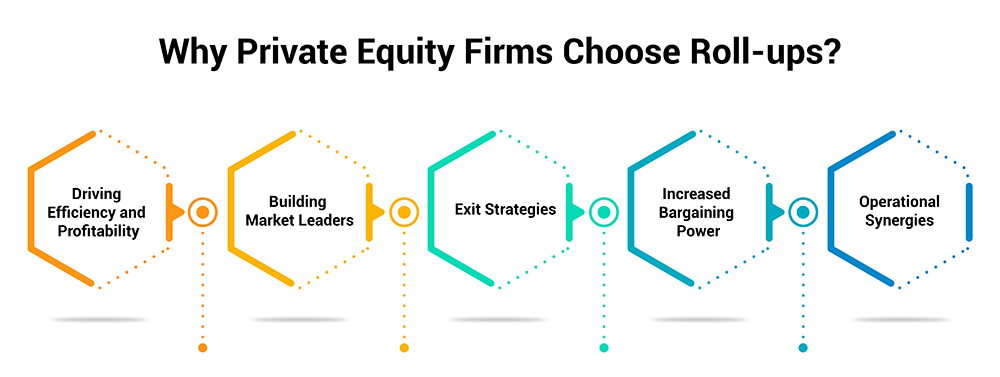

Why Private Equity Firms Choose Roll-ups?

Private equity firms use equity roll-ups more to further improve value creation and standing in the market. This method offers several compelling advantages that align with their investment objectives:

-

Driving Efficiency and Profitability: Consolidation reduces operational costs tremendously through roll-ups. One reason touching up overlapping activities within firms is plausible is improved resource utilization or enhanced every square inch of margins.

-

Building Market Leaders: Through multiple acquisitions of companies in a highly dispersed industry, private equity firms can cultivate dominant market actors. This market share advancement not only ensures future market growth for the entity but also makes it easy to attract potential buyers in the time of exit strategies.

-

Exit Strategies: An efficient roll-up can give several exits, including to a forthcoming large strategic acquirer or an initial public offering (IPO). The integrated, more prominent company often gets better market value, optimizing investors' returns.

-

Increased Bargaining Power: Consolidation efficiently realizes scale advantages, ensuring the new company has much bargaining power when negotiating with its supplying and purchasing partners. This benefit can mean better pricing paradigms and superior terms.

-

Operational Synergies: Roll-ups give opportunities for interaction between the acquired companies. This includes combining technology resources, reselling products, and synchronizing promotional campaigns, all of which help boost overall revenue prospects.

Thus, private equity firms opt for roll-ups to improve the economic efficiencies of acquired companies and strengthen the leaders in a field capable of offering superior strategic value for all stakeholders in a competitive environment.

The Benefits of Roll-up Strategies in Private Equity Investment

Roll-up strategies are attractive to private equity firms because they combine many small businesses into one giant, much more challenging business. These strategies are not just about business growth; they also lead to improvements in value proposition and delivery, feedback positioning, and operating effectiveness.

-

Increased Bargaining Power: By merging many companies into a single entity, the roll-up acquires greater purchasing power with suppliers, distributors, and customers.

-

Operational Synergies: These benefits include cutting encumbrances, avoiding duplication, and increasing efficiency in most operations processes. They also tend to reduce operational costs and enhance profitability.

-

Diversification: A strategic way to manage acquisition risk is to diversify a business with a diverse product portfolio or geographic presence. It is also a tradition: Companies with greater overall size than their components are usually valued at a higher price than independent businesses, which is advantageous for private equity firms because it is easier for them to sell large, merged companies or take them public.

Private equity roll-ups allow the creation of market winners with enhanced competitive positions and higher sustained growth rates.

The Future of Roll-up Strategies in Private Equity Investment

The environment surrounding private equity roll-up strategies is dynamic, mainly because of technological changes and other market forces. As private equity firms adapt to a more competitive environment, several emerging trends are shaping the future of these strategies:

-

Global Expansion: Most private equity firms are shifting their focus overseas to exploit globalization, especially in economies with segmented markets.

-

Focus on Sustainability: Environmental, social, and governance (ESG) considerations are becoming vital when evaluating acquisitions. This approach addresses the stakeholders’ concerns and improves the companies’ value creation.

-

Digital Transformation: The success of integrated technology use depends significantly on the degree of use in acquired entities, which is often intended to enhance operational performance.

Such trends point towards a vibrant future for private equity investment, especially in implementing roll-up strategies that focus on innovation.

Conclusion

In private equity investing, roll-up strategies effectively consolidate fragmented industries, achieve cost savings, and generate superior investment returns. The idea is that private equity can create value by acquiring strategic stakes and managing to establish market leaders. Yet, achieving this depends on proper implementation, a good level of system entwining, and potential issues such as compliance or too much competition.