Foundation of private equity

In the market for corporate control and entrepreneurial capital, private equity firms function as intermediaries between non-public firms in need of financial resources and investors seeking greater returns on an alternative asset class.

PE has always existed…only in a different form than today

Let’s talk about Columbus: Entrepreneur, Scientist, and Venture Capitalist

Columbus persuaded the Spanish monarchs to fund his journey to the West after seven years of campaigning. His prospective elevator pitch had to be about building a shorter and fresh naval route to the Indies in the West, defying the components, and enriching the investors with high profits, leaving behind the Portuguese and their blocs on the Eastern routes.

Even Columbus would not have comprehended that he was setting up a venture capital firm at this point. However, he was as a result of his project's combination:

-

High risk of failure with a high return potential

-

Barriers to entry protecting a competitive advantage

-

Entrepreneurial venture financed by external investors

These elements form, at various degrees, the common ground for PE deals (LBO, growth capital, venture capital, etc).

At present, most PE firms are organized as limited liability corporations or as partnerships. PE firms on average employ not more than 13 investment professionals having investment banking backgrounds. These professionals are highly qualified with one or more private equity certifications and with good experience in handling investment management, fundraising, and sometimes delegating part of their responsibilities to investment advisors, or even participating in ‘club deals’ with other PE firms to tackle larger deals.

Rise of private equity

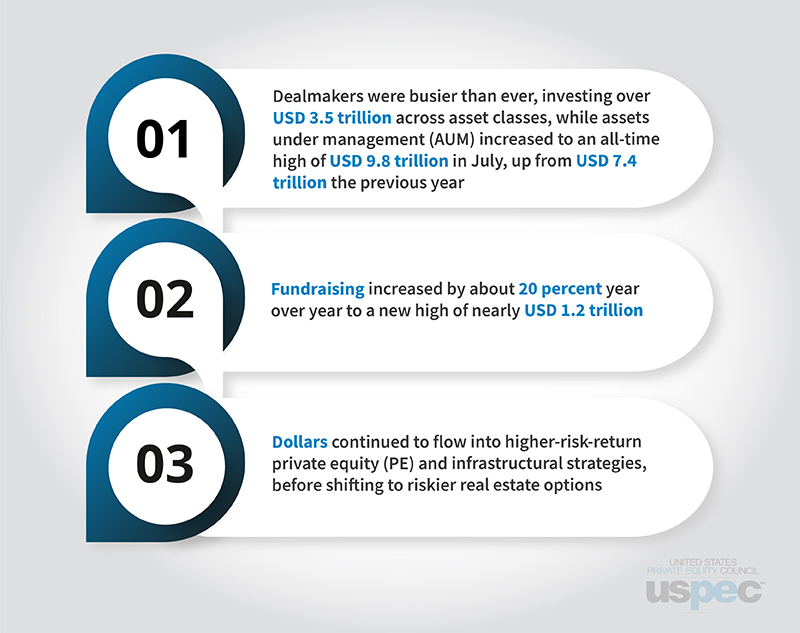

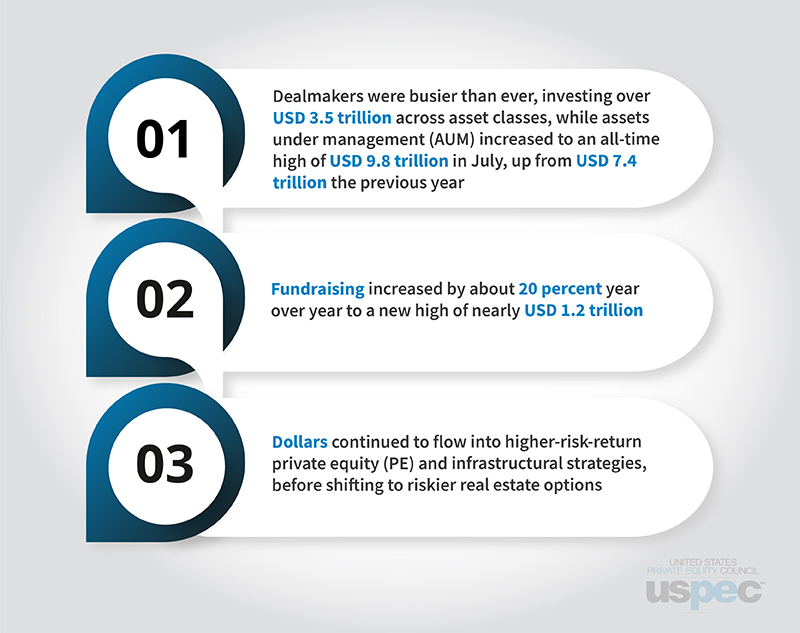

Between 2021 and the first quarter of 2022, the private equity sector has shown a great resurgence — PE markets have recovered across the board after a year of pandemic-related turmoil that slowed fundraising and acquisition activity. According to recent McKinsey reports:

As suggested by Institutional Investor, with an annual rate of return of 11.5 points, PE outperformed the MSCI World index and the S&P 500 from 2002 to 2020 by 4.1 and 2.8 percentage points, respectively.

The aforementioned statistics suggest that the past two years are witness to the resilience of the PE sector, it has been nothing less but creative in investing in a huge volume of dry powder available. Let’s take a closer look at how private equity is expected to grow in 2022.

Supply chain concerns, inflation, and increased interest rates may make things difficult for private equity organizations.

PE firms are preparing to re-strategize in the face of uncertainty. Several banking institutions raised interest rates unexpectedly in December, and many analysts predict that further hikes are on the way to combat inflation sooner rather than later.

What happens when interest rates go high?

Higher interest rates make borrowing more exorbitant for both firms and consumers, leading to increased interest payments for everyone.

Those who are unable or unwilling to make the additional installments postpone projects that require finance. It also encourages consumers to save money to receive bigger interest payments. This reduces the amount of money in circulation, which tends to cut inflation and reduce economic activity — or, to put it another way, cools the economy

With continuous supply chain concerns and an influx of COVID-19 cases, PE businesses that succeed in the conditions of adversity will be capable of simulating risk and adjusting accordingly. It will be a great deal for PE firms to have talented and certified private equity experts with cutting-edge skills and capacities to deal with such economic scenarios.

PE will focus on technology and healthcare, but retail investors will need to be reviewed.

The interest of private equity in investing in technology will remain. The amount of PE-backed technology agreements reached an all-time high in 2021, and there is no evidence that this trend will fall off in 2022. Healthcare and retail are two more industries where the market can expect high PE interest, with private equity activity in consumer retail totaling USD 13.7 billion in the first three quarters of 2021, outpacing each of the previous three full years (Source: BDO)

Due to the solid recurring-revenue models and regular returns offered by software-as-a-service enterprises, technology will endure to be a sector of interest for PE. There is a lot of profit to be gained in healthcare. However, due to high valuations and a limited appetite for credit risk, PE companies may need to reconsider their traditional retail strategy.

Leveraged Buyouts (LBO) are long-term, but rising interest rates may put a damper on them.

The level of LBO activity will stay high. PE companies in the United States have an estimated USD 960 billion in dry powder waiting to be deployed.

As suggested by BDO's Autumn 2021 Private Capital Pulse Survey, 42 percent of fund managers think they will put the most money into new deals, which is more than double the percentage who stated the same in 2020.

With plenty of dry powder, the year 2022 appears to be auspicious for LBO. LBO, on the other hand, will become immoderate, curtsy, and rise in interest rates. Before this happens, PE firms can explore expediting deals or financing acquisitions with greater equity.

Interest in environmental, social, and governance (ESG) and impact investing is not waning

Private equity has been chastised for acquiring fossil-fuel ventures and serving as a lifeline for coal-fired power facilities. As reported by Nytimes, renewable energy has received only 12 percent of private equity company investment in the energy sector.

PE firms will be under more obligations to disclose climate-related risks and show how their investments are helping to build a greener future. To address climate-related risks and contribute to a greener future, PE businesses are required to have professionally qualified personnel, most of whom have excellent job profiles and hold one or more PE or finance-related certifications. By reporting on how their holdings and activities support environmental, social, and governance goals, private equity should get ahead of ESG.

Building loyalty and satisfaction among limited partners is vital

Limited partners are the third biggest stakeholder in PE, and their contentment is typically critical to the company's success. LPs want to participate in high-quality businesses with strong transaction flows, solvency options, and well-stated exit strategies. While performance may be the most important factor in LP satisfaction, other factors like transparency, fee management, flexibility, and an emphasis on social responsibility all have a role.

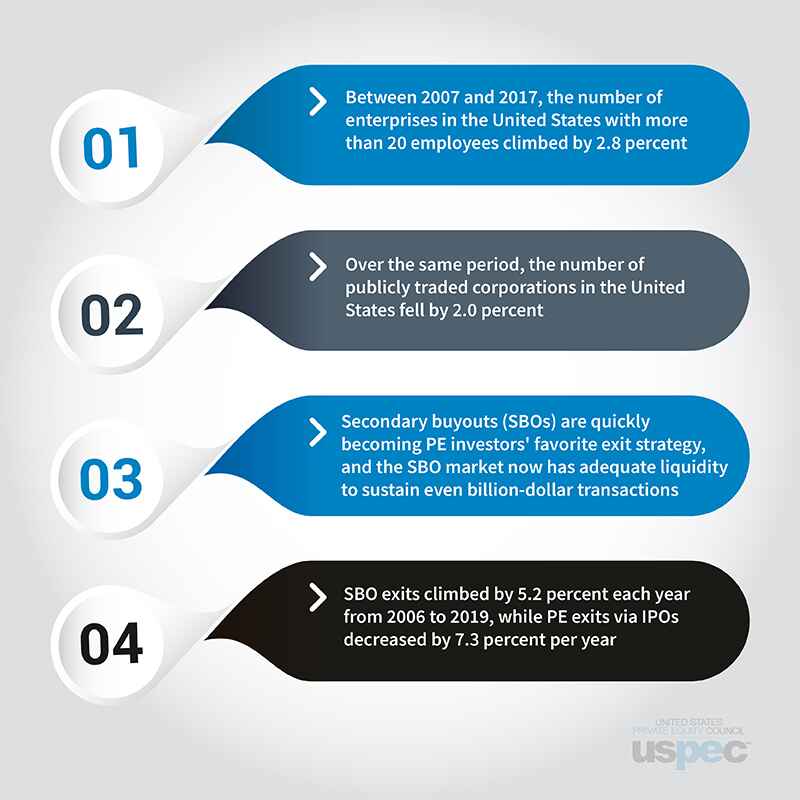

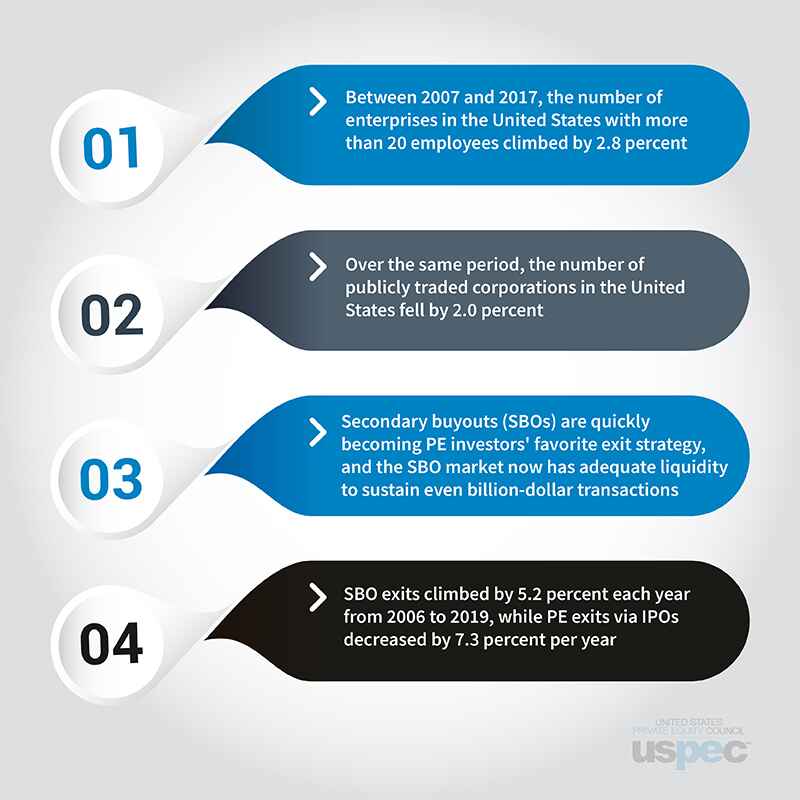

PE firms act as a link between LP money and private enterprises, allowing LPs to reach their goal allocation while also offering growth capital to small businesses. Since this pool of private enterprises to invest in is huge and growing, this position is becoming increasingly essential. As reported in the Q2 2020 US PE Breakdown “Pitchbook”:

PE firms with an efficient operational model can keep an eye on industry developments and take advantage of fresh financing and deal-making opportunities. Firms may reconsider operational factors such as deal sourcing, product launches, and exit strategies in light of current developments.

End Notes…

Over the next five years, the private equity industry is expected to grow significantly. While there are various ways to succeed in this rapidly growing business, ensuring the satisfaction of key stakeholders, employees, portfolio firms, and limited partners will almost certainly be at the heart of each approach. Some companies may place a premium on keeping and attracting excellent personnel with top-notch skills by offering equitable opportunities in senior management to deal with technologies and work on a greener future.

Top talent at high-performing PE firms can assist portfolio companies in increasing sales and profits by providing insight and network connections. Finally, companies that are responsive to changing investor preferences, such as customer experience, technology, ESGs, and product selection, can build stronger connections with limited partners.