Introduction

The role of Private Equity Associate is one of the most popular positions, giving you an opportunity to participate in the implementation of large transactions and management of substantial investments. As a private equity associate, you will be in the middle of the private equity world providing analysis for potential investments, assisting with deal-making, and overseeing invested companies. With the right credentials and connections, it is a very fulfilling and well-paying profession.

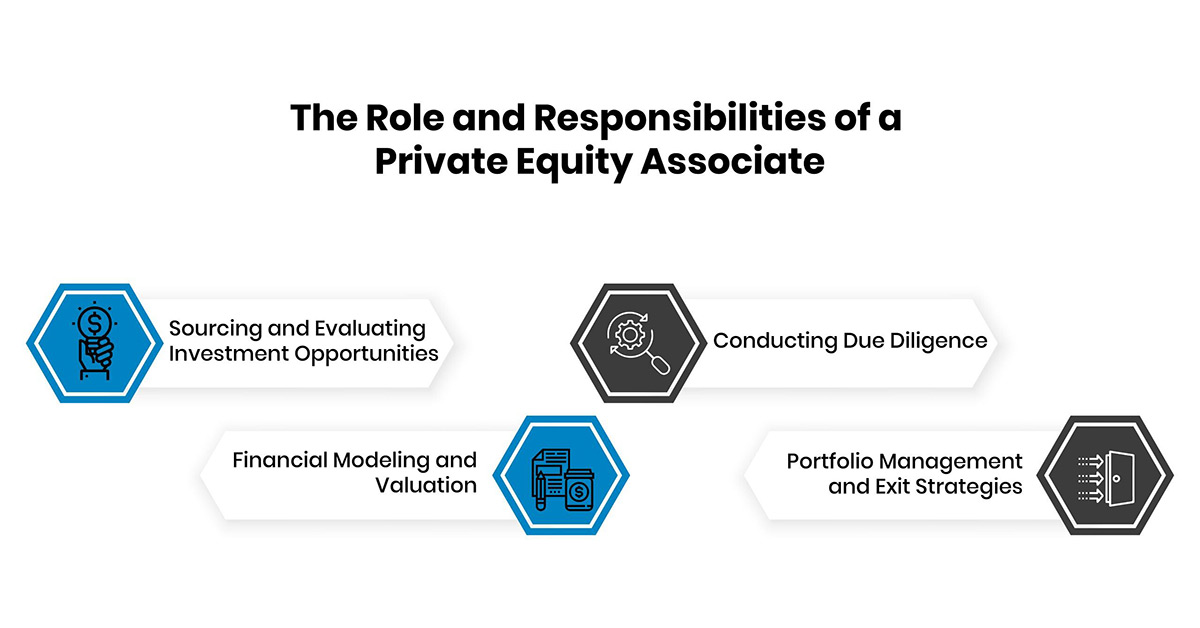

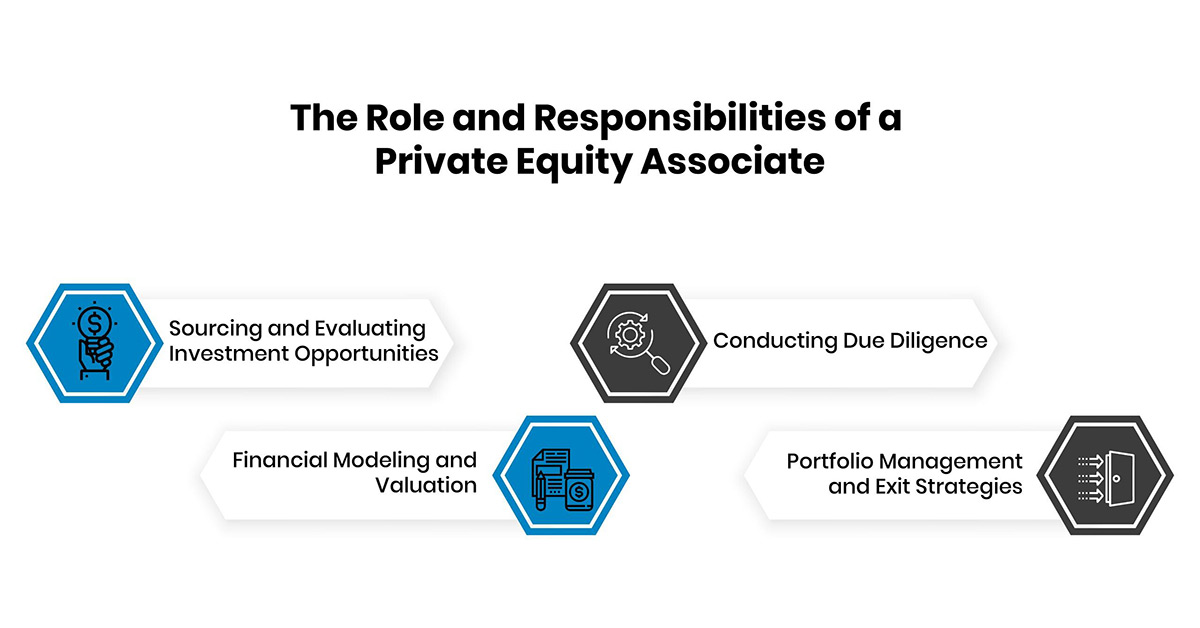

The Role and Responsibilities of a Private Equity Associate

As a Private Equity Associate, you'll be in the middle of the investment process and contribute to the outcome of deals. It’s not just about the figures and the figures only but an ability to think and decide for the future of millions or rather billions of dollars. The position is quite complex and versatile, which means that you must perform several tasks every day.

In essence, a Private Equity Associate is responsible for:

-

Sourcing and Evaluating Investment Opportunities: To identify potential investment opportunities engage in market research, conduct meetings with potential acquisition targets, and utilize network of contacts within the industry. When a particular opportunity is spotted, you’ll have to engage in a more comprehensive analysis of the financial situation and prospects of the company, as well as its market situation.

-

Conducting Due Diligence: Every investment opportunity is analyzed before the actual investment is made. This includes checking the financial statements of the target company, evaluating the risks, and having knowledge of the industry. You’ll be required to engage legal, financial, and operational advisors to assess and validate all parts of the transaction.

-

Financial Modeling and Valuation: Another important duty is the creation of financial models. The above models aid in determining the worth of a company and its likely fiscal performance in the future. Analysis of this nature will help us ascertain the price we are willing to pay and the possible returns.

-

Portfolio Management and Exit Strategies: Once the investment is made, your efforts will be directed toward the management of the portfolio company. This involves activities such as performance evaluation, formulation of value creation plans, and at the end of the process developing strategies for the exit of the firm to get the best returns.

It is a challenging position but very fulfilling as you’ll have a say in major financial matters and be part of the success of organizations.

Educational Requirements and Qualifications

Private Equity Associate requires an Individual to have basic education and qualifications to qualify for the position. It is standard practice for most firms to demand at least a bachelor’s degree, preferably in finance, economics, business, or any related field. However, due to the high competition, it is common to find candidates with additional education, such as an MBA from a prestigious business school.

Key educational qualifications include:

-

Bachelor’s Degree: A basic corporate finance course, preferably in finance, economics, or business administration.

-

Advanced Degrees: An MBA is very important, and being from a reputable university is even better. Not only does it improve your understanding of finances, but it also grows your circle of contacts, which can become a valuable asset in private equity.

-

Certification: Experience and professional certificates such as the Chartered Private Equity Professional (CPEP™) can be an advantage to candidates. The CPEP™ program prepares candidates for specific tasks involved in investment management, and financial analysis as well as for ethical standards, all of which are valuable in private equity positions.

Apart from academics, rigorous and robust analytical and quantitative skills are very relevant. Private Equity Associates are expected to provide detailed financial modeling techniques, valuation, and due diligence. Hence, there is a need to understand the fundamentals of financial statements, corporations’ finances, and investments. Moreover, critical and innovative thinking skills are valued for this position, as they play an enormous role in evaluating possible investments and achieving successful results.

Relevant Experience and Skill Sets

As a private equity associate, experience and the ability to develop the following skills are vital. Generally, candidates who have previously worked at investment banks, consulting companies, or in corporate finance are very attractive to the company. Such roles offer the general background and practical thinking required for private equity.

Key skills and experiences include:

-

Financial Modeling: Knowledge of how to develop sophisticated economic models to assess possible investments is crucial. This is an area of knowledge that entails familiarity with cash flow expectations, value estimation and modeling, and situation evaluation.

-

Due Diligence: It is important to have experience in conducting a thorough due diligence process. Associates must be able to interpret financial data, evaluate the risks, and come up with problems with the acquisition targets.

-

Deal Execution: Understanding the deal process, including the approach to the deal, the structuring and execution of the deal, and the post-deal activities, is an important strength. This involves defining the deal terms, coordinating the entire transaction, and engaging with all the stakeholders.

-

Analytical and Quantitative Skills: It is crucial to have a good understanding of market trends and the ability to process big data, conduct market research, and identify opportunities in the process.

-

Communication and Interpersonal Skills: As an associate, you will be required to present their recommendations to senior management and investors, and this has to be done within a short duration of time. So, it is essential to develop effective communication and interpersonal skills.

Internships and entry-level positions in the field or related industries offer practical working experience and are often a means of getting into the position of an associate. Gaining these skills and experiences will greatly improve your probability of getting a job in private equity.

Networking and Industry Connection

Networking is a very important factor in getting a footing in the industry of private equity, which is highly competitive. Developing a good network can help one gain access to opportunities that are not advertised and can greatly increase the chances of getting a Private Equity Associate job.

Key Strategies for Networking:

-

Attend Industry Events: One of the best ways to get in touch with people in the field is by attending private equity conferences, seminars, and networking events. These events allow interaction with the industry and to learn more about trends that are emerging.

-

Leverage LinkedIn: LinkedIn is one of the most important sources to cultivate and keep professional contacts. Try to update your profile frequently, espousing your interest in private equity, participating in groups of your choice, and contributing actively in the discussions to ensure you are seen in this field.

-

Utilize Alumni Networks: It is not a rare occasion to find many successful private equity professionals who are willing to help or even provide guidance to the alumni of the same university. Contact the alumni who are practicing private equity and request informational interviews to gain more insight into the industry and job openings.

-

Engage with Recruiters: Professional recruiters can assist you in understanding how the private equity job market works. Create a rapport with some of the recruiters who deal with private equity job seekers to get leads and information on the current job market.

Compensation and Career Progression

The private equity salary for associates are quite good, given the high levels of responsibility and the opportunities for substantial compensation. The package of an Associate also entails a base salary, which can be between USD 135,000 and USD 155,000 per year, depending on the firm and its location. Besides the base pay, the Associates may also be given performance-based bonuses that can increase the overall remuneration package by as much as double the base pay.

Beyond the immediate financial benefits, a career as a private equity associate offers substantial long-term rewards and opportunities for advancement.

-

Promotion Path: Analysts can be promoted to the Vice President (VP) level within the next 2–4 years, and their focus will now include deal sourcing and execution.

-

Increased Earnings: At the higher levels of the career hierarchy, the remuneration packages are rich, especially for the VPs, who can be paid as much as USD sa340,000 or more, with bonuses.

-

Equity Participation: In other management roles, for instance, principals or partners are afforded equity in the firm’s investments and thus stand to gain a lot of wealth through carried interest.

The enhancement in responsibility and remuneration makes the private equity career path very alluring.

Conclusion

Becoming a private equity associate is a promising job opportunity that calls for the right education, practical experience, and connection-building. Honing the right skills and knowing how and where to apply are keys to getting the right job. The financial and career remunerations are great, which makes it a competitive and rewarding career choice in the financial sector.