This is a time of rapid contraction for the PE industry. While General Partners are focused on stabilizing their existing portfolios and zeroing in on the present and future challenges, sellers are keeping their assets intact. Banks are reluctant to offer new loans and underwriters are minutely scrutinizing their fund distributions. Together these withdrawals adding to the market volatility.

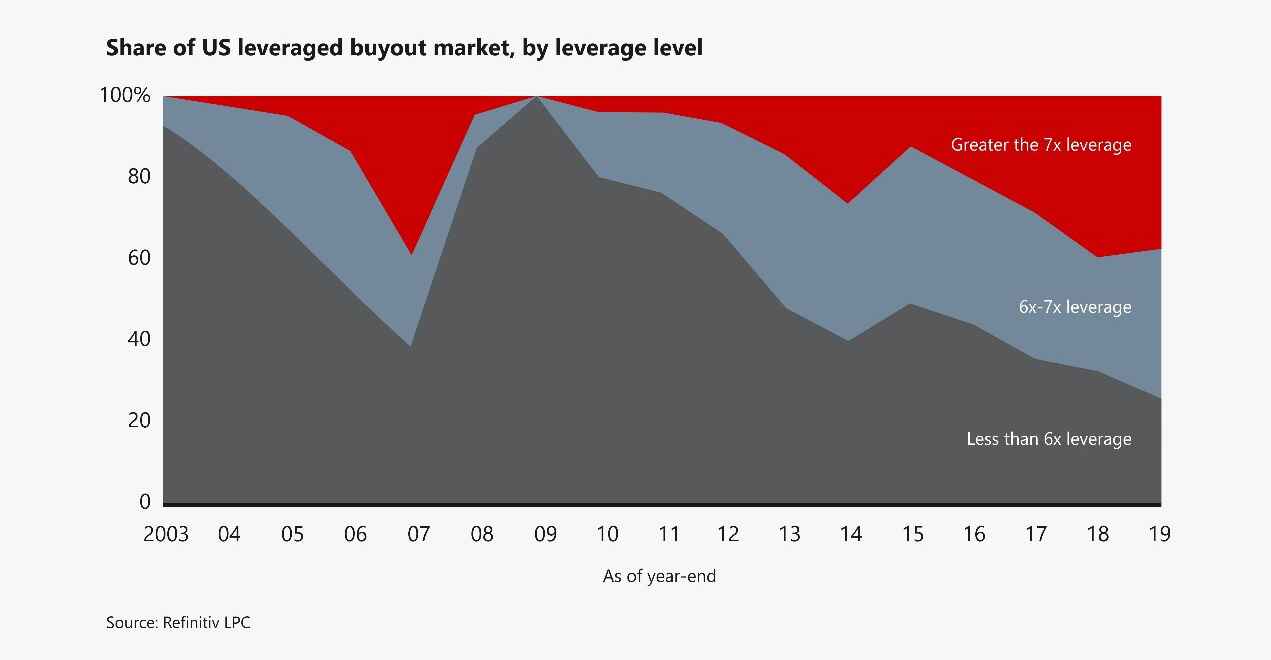

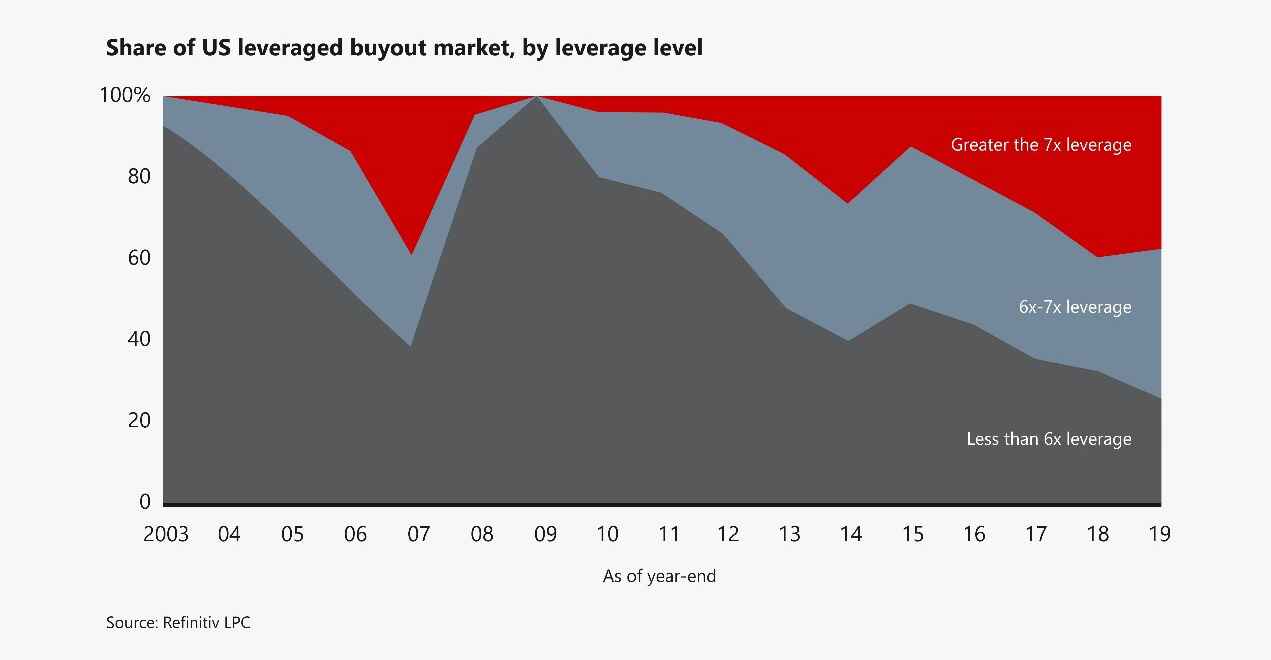

But contraction cannot be a far-sighted strategy. PE industry had a sound footing in the past decade. It saw a surge in valuations, transaction volumes, and fundraising. “In 2019, around three-quarters of all deals were leveraged at more than six times earnings before interest, taxes, depreciation, and amortization” (Bain.com).

This fortunate placement has bulwarked their footing in the few past few months and if the firm has been vigilant then may be for a few more months ahead. But what after that? The excess dry powder around USD 2.5 trillion and more than USD 800 billion for buyouts is forcing GPs to seek new deals and up their strategies at once.

PE Industry’s COVID-19 Pain Points:

COVID-19, unlike previous challenges, has impacted the PE industry on multiple fronts: slowed deal activities, misaligned valuation expectations, diminishing fund performances. But, mostly it has bared the PE industry’s technological inadequacies.

In a recent survey conducted by PwC, top COVID-19 concerns include its financial impact; effects on operations and its results; future periods, liquidity and capital resources, and; potential global recession. Next in line is the effect on the workplace productivity that stood at 41 percent.

COVID-19 has exposed operational vulnerabilities and deepened its existing gaps.

-

Deficient contingency plans for dealing with an emergency like this.

-

Inadequate cybersecurity.

-

Limited HR expertise and infrastructure to extend additional guidance to portfolio companies.

Limited remote working knowledge and capabilities.

-

Rigid safety and continuity plans for manufacturing facilities.

-

Unpliable supplier networks. Specialized industries may need to locate new suppliers. These new ones may not meet the expectation.

-

Adherence to new rules and regulations.

-

Sluggish alignment with changing customer behavior and consumption habits.

In deals, COVID-19 is posing challenges on two fronts:

The coronavirus impact has driven GPs to seek relief away from the material adverse effect (MAE) clause but, despite the buffer it offers, the clause is cumbersome and tricky to implement. Even the MAE clause don’t include pandemic in most cases.

How PE Leaders Are Overcoming the Covid-19 Challenge:

PE firms are working on five priority areas: workforce protection and productivity, engaging with customers, managing financial and liquidity risk, stabilizing operations, and preparing for recovery and growth. Most industries are undergoing massive overhauls. From reinventing the supply chains to restricting the balance sheets to meeting a steep surge in consumer demand, businesses are stretching at multiple ends.

We suggest a six-pronged action plan.

#1. Brace up your communications

At a juncture like this, it is important for the PE Industry to keep their operations running. This means they must continue assessing investment pipeline, regularly interact with portfolio-companies’ leaders, and carry-on with the investment committee discussions.

Videoconferencing can come to their aid here. It can also be used to conduct board and review meetings. Limited partners need special support during these challenging times. Few sponsors are sending continuous market updates in their communication.

#2. Identify critical areas that need support

Sponsors need clarity on the areas in which the portfolio companies need support and which ones need a change in resource allocation.

COVID-19 has changed the course of several industries. While industries like healthcare and essential services have boomed, previously thriving ones like travel and hospitality have taken a hit. Because sponsors have limited resources that they can share with their owned companies, they need to make a judicious choice and identify areas where the allocated time and resources will bring the best results. A prioritization activity will help in reinforcing the team’s confidence.

#3. Expand supplier network

Portfolios that depend on the international supply chain now may have to seek new suppliers.

Many industries shifted their production to produce medical supplies or critical necessities. Companies in healthcare are investing their efforts in improving their supply chain and operations. Tech companies are following up on their supply chains. Hospitality, travel, and oil and gas have moved their efforts to trim their liquidity risks.

#4. Adopt agile investments

Many investors are widening their investment possibilities by considering debt and rescue financing.

Sponsors with dry powder are at a privileged position here. Rapidly assess potential risks and cash savings at hand. Use internal and external data to model cash flow to check balances under different potential events. Identify cash levers, review balance sheet and propose cash levers for important assets and liabilities and actively collaborate with business leaders and external experts.

McKinsey suggests setting up a “cash war room” for companies that are facing drastic reduction in their customers or have reduced liquidity.

#5. Encourage portfolio companies to calibrate resources

GPs have introduced many new ways to inject money in exiting investments that need support. They are creating fund-level credit to build a pool of capital for portfolio companies.

Most LPs are willing to support if they understand the motivation behind the request and their calibration with the GP isn’t affected. The portfolio companies must analyze the available inventory with them and study it against the demand forecast. Identify alternate supply sources.

#6. Prepare for post-COVID scenario

GPs must be ready for exits that will rebound soon as the market begins to resume some sense of stability.

Efforts are ongoing on multiple fronts. Some prominent PE firms are working to up their risk strategy. Leading ones are developing tools and techniques to anticipate similar risks in the future. Others are expanding their scenario modeling techniques. Many are developing digital supply chain tools. A greater number of firms are investing heavily in remote work and back-office facilities and, are introducing virtual training.

The Upshot:

Whatever the outside factors, expectation from PE investors is of consistent results. And they have always delivered. Before they deal with deals, they learn to deal with challenges. In 2008, post the Great Recession, private lenders emerged as a major force and disbursed three times assets. This time too they can fill in the gap left by Banks. In the immediate future, we suggest the following action points:

-

Improve strategic sourcing techniques.

-

Develop a crisp communication plan for stakeholders.

Build action plans for 3-6 months impact and 12-18 months impact.

-

Strengthen your digital network.

Assess operational risks internally and discuss them with key partners and suppliers.

Build facilities for remote work.