Introduction

In corporate financial reporting, understanding the noncontrolling interest is important to properly reflect minority shareholders' ownership stakes in subsidiary companies. A non-controlling interest is the equity portion not attributable to the parent entity. This concept is essential in consolidated financial statements to provide transparency and fairness. Its implications are to highlight the financial influence of minority shareholders to induce better-informed decision-making, ensure compliance with regulatory standards, and provide a holistic view of the financial health of today’s dynamic business environment.

What is Noncontrolling Interest: Key Concepts and Distinctions

The equity stake in a subsidiary of minority shareholders without control of such an entity is known as a non-controlling interest (NCI). It is a key component of financial reporting and transparency about how ownership and financial allocation work within parent-subsidiary arrangements.

Features of Noncontrolling Interest:

-

Definition and Role: It ensures accuracy in the third-party equity reported on consolidated financial statements and reflects the proportion of a subsidiary not owned by the parent company.

-

Ownership Perspective: NCI differs from control of interest because it does not provide the subsidiary’s operations with decision-making authority or the ability to influence significantly.

-

Importance in Transactions: NCI is essential to recognize during mergers, acquisitions, and joint ventures, where partial ownership structures are often established.

Features of Noncontrolling Interest:

-

Definition and Role: It ensures accuracy in the third-party equity reported on consolidated financial statements and reflects the proportion of a subsidiary not owned by the parent company.

-

Ownership Perspective: NCI differs from control of interest because it does not provide the subsidiary’s operations with decision-making authority or the ability to influence significantly.

-

Importance in Transactions: NCI is essential to recognize during mergers, acquisitions, and joint ventures, where partial ownership structures are often established.

Critical Distinctions:

-

Control vs. Non-Control: The strategic decision-making is driven by controlling shareholders. At the same time, the subsidiary's performance benefits the NCI holders without participating in the governance of the subsidiary.

-

Transparency: Disclosure of minority ownership enhances clarity, spurs investor trust, and ensures contractual observance of accounting standards.

Calculation and Presentation of Noncontrolling Interest

A noncontrolling interest (NCI) is determined by allocating part of a subsidiary's net income and equity to shareholders who do not hold a controlling position. This ensures that the consolidated financial statement truly reflects ownership proportions.

Steps to Calculate Noncontrolling Interest:

-

Determine Ownership Percentage: Determine the percentage of subsidiaries relatively owned by the noncontrolling shareholders.

-

Calculate Share of Net Income: Allocate the earnings attributable to NCI by multiplying the subsidiary’s net income with a noncontrolling percentage.

-

Adjust for Dividends: Dividends distributed to noncontrolling shareholders will be subtracted from the income allocated to them.

-

Allocate Equity: The NCI’s equity share is calculated by applying the noncontrolling percentage to the subsidiary’s total equity.

Presentation of Noncontrolling Interest:

-

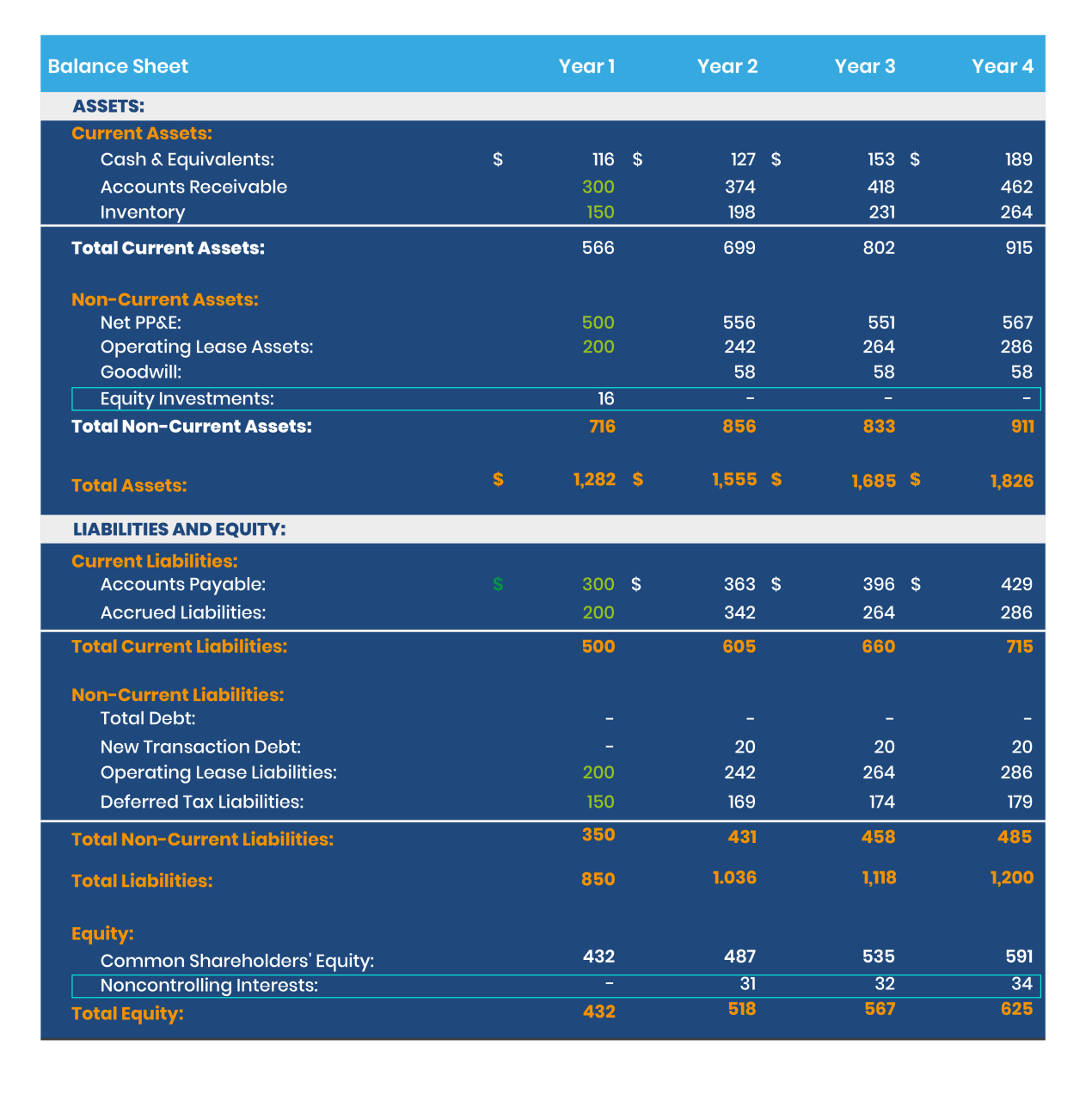

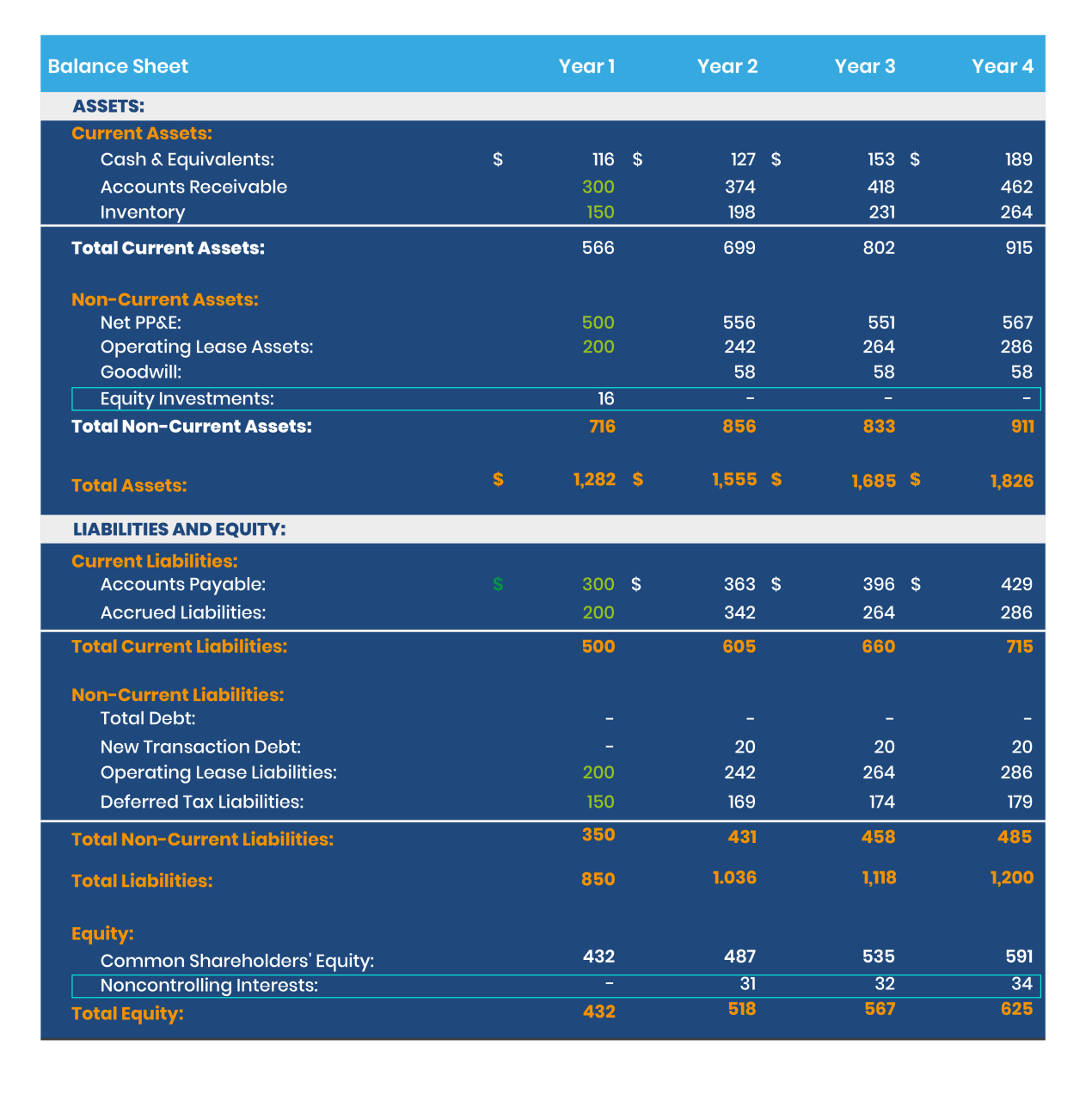

Balance Sheet: The equity section shows NCI as a line below under the equity section to show that it is a separate line from the parent company’s equity.

-

Income Statement: The consolidated net income is the part of the subsidiary’s net income that is not attributable to NCI. It is then subtracted to obtain the figure for the distributable earnings to minority shareholders.

The structure of accounting for noncontrolling interest calculation and presentation in this way keeps things clean and on standard, enabling the stakeholders to view financial performance with clarity and ownership distribution.

Impact of Noncontrolling Interest on Consolidated Financial Statements

The presence of noncontrolling interest (NCI) has a large impact on how a company reports its financial position and performance. In the consolidation process, the financial results of a parent company and its subsidiaries are combined, and the noncontrolling interest is the portion of the subsidiary that does not belong to the parent company. As their viable interest must be tallied carefully, it impacts the equity and income portions in the consolidated posted charges.

Critical impacts include:

-

Income Allocation: One of the elements of the income statement must represent the parent’s and noncontrolling shareholders’ share of net income. This leads to an adjustment to correctly deduct the net Income attributable to the noncontrolling interest from the consolidated net income. It ensures transparency and accurately reflects the parent's portion of profit or loss.

-

Equity Adjustments: The equity section of the balance sheet must include the ownership of both the parent company and the noncontrolling shareholders. The noncontrolling interest is separate from the parent company’s equity, listed separately within equity. This allows ease in identifying the owner’s equity from the portion owned by outside investors.

-

Consolidation Challenges: Consolidating less than 100 percent parent company ownership in a subsidiary makes for a more complex deal. Income and equity may be adjusted differently depending on different ownership percentages. However, these adjustments should be applied similarly and by accounting standards to record financial reporting.

Noncontrolling interests play a key role in ensuring the presentation of the financial outcomes of the parent and noncontrolling shareholders, making the consolidation and financial accounting accurate and transparent.

Methods of Recognizing and Measuring Noncontrolling Interest

Measurement and recognition of noncontrolling interest are important to correct financial reporting where fair representation of ownership stakes in consolidated financial statements is required. Two primary methods are commonly used:

Fair Value Method

-

Definition: It measures the noncontrolling interest at the 'fair market value' of the acquisition date.

-

Benefits: It offers an overall valuation of the subsidiary considering the full equity count, which includes control and non-control components.

-

Advantage: It gives a realistic ownership value picture that aligns with market-based valuation.

-

Challenge: Calculating fair value can be complex and resource-intensive. The precise estimations and adjustments necessary eventually leave little room for manipulation.

Proportionate Share Method

-

Definition: NCI is a proportionate share of the subsidiary's identifiable net assets.

-

Benefits: Less reliance on market valuation data and simpler calculation.

-

Challenges: It does not capture the premium value of the subsidiary or overestimates the NCI.

The pooled financial statements differ from each method because each has advantages and limitations. The fair value method may encompass detailed market-based valuations, while the proportionate share method may be suitable for simple reporting. The choice of method is based on whether the entity meets its financial goals by complying with accounting standards and accurately representing noncontrolling interests in financial reports.

Regulatory Frameworks Governing Noncontrolling Interest

Noncontrolling interest is standardized in consolidated financial statements through regulatory frameworks governing its recognition and reporting. These frameworks establish rules for how entities measure, present, and disclose noncontrolling interest, ensuring consistency and transparency in financial reporting.

Key Guidelines include:

-

Recognition:

Noncontrolling interest must be recognized as a separate equity component in the consolidated balance sheet. It depicts the minority shareholders’ part of the subsidiary's net assets.

-

Measurement:

Noncontrolling interest may be measured using the fair value method, determined by entities using the current market value or proportionate share method, which reflects the minority interest in the subsidiary’s identifiable net assets.

-

Disclosure Requirements:

The frameworks focus on clearly disclosing the measurement of noncontrolling interests, changes in ownership percentages, and their portion of consolidated income or losses, either in consolidated or separate statements.

-

Consistency Across Standards:

All accounting frameworks provide similar guidance, but variations exist in recognizing changes in ownership that do not mean loss of control. Entities must adhere to these nuances to remain compliant.

Strategic Implications of Noncontrolling Interest

Noncontrolling interest is an important factor influencing enterprises' strategic and financial development. It allow enterprises to develop various forms of outside ownership, which can help them attract investors without sharing management powers. Such a structure of ownership makes partnerships possible that can help spur growth and innovation while retaining key decision-making by the parent company.

Main strategic implications include:

-

Structuring Deals and Investments:

Noncontrolling interests are used in businesses to ensure they receive funds from investors interested in owning a minority stake. They allow the parent company to receive funds in its entity while retaining absolute control of the subsidiary.

-

Enhancing Financial Transparency:

Noncontrolling interests should be reported clearly so that users can ascertain the actual performance of the consolidated partners.

-

Facilitating Strategic Partnerships:

Noncontrolling interest is also used to define cooperation or acquisition of the organization with local or specialized partners to gain market access, know-how, or other advantages.

As a result of the interests of both the majority and the minority shareholders, the noncontrolling interest promotes equity power that fosters unity in the long-run value creation. This is not only proficiency in resource management but also puts companies in good standing against competition in various markets.

Conclusion

Noncontrolling interest is central to financial reporting because it demystifies ownership structures and provides disclosure in consolidated statements. It can be calculated, recognized, and presented to give a correct picture of equity and income. It is important in contemporary accounting because strategic aspects, like structuring partnerships and accountability, cannot be underestimated. Consequently, as rules change, knowledge of noncontrolling interests is important for legal compliance and investor relations.