An Introduction to Growth Equity

Growth equity has emerged as a compelling strategy that bridges the gap between venture capital and traditional leveraged buyout approaches. While it's often characterized as an intermediate option, growth equity has evolved into much more. This investment avenue offers a distinct risk-return profile, emphasizing rapid operational enhancements, revenue growth, minimal leverage, and protection against downside risks. Its unique features make growth equity an attractive component of a diversified portfolio, offering investors the potential for substantial returns while mitigating risks.

According to Pitchbook, there were at least 1,508 growth equity transactions in the United States in 2021 with a total investment value of USD125 billion. Compared to the same statistic in 2020, this number has increased by more than 60 percent.

This blog explores the unique characteristics of growth equity and its role as a strategic investment tool for established companies seeking expansion. It also includes the benefits, challenges, and best practices associated with growth equity investing, providing valuable insights for investors and businesses alike.

What is Growth Equity?

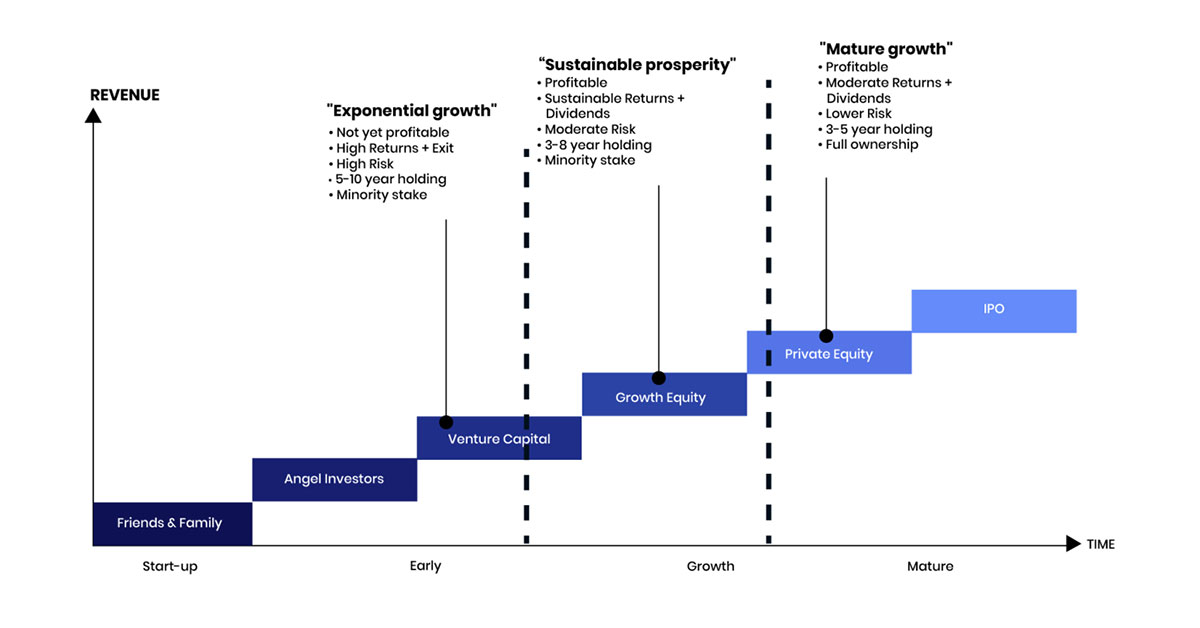

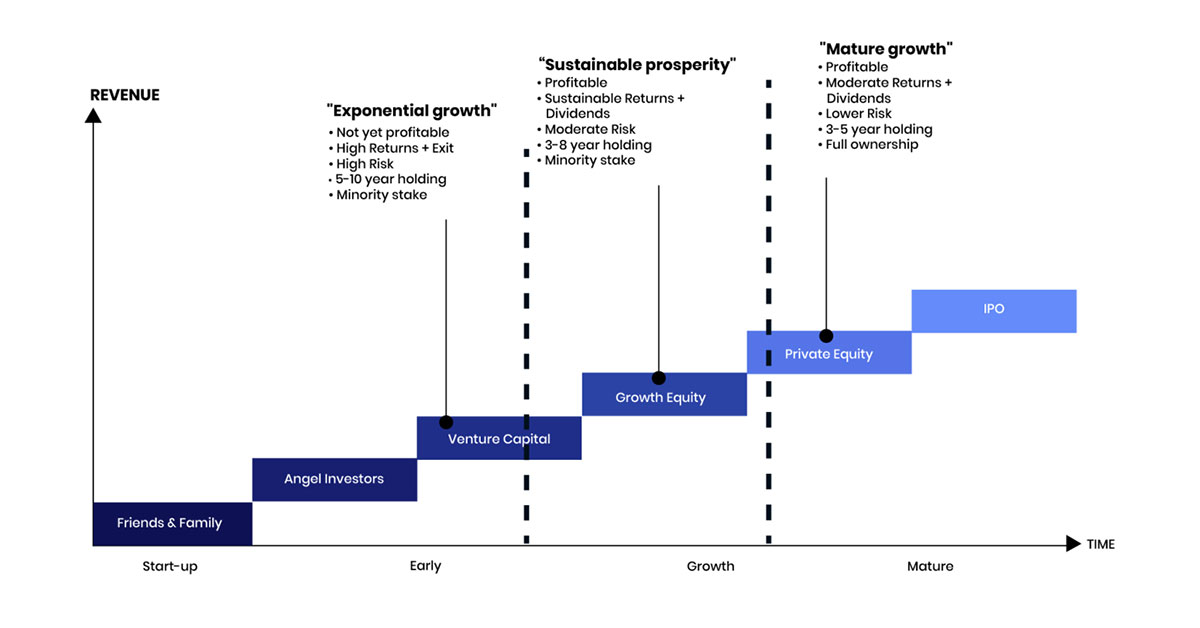

Growth equity, also known as growth capital, represents a pivotal phase in a company's lifecycle, where strategic investments are made to propel expansion and innovation. Unlike traditional venture capital, which targets early-stage ventures, growth equity is deployed in established firms with a proven track record seeking to scale their operations and market reach.

This form of financing stands out for its alignment with long-term growth objectives, offering a compelling alternative to debt financing. It typically involves a minority equity stake, enabling investors to participate in the company's success without compromising its operational autonomy.

Moreover, growth equity investors play a proactive role, collaborating closely with management to strategize and execute growth initiatives. This partnership extends beyond financial backing, encompassing strategic guidance, operational expertise, and access to extensive networks. It acts as a catalyst for sustainable growth, empowering companies to manage complex market changes and rise as industry leaders.

What are the Uses of Growth Equity?

Growth equity emerges as a pivotal financial instrument for companies aiming to expand their operational footprint and ascend to new heights. Its distinctive characteristic lies in offering companies the freedom to pursue diverse strategic objectives without the constraints often associated with traditional financing options.

The main applications of growth equity are as follows:

Market Expansion

Growth equity provides the necessary capital for companies to venture into untapped markets, whether geographical or demographic. This could entail establishing new branches, launching innovative products, or diversifying distribution channels.

R&D and Innovation

Companies leverage growth equity to invest in research and development to promote innovation in product lines as well as enhance existing offerings. This strategic move ensures sustained competitiveness and relevance in evolving markets.

Strategic Acquisitions

Growth equity enables companies to pursue acquisitions as a growth strategy. Acquiring complementary businesses can accelerate growth, facilitate market entry, or broaden product portfolios.

Operational Enhancements

Companies utilize growth equity to optimize operations, such as adopting cutting-edge technologies, streamlining supply chains, or recruiting key talent.

What are the Advantages and Disadvantages of Growth Equity?

Growth equity offers a promising path for companies eyeing expansion, yet it comes with both upsides and downsides worth exploring. Understanding these facets can guide businesses in deciding if growth equity aligns with their growth strategies.

Advantages of Growth Equity

-

Financial Flexibility: Unlike loans that demand regular payments, growth equity provides a more adaptable financial structure. This freedom allows companies to invest in growth without immediate repayment pressures.

-

Strategic Support: Growth equity investors bring more than money to the table. They offer strategic advice and industry insights, along with access to valuable networks that can propel growth.

-

Long-Term Vision: Growth equity investors tend to focus on long-term growth, which suits companies aiming for sustained expansion rather than quick profits. This approach supports initiatives that may take time to mature.

-

Ownership Retention: Unlike venture capital, which often requires significant ownership stakes, growth equity deals typically involve a smaller share. This means companies can maintain more control over their operations.

Disadvantages of Growth Equity

-

Loss of Control: While investors offer valuable support, they may also seek influence over key decisions. This could potentially restrict the freedom of the company's management.

-

Costly Investment: Growth equity investments can be expensive, as investors expect substantial returns. This can be challenging for companies, especially those with tight budgets.

-

Risk of Underperformance: Like any investment, growth equity carries a risk. If the company fails to meet growth targets, it may struggle to meet investor expectations.

-

Limited Accessibility: Growth equity may not be available to all companies, especially those in niche industries or early stages of growth. This limitation can restrict financing options.

Growth Equity Investing

What is Growth Equity Investing?

Growth equity investing is a strategic form of financing tailored for companies that have surpassed the initial startup phase and are poised for significant expansion. It is directed towards established firms seeking to scale their operations and market presence.

The distinguishing feature of growth equity investing lies in its focus on companies with a proven track record of success and a stable revenue base. These companies have usually moved past the risky startup phase and are now positioned for accelerated growth and market leadership.

In a growth equity deal, investors inject capital into the company in exchange for a minority ownership stake. This capital infusion is intended to fuel the company's expansion plans, such as entering new markets, developing new products, or making strategic acquisitions.

Unlike venture capitalists, who often take an active role in the management of early-stage startups, growth equity investors typically adopt a more hands-off approach. They provide strategic guidance and support as needed but generally allow the company's existing management team to retain control over day-to-day operations.

How Does Growth Equity Investing Work?

Growth equity investing is about fueling sustainable growth in established companies that have already proven their potential for success. It's a strategic partnership between investors and companies, with the shared goal of driving growth and creating long-term value.

-

Identification of Promising Companies: Growth equity firms seek companies that have already demonstrated a strong value proposition and product-market fit. These companies have proven their potential for growth and are seeking capital to fuel their expansion plans.

-

Investment Structure: In a growth equity deal, investors provide capital in exchange for a minority ownership stake. This structure allows companies to retain control over their operations while benefiting from the strategic guidance and support of the investors.

-

Strategic Support: Beyond financial backing, growth equity investors offer strategic guidance and support to help companies achieve their growth objectives. This can include assistance with market expansion, product development, and operational improvements.

-

Focus on Growth and Expansion: Growth equity investors prioritize future growth and expansion potential. They look for companies with a clear pathway to profitability and a solid business plan for capturing market share.

-

Ideal Target Characteristics: Companies that do not necessarily need the growth capital to survive are ideal targets for growth equity investment. These companies have enough funding or cash flows to finance their expansion strategies and are not solely reliant on this investment for survival.

-

Exit Strategy: Like all investments, growth equity investments have an exit strategy. This typically involves selling the investment after a certain period, often 5-7 years, either through a sale of the company or a public offering. The goal is to realize a return on the investment that exceeds the initial capital outlay.

Growth Equity vs. Venture Capital

Both growth equity and venture capital are forms of private equity investment, but they serve different stages of a company's lifecycle and have distinct characteristics. Understanding the differences between the two can help companies determine which type of investment is most suitable for their needs.

Growth Equity

-

Stage of Investment: Growth equity is typically invested in companies that have already achieved a level of success and are looking to scale their operations further. These companies have proven their business models and are generating revenue.

-

Investment Size: Growth equity investments are usually larger than venture capital investments but smaller than traditional buyout investments. They typically range from USD5 million to USD100 million or more.

-

Ownership Stake: Growth equity investors usually take a minority stake in the company. This means that they do not have control over the company's operations but have a say in strategic decisions.

-

Focus on Growth: The primary goal of growth equity investors is to help the company grow and increase its value. They provide capital to fund initiatives such as expanding into new markets, developing new products, or making strategic acquisitions.

-

Time Horizon: Growth equity investments typically have a longer time horizon than venture capital investments, often ranging from three to seven years.

Venture Capital

-

Stage of Investment: Venture capital is invested in early-stage companies that are in the early stages of development and have not yet proven their business models. These companies are often pre-revenue or generating minimal revenue.

-

Investment Size: Venture capital investments are typically smaller than growth equity investments, often ranging from USD 500,000 to USD10 million or more.

-

Ownership Stake: Venture capital investors often take a significant ownership stake in the company, often 20 percent to 50 percent or more. This gives them control over the company's operations and strategic direction.

-

Focus on Innovation: Venture capital investors focus on funding innovative ideas and technologies that have the potential for high growth. They are willing to take on higher risks in exchange for the potential for higher returns.

-

Time Horizon: Venture capital investments have a shorter time horizon than growth equity investments, often ranging from three to five years.

Growth equity is suited for established companies looking to accelerate their growth, while venture capital is more suited for early-stage companies with innovative ideas. Both forms of investment play an important role in fueling entrepreneurial growth and innovation in the economy.

Conclusion

To sum up, growth equity emerges as a critical enabler for established companies seeking expansion. Growth equity is aimed at well-established businesses with a track record, in contrast to typical venture capital, which focuses on early-stage entrepreneurs.

What sets growth equity apart is its strategic nature. It goes beyond funding, offering strategic insights and operational expertise crucial for managing complex markets and sustaining growth.

By emphasizing long-term value creation, growth equity investors play a vital role in driving economic growth and fostering innovation. This collaborative approach benefits not just the companies but also the broader economic landscape.