Stock markets are shrinking with the yields now even less than half of the 1990s boom. The private markets, in contrast, are growing and gaining traction.

The global private equity’s net asset value has multiplied by 8 times since 2000 – nearly 3X faster than public market capitalization. (McKinsey Report 2020)

The number of PE-backed ventures in the US almost doubled in a decade by 2017. PE industry presently controls over 8000+ businesses in the US, contributes about 5% to the country’s GDP, and hires a substantial share of the workforce. It is also expanding footprints in essential sectors such as healthcare, private prisons, and more.

By the virtue of its increasing role and large-scale impact in society, it is important the industry is held to a higher standard of behavior. What does this fourth-largest employing sector owe?

When you start to become systemically important, it becomes your fiduciary responsibility to earn a social license to operate and keep it by pushing for positive change.

PE firms have an accountability to consider material risks to their portfolios including environmental, social, and governance (ESG) considerations. Regulations and global shift toward sustainable investments have confirmed that ESG isn’t secondary to returns, and its neglect exacerbates systemic risks.

So, how is the private equity industry responding to systemic and systematic risks? More importantly, how impactful are those responses. USPEC takes a look.

Eight Types of PE Responses to Crises

No crisis occurs in a vacuum. Most are a result of interconnected systemic and systematic risks brewing in the system, which snowball to lead to negative consequences. Acting and responding to the inherent root causes is more important than reacting to the negative impacts after they have surfaced.

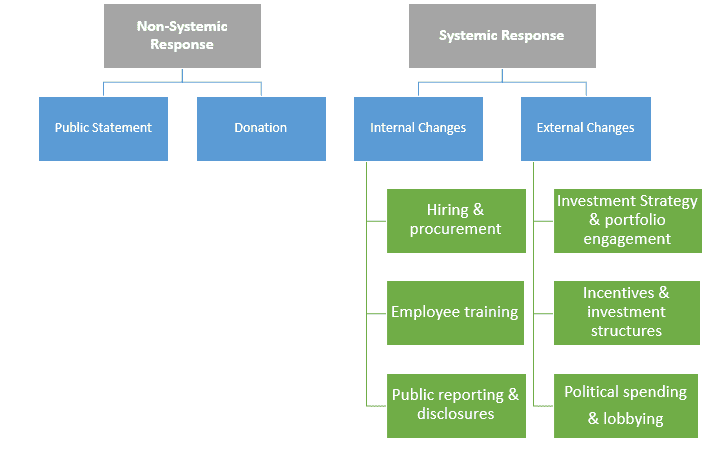

In a research study, 17 Communications evaluated private equity firms’ 8 potential responses to the triple crises – Climate Change, COVID-19, and Racial Injustice.

The non-systemic responses, i.e. statement and donation, are high-level responses, rather than a way of addressing the root causes. Systemic responses, in contrast, represent significant steps toward bringing transformational systemic and systematic change.

Here’s what each response type comprises.

-

Public Statement: Acknowledging an issue by issuing a statement. For instance, a letter from the CEO, a declaration on social media, etc.

-

Donation: Giving back by donating to an NPO in solidarity with one or more issues.

-

Hiring and Procurement Practices: Increasing hiring of ESG professionals; ensuring diverse representation; developing diversity policies; commitment to pay equity, and more.

-

Employee Training: Organizing DEI training; forming ESG committees and grievance redressal mechanisms; etc.

-

Public Reporting and Disclosures: Publishing sustainability and ESG reports with data; disclosing diversity and pay ratio targets; and more.

-

Investment Strategy and Portfolio Engagement: Staying away from risky sectors like fossil fuels; supporting and investing in portfolio companies with ESG orientation; and more.

-

Invectives and investment Structures: Aligning employee incentives with ESG and impact investing; improving tax transparency; narrowing pay gap between portfolio company worker and fund manager.

-

Political Spending & Lobbying: Aligning lobbying practices with ESG goals; disclosing political spending; etc.

Which Style of Response PE Firms Chose

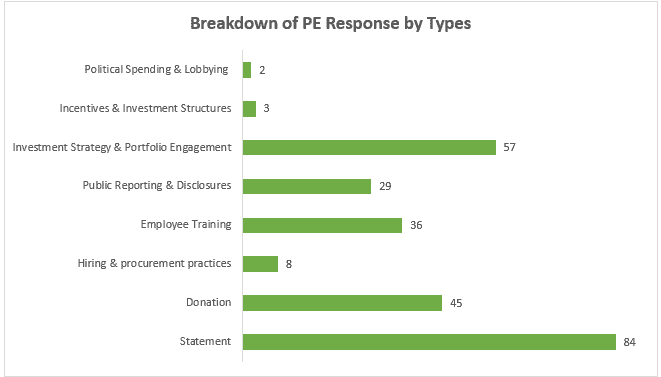

In total 264 responses of PE firms were recorded from which issuing a statement (84) turned out to be a most common response, followed by internal change (73), external change (62), and then a donation (45).

Private equity firms are quite hesitant in bringing fundamental changes that address the root causes. This suggests that most firms are doing the bare minimum and are failing to take systemic risks seriously enough to bring changes required to prevent perpetuity of a crisis.

Stuck in Thoughts and Prayers Mindset

The communications playbook subscribed by private equity firms indicates they are following the “thoughts and prayers” model, i.e. giving out an impression of empathy through statements but taking few tangible steps to prevent the recurrence of a problem.

This habit of incremental solutions should be let go. PE needs to learn to address the systemic and systematic risks at the root before they have an opportunity to snowball. When done right, PE can be a model for capital markets at large due to its unique position and growing influence.

USPEC’s Take

Although far from enough, even this lukewarm level of response is unusual from an industry that has been opaque about its practices beyond announcing transactions and fund closings. PE has been most vocal on social issues in 2020 than in no time ever. This trend will only grow in 2021 and beyond.

Committing to ESG isn’t quite donning a hair shirt. Climate change, inequality, gender disparity, and weak capital structures can destabilize portfolios in the long run. Adequately responding to the causes of systemic and systematic risks is material for PE managers for the health of the overall system and portfolios.