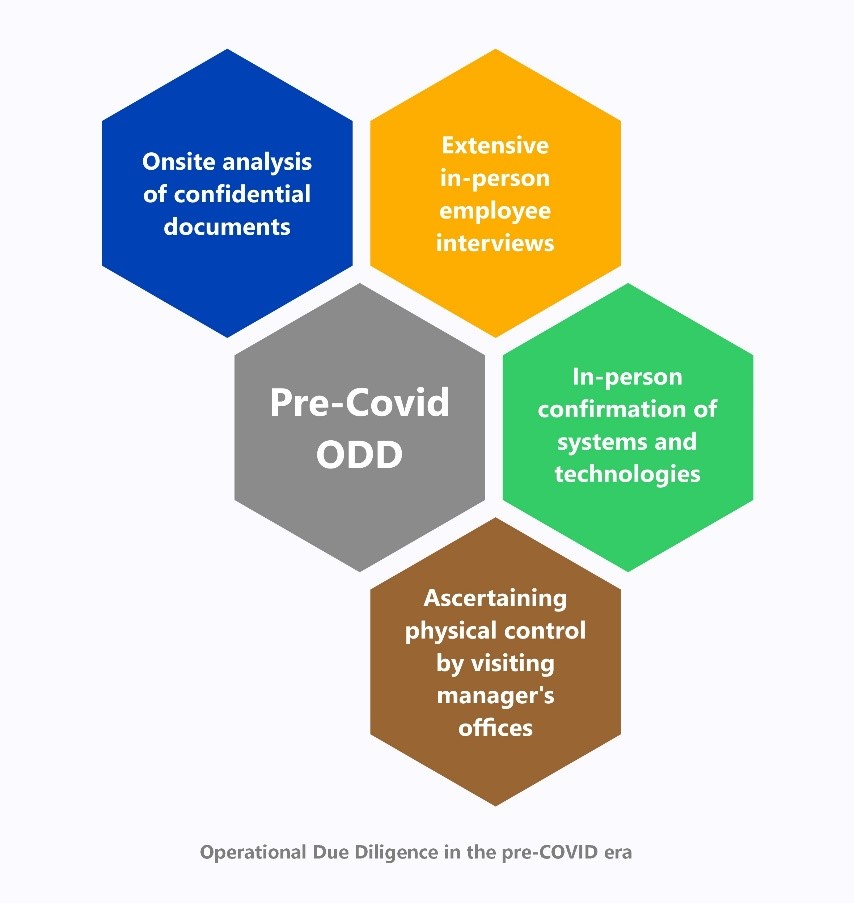

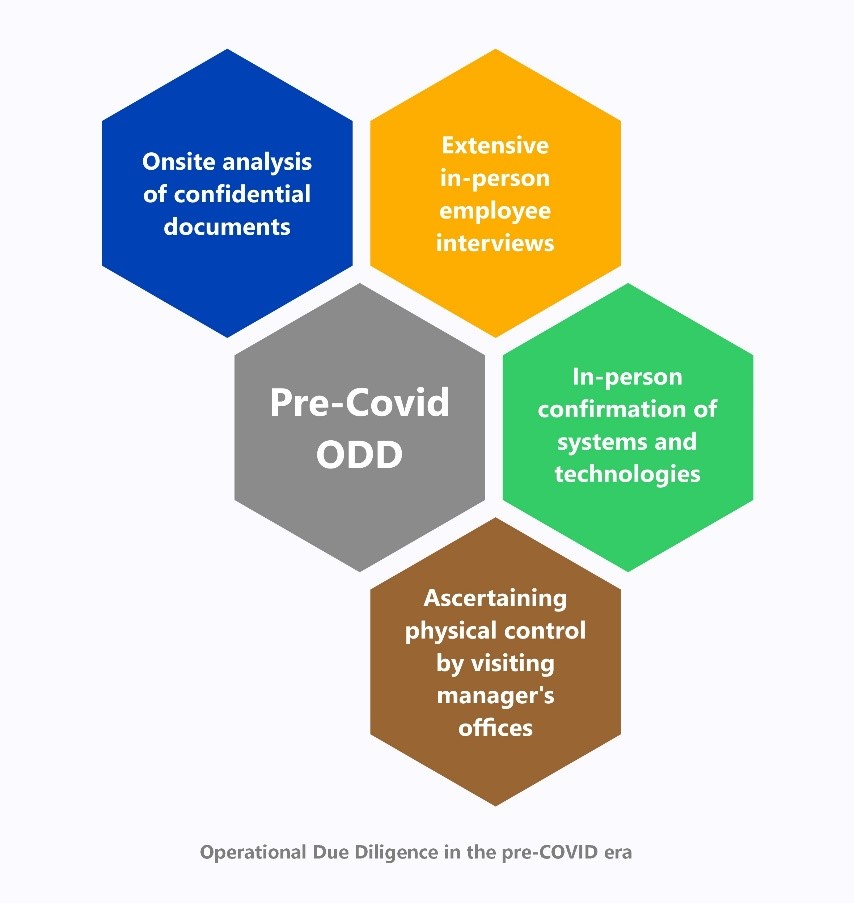

In the pre-COVID era, operational due diligence (ODD) was a highly in-person interactive activity centered around taking a trip to the investment manager’s office and meeting and interviewing the parties, reviewing documents, and evaluating reliability.

COVID-19 puts a full stop on the existing ways.

With nearly 66% of the employees in the US working from home, virtual due diligence became a mandate almost overnight.

The general consensus among PE leaders is – like the Great Recession of 2008 and Hurricane Sandy of 2012 – the PE industry exceeded expectations and rebounded to normalcy quicker than thought. It surpassed most industries in its quick transition to remote working.

“Most businesses were able to establish new ways of working in a matter of days and not weeks, and it has been business as usual,” says Mitchee Chung, European director at investment consultant Mercer Sentinel Group.

Today:

29% of investment due diligence employees are no longer conducting in-person interviews. – The Investment Management Due Diligence Association

These employees are working remotely and are using improved data management, record digitalization, and videoconferencing technologies. A few others are using drones, Google Earth, and satellite images to reach hard-to-travel places. More PE firms are using data rooms to share confidential documents like SEC letters.

Meketa Investment Group, an overseer of USD 1.5 trillion client assets, plans to go fully remote in the near future.

This is one happy lot. But there’s another no-so-talked-about lot that has kept its deals on hold or has curtailed the new ones. These fall under two divisions:

# They delayed new managers’ engagement

Among the ones who froze their new deals waiting for the storm to pass were the likes of Public Officials Benefit Association of Korea and MG Korean Federation of Community Credit Cooperatives, who decided to do operational due diligence on a case-to-case basis.

This group had a hard time trusting the reliability of the remote Zoom, conference calls, and screen-sharing methods of information sharing. Remote diligence was a strict no-no for the first-time funds.

# They invested in the existing managers who had completed ODD exercises previously

Korean Teacher’s Credit Union Retirement Fund decided to invest only in the managers they are already engaged with.

Benefits of Remote Due Diligence

Remote due diligence came with its own set of benefits. The most important ones were:

It eliminated the need to pack multi-hour interviews into a single day. With remote setups, analysts can conduct the ODD with key officers over several meetings spread over many days. This also makes space for more detailed and all-inclusive reviews.

Most hedge funds did not cover for extensive travel budgets, so analysts missed important capital introduction events. With remote access, they can access an event anywhere, anytime.

Challenges of Remote ODD

A few challenges still need to be addressed.

Due diligence teams are accustomed to in-person interactions. They are yet to discover their comfort with remote operations, which includes understanding the inter- and intra-team dynamics, analyzing policies and compliance manuals, or evidencing a live trade show in an order management system.

Activities that were earlier considered low-risk such as events-based termination of material contracts and supply chains security may now need careful study.

Transitioning to remote work is harder for smaller firms and new businesses. Curtailed in-person interactions inhibit their capability to invest in good funds.

Younger staff may miss their training.

7 Tips to Transition to Remote ODD

Those new to remote ODDs can use these seven tips to expedite their transition:

Inform all parties involved in the ODD

Use video conferencing for better communication

Outline an agenda covering the meeting timings and details of the participants

-

Compile a list of documents needed for the meeting and arrange their digital copies

Share the documents beforehand with the attendees

Ensure screen-sharing is functioning for demonstration of important processes like trade reconciliation and trade execution

Ensure transparent and consistent communication and verification with the service providers

The Post-COVID future of Operational Due Diligence

COVID-19 has brought an onslaught of both short-term and longstanding changes for the PE industry.

Remote ODD has paved a new path to conduct efficient deals, one that is likely to extend in the post-COVID future. It also saves infrastructure costs and improves efficiency.

A recent report from Deloitte says that in the post-COVID period, owing to added health demands, the average cost per-in person employee will increase by 40% to 50%.

That being said, most offices aren’t planning to go fully remote. Many experts speculate that future offices will be limited to shared meeting spaces with limited spaces for critical in-person staff. The physical footprints in offices are likely to remain low in times to come.

As the COVID-19 situation eases, the PE market can take a favorable turn for investors as troubled firms will seek exit routes. In the post-COVID period, PE firms must be prepared to generate outsized returns.

Before we part, here’s a look at how the market got brighter for PE firms post the 2008 debacle.