The mere thought of having a private equity investment conjures up envy, admiration, and lucre - a lot of it. But that is not all there is to it. Behind the scenes of this high growth, the brilliant industry that seems to effortlessly acquire the best minds in finance, lie some of the most detailed and stringent scrutinies of a target acquisition's finances, team, operational history, and future growth potential.

A Deep Dive into What PE Firms Actually Do

In short, private equity firms raise capital from institutional investors and high net worth individuals and then select enterprises where they can deploy this capital, administer it through a rapid (sometimes slow) transition phase of growth, and eventually when the value of the capital appreciates many times over. The PE firm then seeks to exit at higher valuations either through an IPO or through the sale of their stake to another entity. They then keep their fees, which is typically 1%-2% and generate massive returns to the institutional investors and HNIs who had backed them. Since the private equity firm’s members are not lenders, the capital deployed is in the form of equity in the company, and not debt, although a blend of both may be put into place given the state of affairs of the target acquisition.

This description is a barebones elucidation of their modus operandi. There’s far more going behind the scenes, given the fact that a successful stake acquisition is just one phase in one deal in the life of a private equity player. As daily operations they have hundreds of due diligence, thousands of proposals and millions of financial records to evaluate and risk mitigate capital deployment.

BEHIND THE SCENES - THE FINANCIAL RATIOS THAT MAKE UP THE DEAL

As a private equity professional, some of the most important decisions are made using financial ratios. Financial ratios are essentially the correlation between different elements that make up the financial statements of an enterprise or business plan, as well as the different correlations between assets and liabilities. They are heavily relied upon by private equity professionals before making an acquisition or investment in ventures. Some of the prominent financial ratios include:

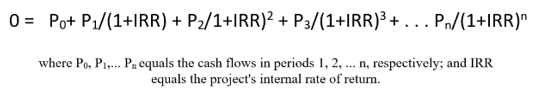

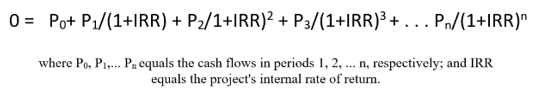

Internal Rate of Returns - Largely used to assess the value of a project or investment, in terms of how attractive it is to an investor. When IRR> company’s rate of return, the investment is deemed attractive, but if IRR < expected rate of return, the opposite is true.

The formula used to calculate IRR:

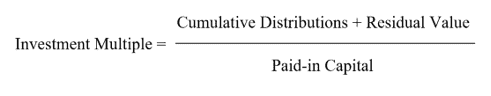

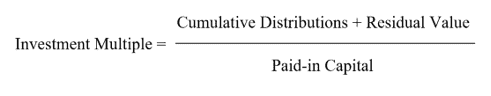

Investment Multiple - Also known as total value to Paid in multiple, it is calculated by dividing both the cumulative distribution and residual value of the firm by the paid-in capital.

The formula used to calculate TVPI:

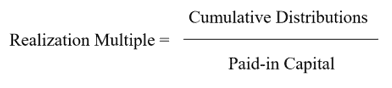

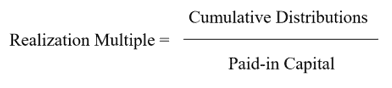

Realization Multiple - Also known as Distributions to Paid in Multiple. One arrives at the Realization Multiple by dividing the cumulative distributions (total amount of stock and cash paid out to partners) by the paid in capital. This is particularly insightful in providing a potential PE manager to gauge just how much of the fund’s return has actually been “realized” (paid to investors).

The simple formula of realization multiple:

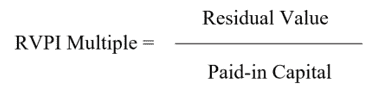

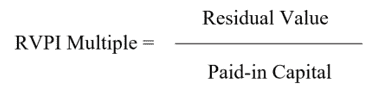

Residual Value to Paid in Ratio: This can be defined as the current market value of unrealized investment as a ratio to the total invested capital. It provides insights into the total multiplied value of up-front capital costs. It is typically calculated by adding up net asset value of the fund’s deployed capital and dividing it by the cash flows paid into the fund. The calculation of RVPI multiple is as follows:

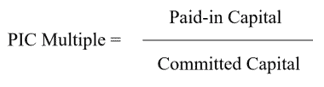

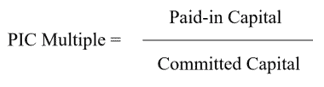

Paid in Capital Multiple: Paid in capital or the PIC multiple is a major indicator of the health of the investment and the firm. It is calculated by dividing the paid-in capital by the committed capital of the fund into the enterprise. This ratio demonstrates the drawdown of the firm’s committed capital. It can be calculated using the following formula:

This was an effort to demystify just some of the hundreds of complex financial transactions, indicators and analysis that you, as an aspiring private equity professional need to use on a daily basis. While this is a job that is sure to challenge your intellect almost daily, the rewards of a high flying and jet-setting, globe-trotting Private Equity career more than makes up for the effort. What you need are the skills and credentials, vetted by the world’s largest single point certification authority on Private Equity. So enroll now and climb the corporate career ladder in this exciting industry today!

(All formulae credits: investinganswers.com | investopedia.com)