Introduction

Private equity technology worldwide is continuing to see considerable momentum. It is the process of investing in technological firms with the view of achieving technological advancement and bearing higher returns. Technology is playing an important role in today's world, and this makes it very important for investors in private equity technology as a key industry. In this resource, we’ll help you to navigate the sphere of private equity technology, describing its peculiarities and giving useful recommendations. Read along!

Understanding Private Equity Technology

Private equity technology is a specialized branch within the broader branch of capital markets. Here’s a breakdown of what it encompasses:

-

Definition and Scope: As the name suggests, private equity technology is the investment by the private equity firms in the technology sector. This can range widely to sub-sectors like software, hardware, telecommunication, and IT services among others.

-

Key Differences: Private equity technology, unlike conventional private equity, is oriented towards sectors which depict high-growth potential and technologically advanced sectors. This usually involves a high amount of risks though the benefits that stem from it are usually higher.

-

Market Importance: It has gradually emerged important due to the climactic role of technology in different sectors. Tech startups and firms are investments that can foster change, productivity, and differentiation.

-

Investor Focus: Private equity technology investors seek firms with fine patents, veritable business propositions, and quite significantly, the capacity to disrupt a market field.

Investment Strategies in Private Equity Technology

Approaches to investing in private equity technology can significantly impact returns and the success of these private equity strategies. Here are five common strategies employed:

-

Growth Equity Investment: This strategy concentrates on acquiring companies operating mature technologies with a stable business model and high growth prospects. It seeks to adapt fast through a vital support system and more capital investment.

-

Buyouts: These involve the purchase of controlling shares in developed technology firms. Private equity firms apply it in executing operational changes that unlock value in the target company and increase its sales.

-

Venture Capital: Specializes in seed-stage technology companies by focusing on their unique value propositions, innovative technologies as well as potential growth rates. This strategy offers working capital funding for startups and aims at helping

growth-stage firms get to the growth stage and market-ready.

-

Distressed Investments: This entails the buying of stocks in struggling or sick technology firms. The intended purpose is to gain control and transform these companies with the target of achieving handsome turnovers.

-

Platform Building: It refers to accumulating several small technology firms and assembling them into a single major program. This strategy thus means that synergies and economies of scale are maneuvered to form a seemingly superior entity and value.

Due Diligence in Private Equity Technology

Private equity technology investments require due diligence to enable the investor to make the right decision in a bid to make a successful investment. Here are five key factors to consider during the private equity due diligence process:

-

Technical Assessment: This technology is not only robust and scalable, but it also is free from patent or copyright infringement. Knowledge of trends in the assessment of the company’s technical base is crucial to determine its sustainability.

-

Market Analysis: It is vital to examine the target audience's characteristics, analyze competition, and identify prospects for development. This also assists in the comprehension of the market features and the company’s position as a technology firm.

-

Financial Health : When reviewing the company’s performance, one should pay attention to key financial statements, the structure of income, and the net profit margin. Therefore, analysis of financial status offers a good insight into the company's financial health and any potential returns on investments.

-

Management Team Evaluation: Evaluate the experience performance and competencies of the team of managers in charge of the organization. Strength in personnel is a significant factor for success and meeting obstacles on the way to achieving the company’s goals.

-

Regulatory Compliance: Regulation and standard practice require that the company remains abreast with changes in its operation. Both legal and compliance issues should be detected beforehand because managing the risks and avoiding future losses is much easier to handle.

Value Creation and Exit Strategies

Value creation and exit strategies are two critical factors regarding private equity technology investments. Here are five key strategies:

-

Operational Improvements : Emphasis on increasing the organizational effectiveness of the arrangement of enterprises. This involves the cutting of costs, attainment of efficiency in processes, and reduction of supply chain costs to increase profits.

-

Strategic Mergers and Acquisitions : Acquire links to competitors through agreements and bring technological advancements into the business. Thus, it contributes to the strengthening of the market position and the growth of the value of the investment.

-

Digital Transformation Initiatives: Digitization of the executive information system for portfolio management companies to align their technology systems with modern technological strategies. Promoting technological advancements including the application of Artificial Intelligence, Cloud computing, and Cybersecurity improves work efficiency and competitiveness in the market.

-

Talent Acquisition and Development: Recruiting and retaining the best workforce to foster creativity, expansion, and development. As part of this, a firm needs to employ competent personnel, offer proper training to its employees, and put in place procedures for personnel development.

-

Strategic Partnerships and Alliances : Establish business relationships and cooperation agreements with other technology companies and other key players in the industry. Such collaborations can give the entrants access to new markets, technology, or expertise and increase the possibility to create more value and achieve good exits.

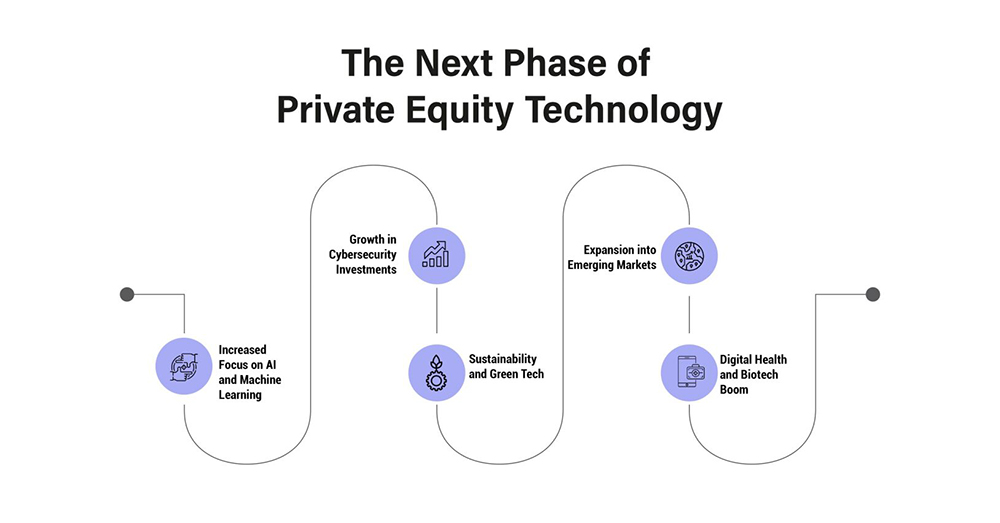

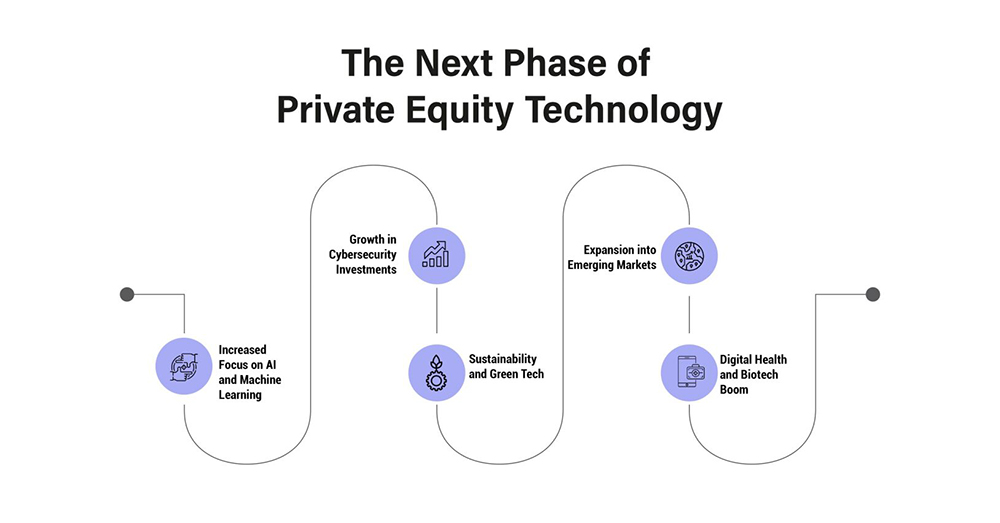

The Next Phase of Private Equity Technology

Modern private equity for technological industries is still emerging and closely associated with new developments and trends. Let’s look at the key emerging trends and the future outlook for private equity technology:

-

Increased Focus on AI and Machine Learning: AI & Machine learning as investment areas are rapidly growing as these technologies are imbued with the potential for as many disruptive efficiencies and values added.

-

Growth in Cybersecurity Investments: As data security and privacy concerns become paramount, private equity technology firms are shifting their focus towards cybersecurity companies and technologies.

-

Sustainability and Green Tech: Sustainable technologies and green tech are already demonstrating trends toward increased development along with a guarantee that the attention of future investments is certain to shine on this division.

-

Expansion into Emerging Markets: The current and potential technology investors through private equity are no longer focusing on the developed markets as they establish new horizons of opportunities in emerging markets where the applications of technology are rapidly escalating and are highly lucrative.

-

Digital Health and Biotech Boom: Digital health solutions and biotechnology have become rising industries as the pandemic has advanced the need for them; this has attracted many firms of Private Equity technology as they seek to invest in growing industries.

Conclusion

To understand the present and future environment of private equity investments, it is crucial to have some background knowledge on how private equity technology works. This article has attempted to expose several issues pertinent to investing in technology covering everything from the participants, investment methods, due diligence, and regulatory environment. Thus, understanding certain opportunities and risks associated with private equity technology will make it possible to turn them into advantages to improve investor portfolios and develop the tech sector further.