Introduction

Private equity’s involvement in healthcare has steadily increased, driven by substantial capital infusions and effective management strategies aimed at overhauling the sector. This is due to a realization of the importance of change, effectiveness, and enhanced quality of care. As private equity healthcare investments increase, they significantly influence the transformation of numerous kinds of healthcare services. This article explores the concept of healthcare private equity funds and the roles of their functions, opportunities, concerns, and prospects as the healthcare industry evolves.

The Growing Influence of Private Equity in Healthcare

Private equity has played a significant role in the healthcare industry over the last decade. The reason why private equity firms began to focus on the healthcare industry was because it was relatively stable and provided consistent returns. This interest has not subsided; rather it grew, resulting in increased investments that are going towards the opportunities that can be found in the industry.

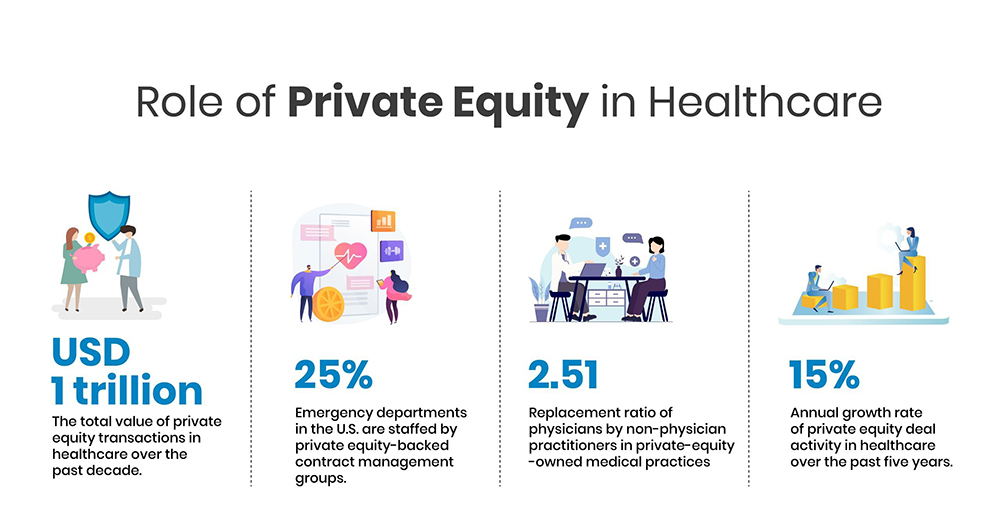

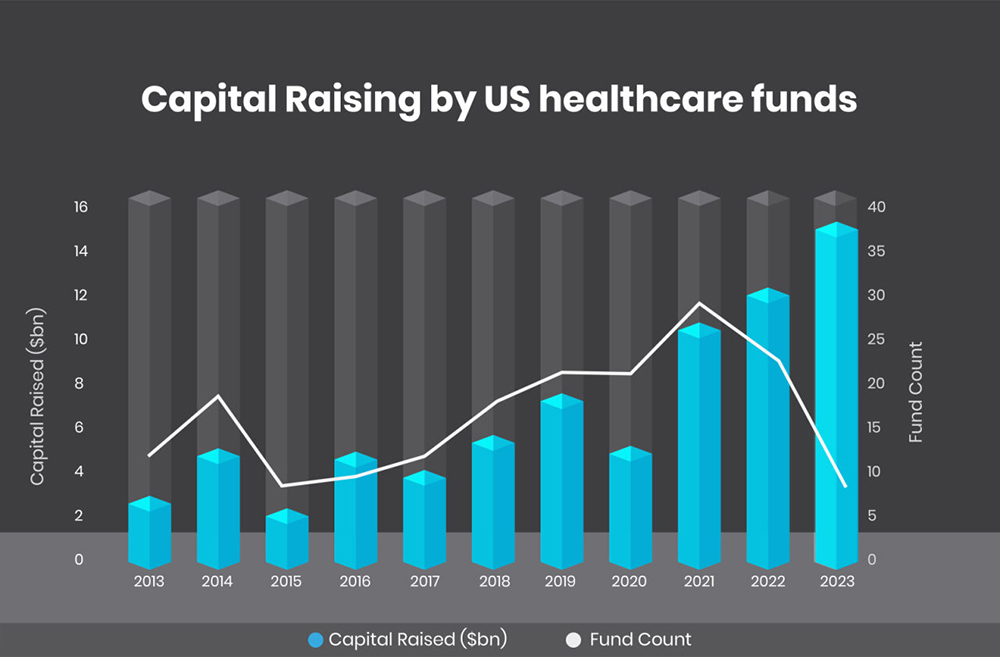

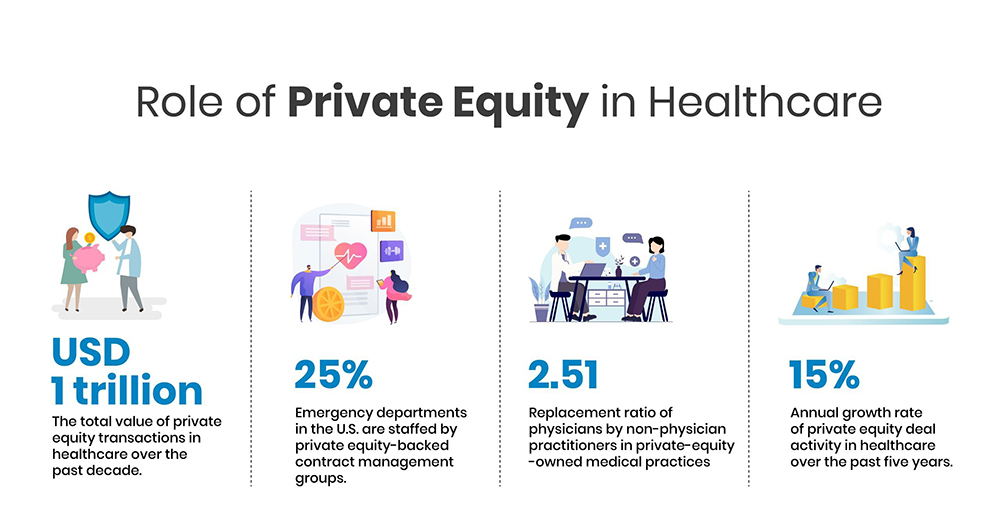

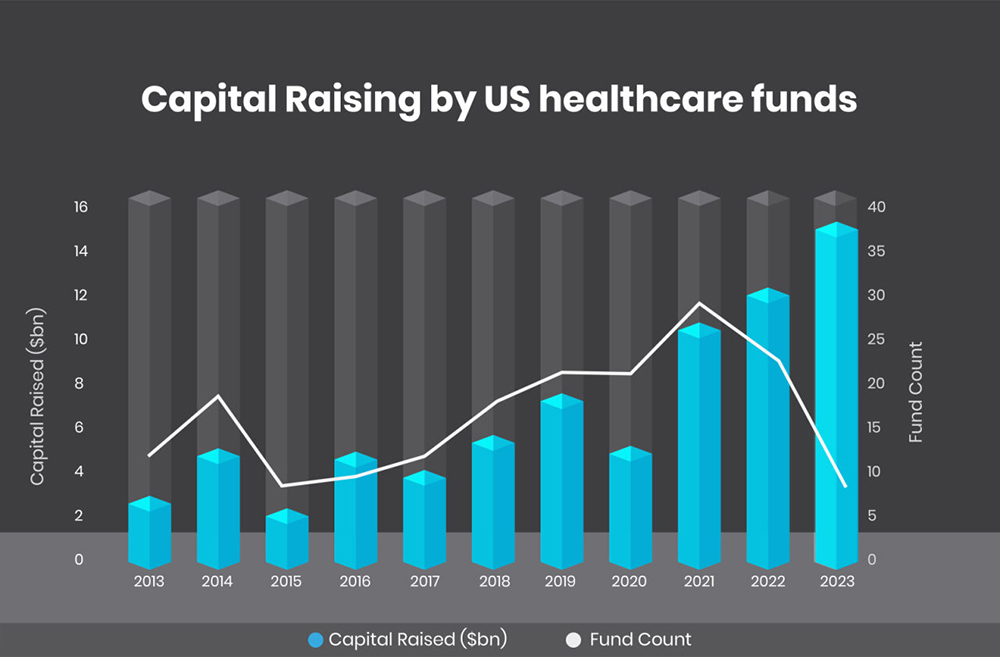

Current trends and statistics highlight the increasing dominance of private equity healthcare investments.

-

Merger and acquisition deals by private equity funds in the healthcare industry stood at USD138 billion for the year 2023. It was also higher than in previous years, which points to rising confidence and transactions in the sector.

-

About a quarter of the 2023 private equity transactions were dedicated to the healthcare industry, proving its demand and popularity among buyers.

- The Compound Annual Growth Rate (CAGR) for private equity in the healthcare sector is expected to be 12% from 2024 to 2028, which reveals a firm future demand and constant trends.

Several key drivers are fueling this surge in private equity investments in healthcare:

-

Aging Population: The increasing population of elders needs more health care services, hence making it a good area to invest in.

-

Technological Advancements: Medical technologies and digital health are gaining attention from private equity firms looking for companies with high growth prospects.

-

Regulatory Changes: As healthcare policies and regulations change frequently, new ventures emerge and existing ones become risky, making private equity firms advance and invest wisely.

- Market Fragmentation: The fragmented nature of the healthcare market means that there are opportunities for consolidation and improved efficiency through private equity investment.

The rising role of private equity in healthcare is transforming the industry, creating both risks and rewards that participants need to manage.

The Expanding Role of Private Equity in Healthcare

Private equity has grown to be very influential in the healthcare industry and has brought about massive changes. Healthcare was not a favorite sector for private equity firms in the past. However, in the last two decades, their importance has emerged tremendously, transforming the provision of healthcare services.

Current trends and statistics highlight the significant growth of private equity investments in healthcare:

Key factors contributing to the rise of private equity healthcare include:

-

Increased Demand for Healthcare Services: Aging demography and an increase in the prevalence of chronic diseases have increased the need for healthcare services, thereby pulling in private equity investments.

-

Regulatory Changes: Due to changes in healthcare laws, private equity firms can now invest in different areas of the healthcare industry.

-

Technological Advancements: The advancement in medical equipment & devices and digital health has created new avenues for investment in healthcare private equity funds.

-

Economic Pressures: Healthcare organizations struggling with reduced revenues and increased expenditures in the form of reimbursement cuts have sought private equity funding and guidance.

Private equity firms are not only financing healthcare organizations but also introducing managerial skills and operational effectiveness. Such an inflow of resources and information is positively impacting patient care, innovation, and healthcare systems.

Private Equity’s Positive Influence on Healthcare Services

Private equity has remarkably impacted the healthcare industry and has offered numerous advantages that have redefined the delivery and management of healthcare services. These benefits include:

-

Increased Access to Capital: These firms also facilitates the infusion of huge amounts of capital into healthcare providers to buy new equipment, build new structures, and improve services. This capital is important for fostering advancements and enhancing the quality of care given to patients.

-

Operational Efficiency: Many private equity firms can provide professional management techniques and operational approaches to the healthcare companies they acquire. This can result in the elimination of redundant processes, less waste, and increased productivity, leading to the advantage of the patients and the staff.

-

Innovation in Healthcare Delivery: Private equity healthcare fund investments have created many developments in healthcare technologies and systems. Some of the trends include the uptake of telemedicine, health information systems, and other e-health solutions that enhance patients’ access and management.

There are several ways in which private equity can benefit the healthcare industry and improve patient care. Thus, these mentioned benefits illustrate the potential for well-executed private equity investments to bring value to the healthcare sector.

Success Stories in Private Equity and Healthcare

It is useful to consider certain cases to understand the effects of private equity healthcare investments in real life. Here are a few notable success stories that highlight both successes and challenges:

-

The Acquisition of Envision Healthcare: In 2018, KKR and Welsh, Carson, Anderson & Stowe bought Envision Healthcare, a major physician services and ambulatory surgery company. The investment was meant to increase efficiency in the operations of Envision as well as the size of the network it covered. This deal showed how healthcare private equity funds can support development and enhance the quality of service by targeting investments and management experience.

-

The Growth of HCA Healthcare: Private equity healthcare has played a role in the expansion of HCA Healthcare, which is one of the largest for-profit hospital chains in the United States. The company, which was founded and initially funded by Bain Capital, KKR, and others, has grown and has extended its market presence. This demonstrates how private equity can lead to massive investments in the healthcare infrastructure and changes in the way the facilities are managed.

-

The Rise of Teladoc Health: Teladoc Health is a telemedicine company that has the boost of private equity investment in its growth process. Teladoc has been able to expand its virtual care services with funding from healthcare private equity funds, which in return has transformed the healthcare industry and created opportunities for digital health technologies.

These case studies highlight the impact of private equity investments in shaping the healthcare industry in multiple directions.

The main challenge in managing private equity platforms is to find the right approach that enables easy access while ensuring adequate research has been conducted to harness the full benefits of private equity investment.

Core Private Equity Investment Strategies

Private equity provides several approaches that depend on the level of risk tolerance and investment goals. These strategies are core components of how funds raise and invest capital and facilitate returns, with the help of active management and value creation. Here's an exploration of some core strategies:

Conclusion

Private equity healthcare has evolved as a key player in determining the healthcare sector’s trajectory and pioneering innovations and improvements. Although it has numerous advantages in terms of opening capital and innovation, it also poses some risks that should be properly harnessed to have positive impacts on patients and providers. Thus, healthcare private equity funds will play a more significant role in restructuring the healthcare industry while considering the growth rate and possible long-term effects.