Private equity case studies serve as a pivotal stage in recruitment. They offer firms a window to assess candidates' analytical, investing, and presentation skills. Understanding the nuances of these case studies can significantly enhance your preparation and success rate.

This comprehensive guide provides insights into the types of case studies, preparation strategies, and key aspects of presentation and analysis. Whether you're new to private equity or a seasoned professional, mastering these case studies is essential for succeeding in a competitive industry.

What Should You Expect in a Private Equity Case Study?

Private equity case studies are a critical component of the recruitment process, offering firms a valuable opportunity to assess candidates' analytical, investing, and presentation skills. Understanding what to expect in a private equity case study can significantly enhance your preparation and improve your chances of success.

What are the Types of Private Equity Case Studies?

Private equity case studies can take various forms, each presenting its unique set of challenges. Candidates can anticipate encountering one of the following formats.

1. Take-home Assignment:

-

Candidates are provided with company information and tasked with evaluating the feasibility of an investment. This type of case study typically involves preparing a comprehensive presentation or investment memo, supported by a detailed LBO (leveraged buyout) model, within a specified timeframe.

-

Candidates are granted several days to a week to research a company, develop a model, and formulate a recommendation for or against an acquisition. This type of case study necessitates critical thinking and external research.

2. In-person LBO Modeling Assignment:

-

Similar to the take-home assignment, but completed on-site at the firm's office within a few hours. Candidates must construct a financial model and make an investment decision based on the provided information.

-

A 1-3-hour test, either conducted on-site or remotely, where candidates must swiftly build an LBO model. Proficiency in Excel shortcuts and familiarity with modelling tests are crucial for success.

3. Paper LBO:

-

A condensed version of an LBO model completed either on paper or verbally. This type of case study focuses on the fundamental aspects of the model and requires candidates to demonstrate their understanding without the use of Excel.

-

Candidates construct a simple leveraged buyout model using pen-and-paper or mental calculations, estimating the internal rate of return (IRR) using rounded figures.

Preparation Strategies

To prepare effectively for a private equity case study, focus on developing your investment thesis, honing your presentation skills, and enhancing your ability to respond to questions thoughtfully. Remember, the complexity of your model is secondary to your capacity to construct a compelling argument for or against the investment.

How to Present a Private Equity Case Study?

Presenting a private equity case study requires a strategic and thorough approach to effectively convey your analysis and recommendations. Whether you're preparing for a take-home assignment or an in-person presentation, mastering the art of presentation is crucial for success in the private equity recruitment process.

Prompt

The core question you'll encounter in any private equity case study is whether you would invest in the company under consideration. To answer this, you'll need to analyze the provided materials and construct a leveraged buyout (LBO) model to assess the potential return on investment. Typically, a return of 20% or higher is sought.

The case study prompt often includes specific assumptions to guide your LBO model construction, such as the pro forma capital structure, financial assumptions, and acquisition and exit multiples. Some firms may provide an Excel template for the LBO model, while others may expect you to create one from scratch.

Presentation

In a take-home assignment scenario, you'll likely be required to present your investment memo during the interview. This presentation is typically conducted in front of one or two representatives from the private equity firm.

The presentation format may vary among firms, with some expecting you to present first and then field questions, while others may prefer the reverse. Regardless of the format, be prepared to articulate your findings and respond to inquiries.

While technical proficiency is important in private equity recruitment, communication skills and attention to detail are equally critical. Interviewers will assess your ability to convey complex ideas clearly and concisely, as well as your meticulousness in addressing all aspects of the case study.

In the private equity interview process, every detail matters. Therefore, strive to provide a comprehensive and well-structured presentation, demonstrating your analytical rigour and ability to communicate effectively.

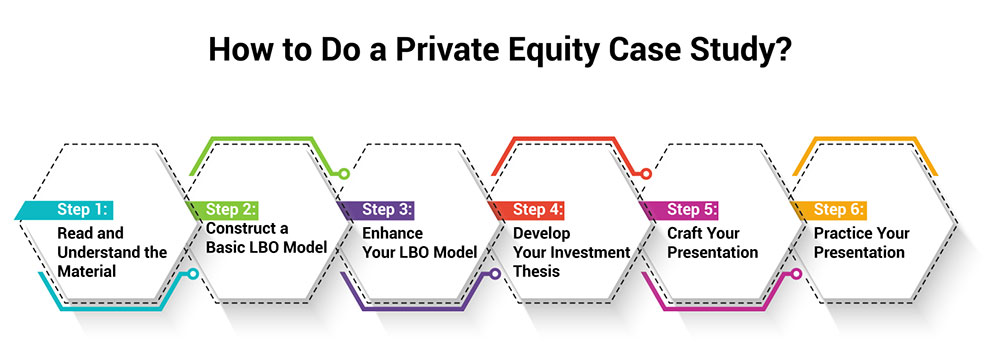

How to Do a Private Equity Case Study?

When tackling a private equity case study, a structured approach is crucial to deliver a comprehensive analysis and recommendations.

Step 1: Read and Understand the Material

Begin by thoroughly reading and understanding the provided materials. Gain insights into the company's background, industry dynamics, and financials.

Step 2: Construct a Basic LBO Model

Build a fundamental leveraged buyout (LBO) model using the ASBICIR method (Assumptions, Sources & Uses, Balance Sheet, Income Statement, Cash Flow Statement, Interest Expense, and Returns). This foundational model will underpin your analysis.

Step 3: Enhance Your LBO Model

Incorporate advanced features into your LBO model as required by the case study prompts. While it's essential to cover all aspects, prioritize completing the core financial model to ensure thoroughness.

Step 4: Develop Your Investment Thesis

Step back and formulate your investment view based on your analysis. Consider critical assumptions, conditions for proceeding with the investment, key risks, and primary drivers of returns.

Step 5: Craft Your Presentation

Organize your insights and analysis into a structured presentation. Clearly articulate your investment thesis, supporting analysis, and key findings.

Step 6: Practice Your Presentation

Rehearse your presentation to ensure clarity and confidence. Be prepared to engage in a discussion and defend your investment thesis.

Approaching a private equity case study with this methodical approach demonstrates your analytical prowess and strategic thinking.

How to Succeed in a Private Equity Case Study?

Succeeding in a private equity case study demands a strategic blend of analytical prowess, strategic acumen, and effective communication.

-

Master the Fundamentals: Start by focusing on the foundational aspects of the case study before delving into the complexities. Build a solid understanding of financial modelling principles and investment analysis basics. This will provide you with a strong grounding to tackle more intricate tasks with confidence.

-

Demonstrate Nuanced Investment Judgment: Avoid simplistic yes or no answers when presenting your investment recommendation. Instead, offer a nuanced analysis that considers the price point at which you would consider investing and the key assumptions driving your decision. Highlight potential avenues for value creation in the deal and discuss the primary risks and uncertainties involved.

-

Engage in Meaningful Dialogue: While the ability to build complex financial models is important, what truly sets you apart is your capacity to think critically and engage in intelligent discussion about the investment. Focus on presenting a well-considered recommendation supported by solid reasoning and analysis. Be prepared to discuss your model and elaborate on your investment thesis clearly and concisely.

-

Prioritize Substance Over Complexity: While showcasing your proficiency in financial modelling is essential, the goal is not to build the most intricate model. Concentrate on constructing a model that is accurate, logical, and well-structured. The true measure of success lies in your ability to derive meaningful insights from the model and utilize them to make informed investment decisions.

-

Highlight Value-Creation Opportunities: In addition to identifying risks, emphasize the potential opportunities for value creation in the deal. Discuss how you would leverage these opportunities to enhance the company's performance and generate returns for investors.

By following these strategies, you can significantly enhance your prospects of success in a private equity case study. Demonstrating your ability to think critically, analyze investments, and communicate effectively will showcase your thought leadership and analytical prowess.

How Do I Prepare for a Private Equity Case Study?

Preparing for a private equity case study requires a structured approach and a solid understanding of the fundamentals of financial analysis and investment evaluation.

-

Understand the Case Study Objective: Begin by understanding the objective of the case study, which is typically to evaluate the investment potential of a company. Familiarize yourself with the key concepts and methodologies used in private equity investing.

-

Review Financial Modeling Basics: Brush up on your financial modelling skills, focusing on key concepts such as revenue forecasting, expense modelling, and valuation techniques. Practice building and analyzing financial models to prepare for the case study.

-

Familiarize Yourself with LBO Modeling: Since leveraged buyout (LBO) modelling is a common aspect of private equity case studies, make sure you are comfortable with building LBO models. Understand the key components of an LBO model, such as debt structure, cash flow projections, and exit strategies.

-

Practice Case Studies: Practice solving case studies to hone your analytical skills and improve your ability to think critically. Look for case studies online or create your own based on real-world scenarios to simulate the interview experience.

-

Stay Updated on Industry Trends: Keep yourself informed about the latest trends and developments in the industries you are interested in. This will help you make informed assumptions and recommendations during the case study.

-

Develop a Structured Approach: Develop a structured approach to solving case studies, including how you will analyze the company's financials, identify key risks and opportunities, and formulate your investment thesis.

-

Seek Feedback: Seek feedback from mentors, peers, or professionals in the field to improve your case study skills. Consider participating in case study competitions or workshops to gain practical experience.

FAQs (Frequently Asked Questions)

1. How do you approach a private equity case study?

Approach a private equity case study by understanding the objective, reviewing financial basics, practicing LBO modelling, staying updated on industry trends, and developing a structured analysis approach.

2. How can I stand out from other candidates?

Stand out by demonstrating nuanced investment judgment, engaging in meaningful dialogue, prioritizing substance over complexity in modelling, and highlighting value-creation opportunities.

3. What is the role of modelling in a private equity case study?

Modelling plays a crucial role in a private equity case study as it helps evaluate investment potential, assess risks, and determine the feasibility of an acquisition.