Private equity (PE), to many, appears to be just about making money. But PE firms in fact play an important economic role – they can help enterprises move on a growth path and, consequently, generate returns for their investors. They become even more useful during crises, where their capital and their industry expertise are integral to helping companies battle the storms.

Valuations support this contention. Rising public market equity valuations mean PE funds are relatively more attractive to investors – for instance, the forward P/E ratio – 27.5 times the earnings estimates by analysts for 2021 – of the S&P 500 was at its highest in a decade. Assets under management (AUM) will grow, pushed by fresh capital and reinvestments from the ability of PE firms to deliver high returns and add value to portfolio companies.

The consequences of the pandemic are still unfolding.

The world has moved beyond the initial shock of possibly the biggest-ever pandemic, but its consequences are far from over. Quick actions to flatten the infection curve may halt or slow down the progress of the virus, but they also do the same for economies and deepen the recessionary impact. The signs suggest the downturn could surpass that seen in the financial crisis of 2008-09, or further back, World War II. Solace lies in how PE investors in the past too have demonstrated agility and the ability to navigate volatile scenarios – they could be instrumental in supporting business and economic recovery.

Businesses themselves have a very important part to play. Small- and medium-sized enterprises (SMEs) in particular have proven to be the growth engines of the global economy, generating 62 percent of net new jobs in the US and even more in developing economies. They however are fighting inflation and supply chain disruptions, a talent exodus across levels, and the need to make huge digital transformation investments necessitated by Industry 4.0.

The crisis is fundamentally different for private equity.

Economies halting around the globe did create buying opportunities but also brought a lot of uncertainty. Businesses under distress got a lifeline of sorts with government intervention, and could hold tight for some time.

Consequently, PE firms have had to reset their liquidity objectives and delay their potential sales processes. Their portfolio companies have been dealing with higher expenses on property, plant, and equipment (PPE); labor shortages; lower footfall; rising energy costs; supply chain constraints; and more. The flip side is that this has brought about unique buying opportunities for PE firms and their portfolio companies, wherein they can make acquisitions at lower prices than prevailing pre-pandemic.

Firms have had to change their tactics.

Some PE firms remain optimistic about prospects, while others have pivoted focus to preserving the value of portfolio companies and strengthening relations with lenders and limited partners. Given how the possible recovery trajectories are so different, PE firms are already taking concrete steps that could reshape their whole approach post the pandemic.

Deal pricing and payment, for instance, have changed. Purchase and sales agreements now include revised definitions for pandemic-related fluctuations in determining EBITDA for setting the purchase price and earnouts to sellers. Net working capital is now defined to exclude the COVID-19 impact on short-term assets and liabilities. More stress is being laid on tighter performance metrics, earn-outs, and longer earn-out durations.

Newer aspects of PE portfolio companies are being scrutinized.

The impact on portfolio valuations is still unfolding. Limited partners are seeking more timely information, and funds require help in guiding their asset allocation decisions. Accordingly, many have moved to more robust portfolio valuations done on a quarterly basis.

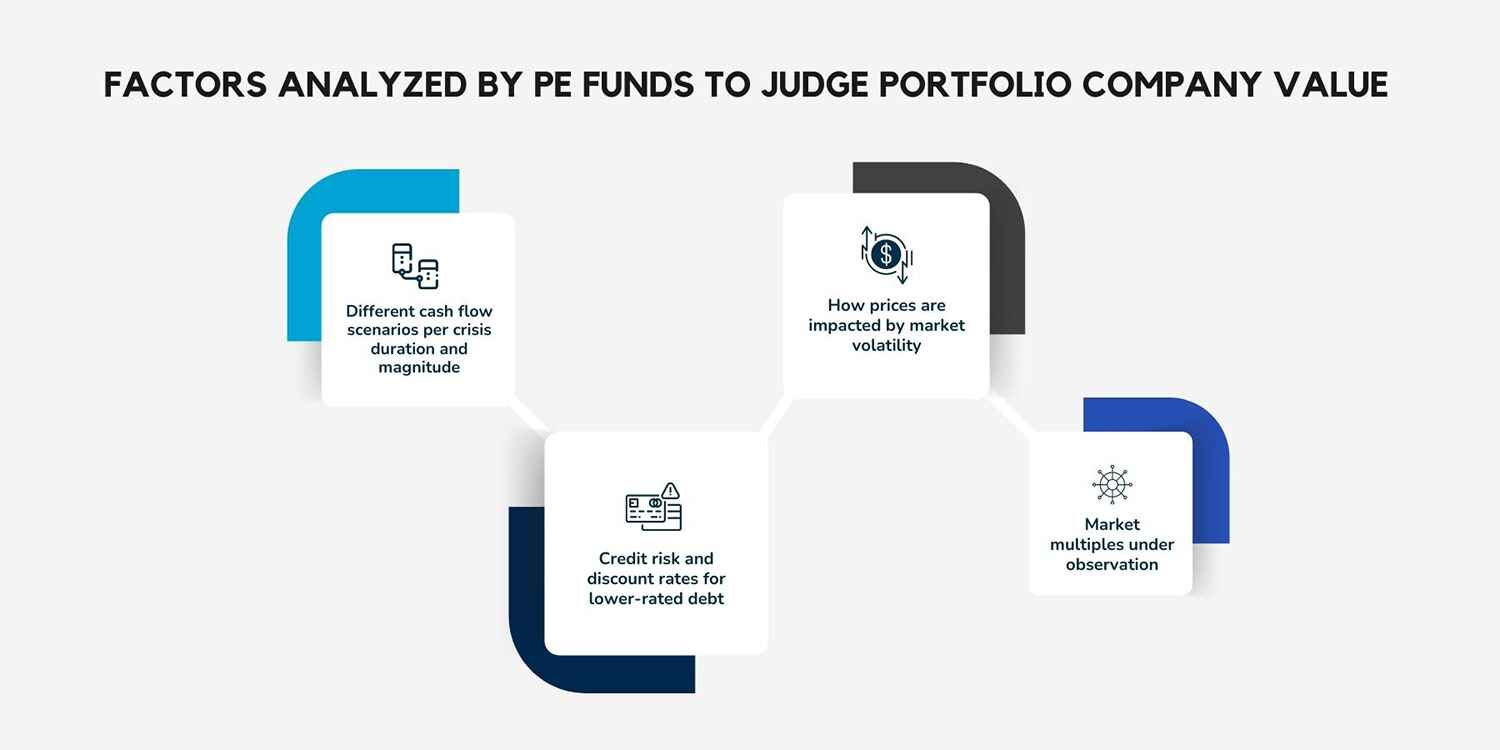

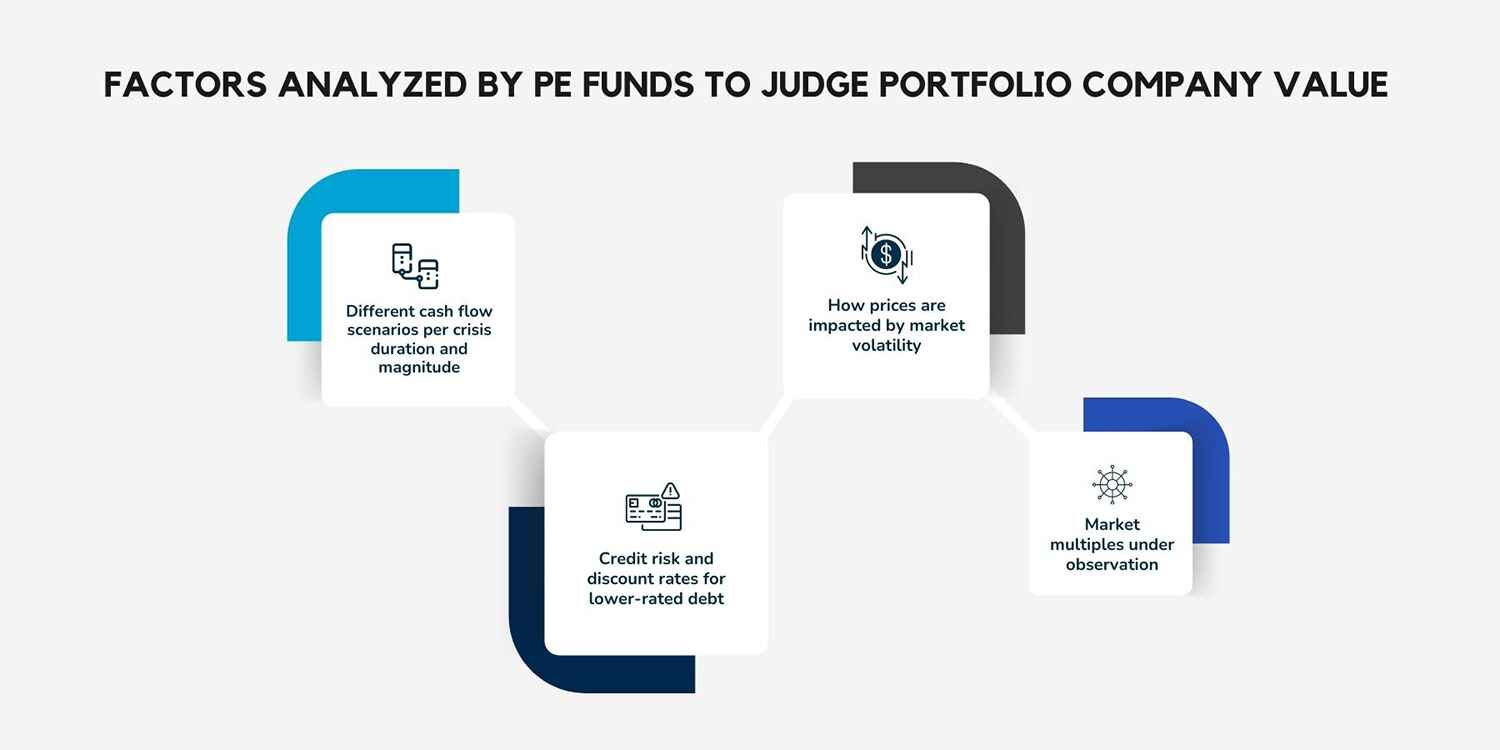

Factors analyzed by PE funds to judge portfolio company value

-

Different cash flow scenarios per crisis duration and magnitude

-

Credit risk and discount rates for lower-rated debt

-

How prices are impacted by market volatility

-

Market multiples under observation

Huge dry powder accumulation means intense market competition and a premium price for the most desirable targets. For those who want to avoid premium pricing, targets are less desirable, and the pandemic has only exacerbated the situation.

PE firms know there will always be some element of liquidity risk, given how their portfolio firms are leveraged with high debt levels. This risk was always assessed when investing, but pre-pandemic, the firms did not consider the challenges in paying interest and avoiding defaults that came with the economic slowdown from the pandemic. They are most certainly now considering future endemics, pandemics, and similar disruptions, which could make for risk assessments that include more conservative cash-flow forecasting.

Good PE deals are in short supply, courtesy the intense competition for top targets. Capital gains legislation is proposed for this year, and businesses rushing to be sold mean underprepared sale targets, which in turn call for additional diligence and sometimes pre-diligence. Of course, many sectors have just been bogged down by the continued effect of the pandemic.

2021 was a year of continued PE momentum.

The end-2020 momentum did not lose steam through 2021, with deal-making hitting record highs. Of the overall PE deal count in the first six months, the highest-ever annual proportion – 64.8 percent (Pitchbook data) – came from mid-market deals. Exit activity did very well too, but overall numbers were greatly boosted by a few large exits. With companies streamlining business models and rethinking essential services in the pandemic aftermath, corporate acquisitions within total exits grew well.

Factors promoting strong deal-making despite elevated valuations

-

Elevated dry powder

-

High-yield debt in strong demand

-

Growth-centric market

Purchase price multiples, then, may not decline significantly anytime soon, though rising interest rates could trip up the dynamic. Dividend recapitalization and refinancing by general partners (GPs) hit record levels, given the appetite for high-yield debt. The persistence of the trend will depend on how monetary policy evolves.

PE can play a strong role in post-pandemic economic recovery.

Structural headwinds and other unfavorable aspects of the playing field are where PE involvement help businesses.

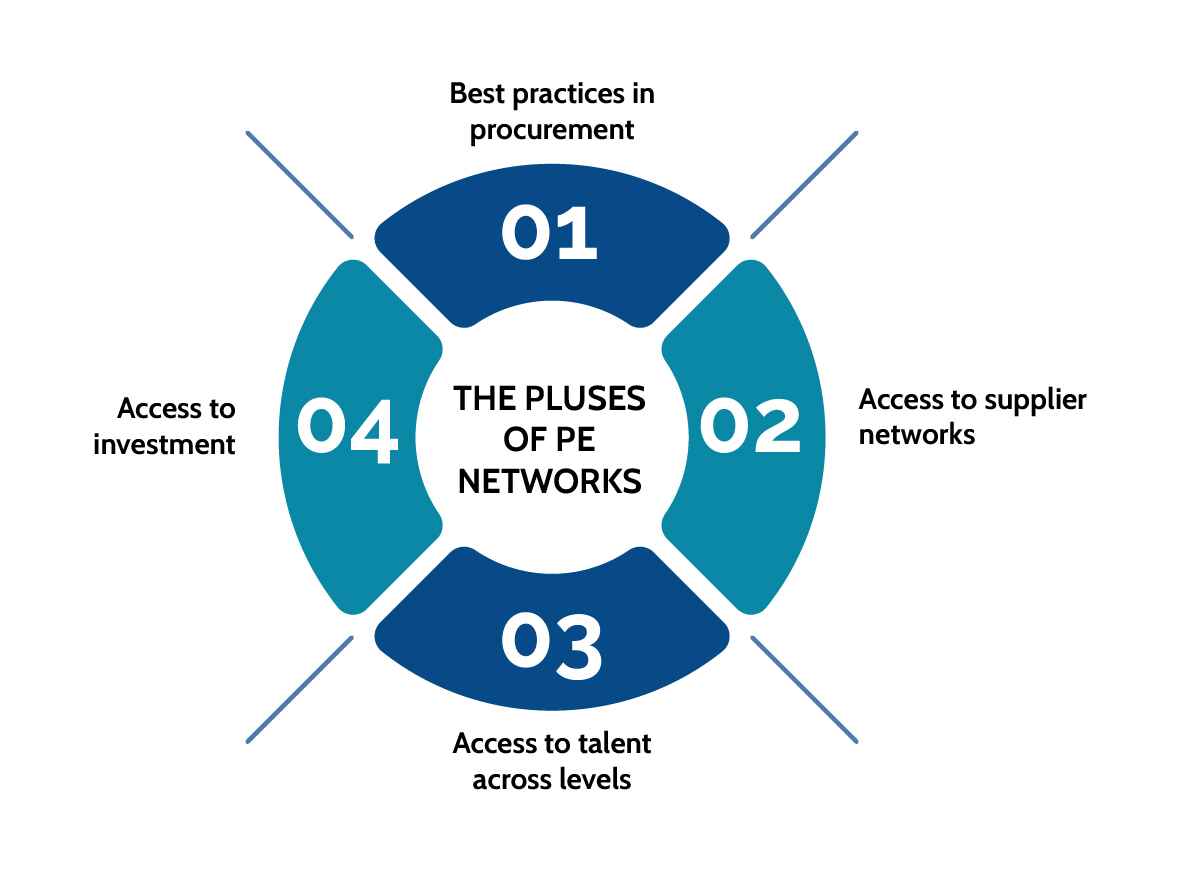

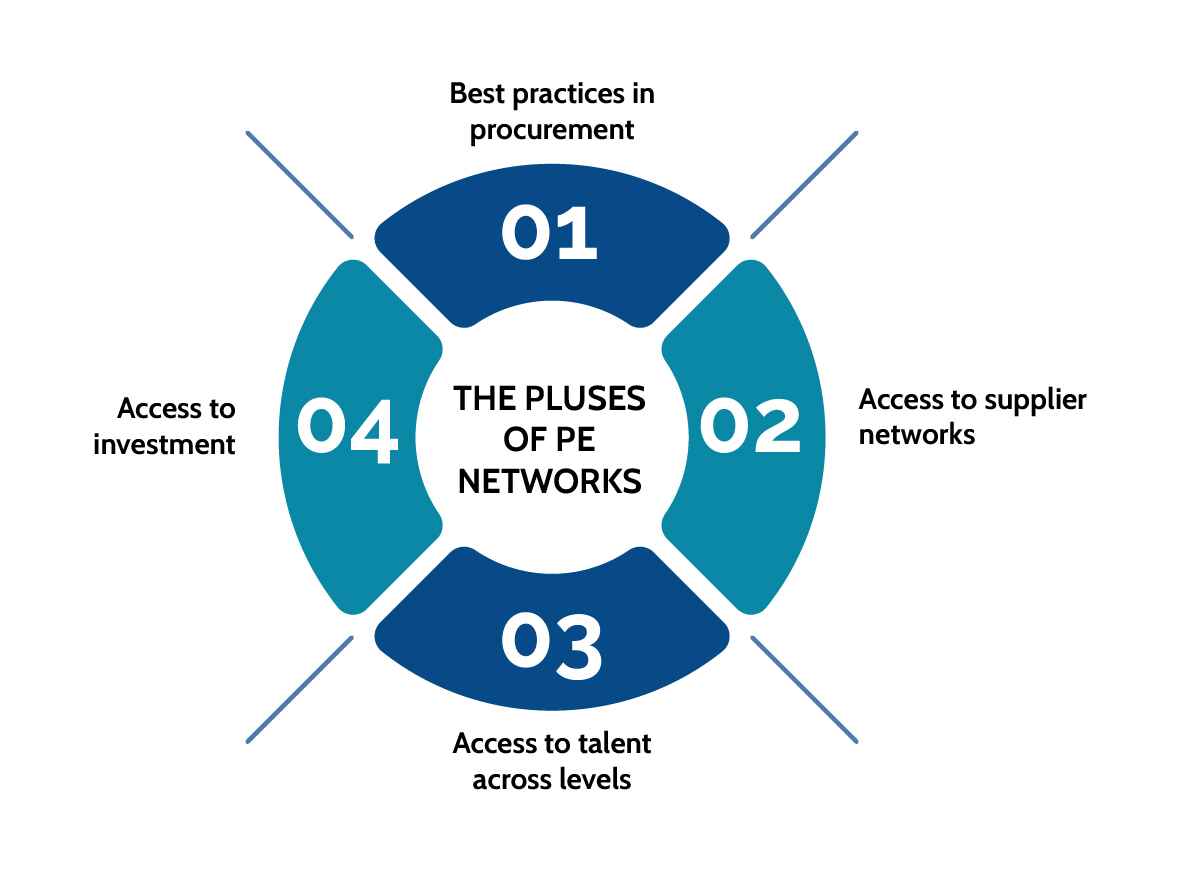

The pluses of PE networks:

Here are the advantages of being part of the network of a PE firm:

-

Best practices in procurement: often improving profitability by up to 20 percent

-

Access to supplier networks: for more resilient, strategic supply chain partnerships

-

Access to talent across levels: through a network of recruiters as well as by repositioning the company to attract more talent

-

Access to investment: through patient private capital that funds transformation toward Industry 4.0

Private equity has new opportunities to capitalize on.

Once the global economy steps out of the shadow of the pandemic, PE firms are likely to broaden their strategies for investment such that they leverage existing legislation as well as stay in sync with market trends (reducing the carbon footprint, shifting toward renewable energy, and more). They will seek sectors that fell out of favor but have strong underlying fundamentals. And with governments seeking to jumpstart economic growth, direct and supporting infrastructure investments will get a fillip.

The world of work has changed with a shift to remote work, more reliance on technology, and a bigger focus on healthcare. The investment focus is likely to shift, with traditional sectors being reassessed and consequently possibly seeing lower growth.

Key criteria to evaluate targets

-

Crisis resilience

-

Correlation of business model to economic cycle

-

Security of channels to access customers

-

Security of supply chains for raw materials

-

Workforce resilience

-

Enabling infrastructure

-

Societal value of the business

Technology, in particular, has played a major role, both in assisting healthcare workers in the fight against COVID-19 through tracing and treating people, as well as in facilitating virtual and online classes. Online retail and e-commerce could see much innovation, given how consumers have taken to these during the pandemic and are well attuned to their advantages.

Other possible growth areas include agriculture, financial services, food and beverages, and manufacturing. Climate change has pressured many countries across the globe into working toward a sustainable environment, and economies could focus investments toward low-carbon solutions and a more sustainable future.

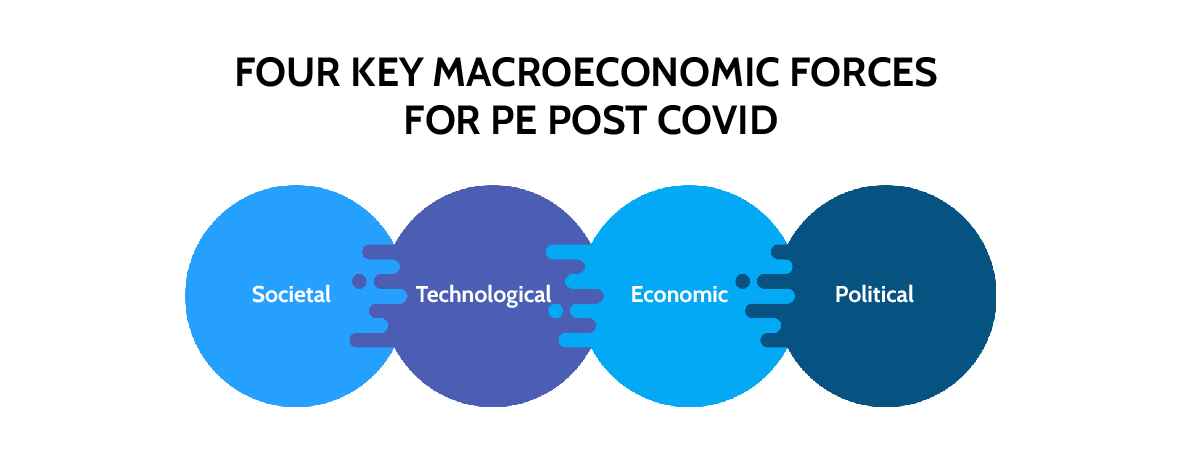

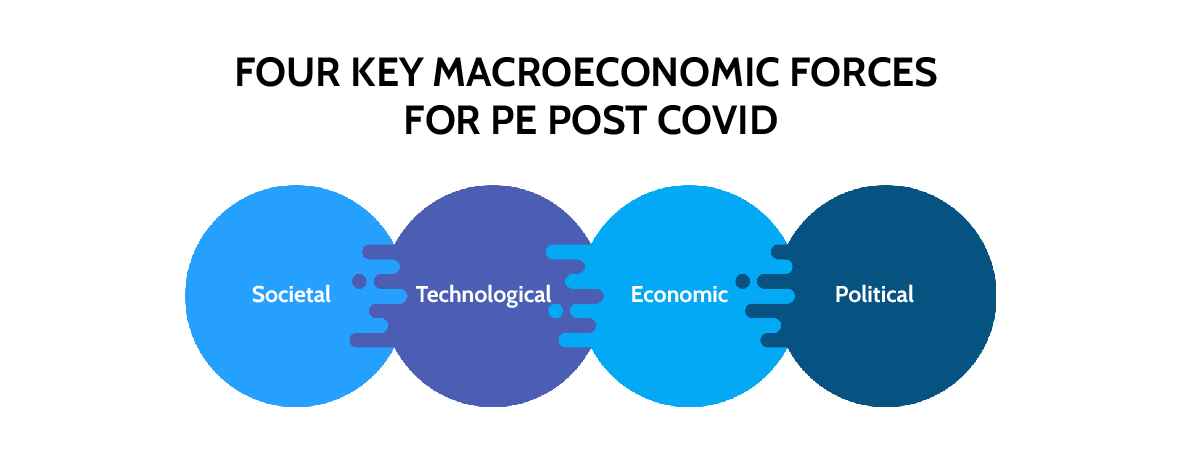

Four key macroeconomic forces for PE post COVID:

Given these opportunities, PE firms are emphasizing on the following macroeconomic factors:

-

Societal: Changes to consumer behavior and spending, plus societal trust

-

Technological: Speed of adoption, sources of innovation, openness toward sharing data

-

Economic: Resilience and recoverability of key markets

-

Political: Fiscal and monetary support, regulation of private and public markets

The last word…

The post-pandemic world should see economic activity return more broadly to normal levels. What positions PE strongly for aiding this recovery is how it can wait for the right moment to deploy funds and the higher control over investments. Active involvement in managing portfolio companies means effective steering during a crisis.

The lessons from the crisis will change where PE funds make investments, how they manage their performance, and how they engage with investors and portfolio companies. The PE industry has flown high on top of its attention to detail and opportunity for improvement, and given the unprecedented size and scope of the challenge that is the COVID-19 pandemic, PE should be up to the task!