August 2019 – the Office of the Comptroller of the Currency in the US voted to amend the Volcker Rule, seeking clarity on which security trades were allowed by the banks and which weren’t. Almost a year later, in June 2020, the Federal Deposit Insurance Corporation (FDIC) relaxed restrictions in the Volcker Rule.

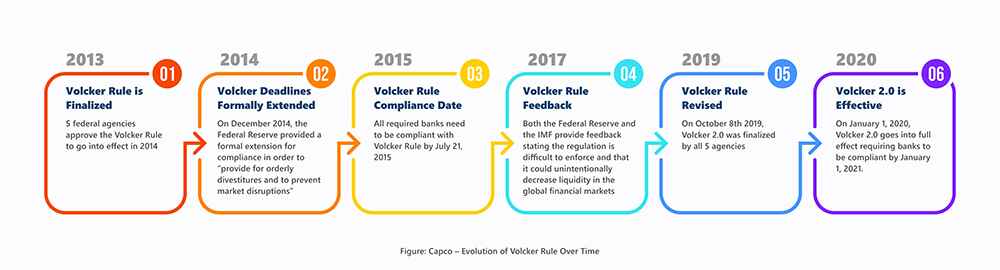

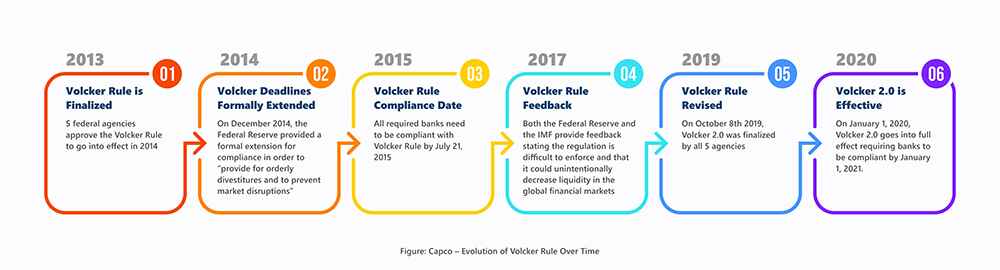

Amendments to the Volcker Rule aren’t new. Take a look at how it has evolved over the years.

How the Volcker Rule Impacted Investments

The Volcker Rule was introduced as a response to the 2008 financial crisis. It restricted banks from engaging in risky behaviors and said:

#1 Banks couldn’t engage in proprietary trading

Under proprietary trading, a bank uses its own money and not clients’ money for investment in securities. It invests on behalf of its clients. In return, it earns commissions or fees. While the profits go to the client, the bank is accountable for all profits or losses. This uneven equation makes the deal riskier for the bank and its depositors.

#2 Banks couldn’t own or invest in a hedge fund or private equity fund

“A banking entity may not, as principal, directly or indirectly, acquire or retain any ownership interest in or sponsor a covered fund.”

In the simplest terms, a covered fund is anything not stated as an investment company in the Investment Company Act. This includes private equity and hedge funds. Banks were allowed to invest a maximum 3 percent of their Tier 1 capital in private equity.

Amendments to the Volcker Rule

Though no change has been made in the definition of a covered fund, a few existing exclusions have been clarified or revised, and several new exclusions have been added. These include exclusions for venture capital funds, credit funds, customer facilitation vehicles, and family wealth management vehicles.

Now, a banking entity does not need to include the value of its ownership interests in 3rd-party covered funds.

In the words of Anna Pinedo, a partner at Mayer Brown (a global law firm), the recent amendments “allow a banking entity to engage in additional risk-mitigating hedging activities in relation to covered funds. A banking entity may acquire or retain an ownership interest in a covered fund as a hedge when the banking entity acts as an intermediary on behalf of a customer that is not itself a banking entity in order to facilitate exposure to the covered fund’s returns.”

A new standard on exceptions for riskless transactions has also been introduced. Recent amendments expand the ‘solely outside the United States’ or SOTUS exception. Foreign banks may depend on an exception to the covered fund for dealings outside the US.

Implications of the Amendments

Banks can now involve better with VC and private debt, and it is good news for PE enthusiasts.

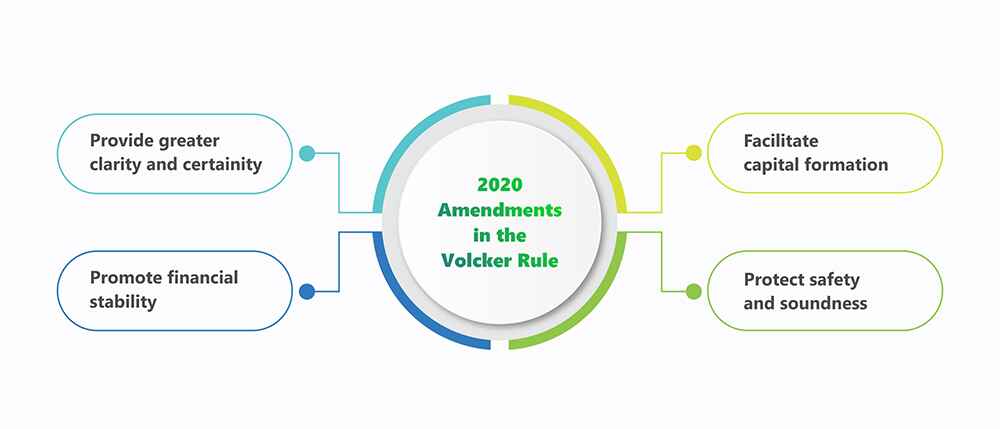

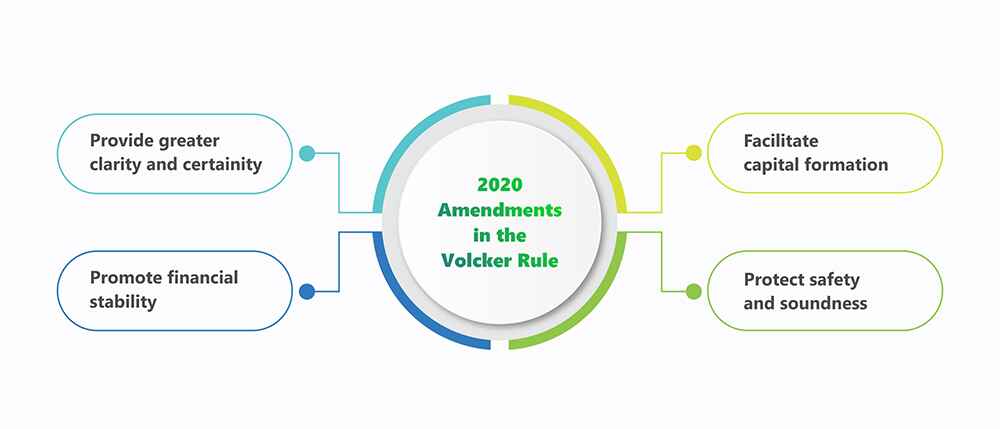

The amendments are helping to:

They will facilitate capital formation, protect safety and soundness, promote financial stability, and provide greater clarity and certainty.

Banking institutions and private markets will be working closely in 2021 and beyond.

How do you plan to benefit from this association?