Introduction

Financial statements are the foundation of decision-making related to private equity investment strategies. Companies interested in private equity value creation must understand these documents as they present complete information on an organization's economic health, which helps in investment decisions and other tactical activities. However, such insights are only helpful when properly analyzed and interpreted. So, viewing financial statements is a process that should be undertaken carefully and attentively.

The Strategic Importance of Financial Statements in Private Equity

Financial statements are the basis of private equity investment strategies, revealing the company's status. These documents are among private equity firms' most significant working tools, helping them evaluate potential investments and manage value-creation processes.

-

Guiding Investment Decisions: Balance sheets and income statements provide comprehensive information about an organization's overall profitability, financial flexibility, and productivity, all of which are important when considering investment opportunities.

-

Informing Value Creation: It is vital to provide financial information in order to establish how the value can be increased through cost improvements, increasing sales, and proper positioning of the company.

-

Vital Financial Statements: Private equity firms tend to focus on particular statements of financial reports they find helpful, and each type of statement serves different but unique purposes for analyzing the company's financial records.

Therefore, knowledge of financial statements enables private equity firms to use capital and credit to make sound investment decisions consistent with achieving strategic investment objectives.

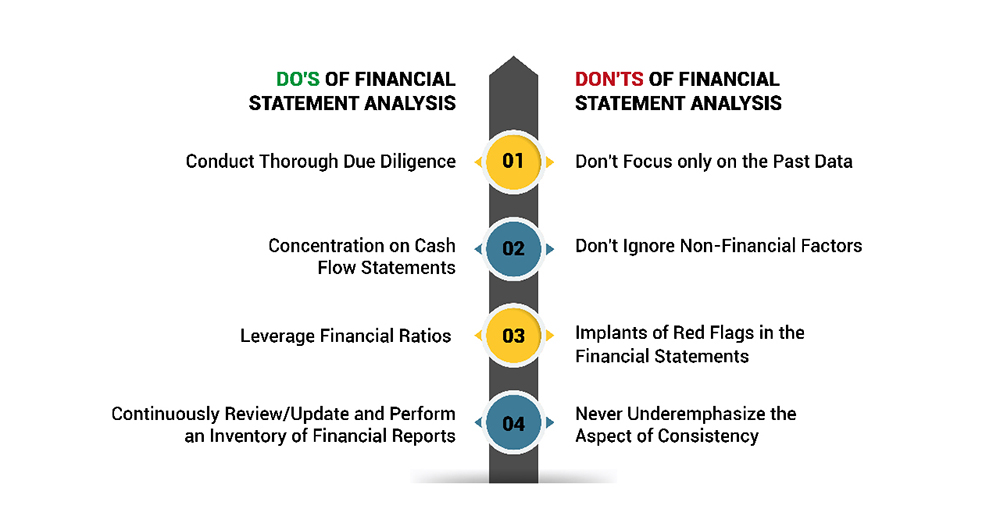

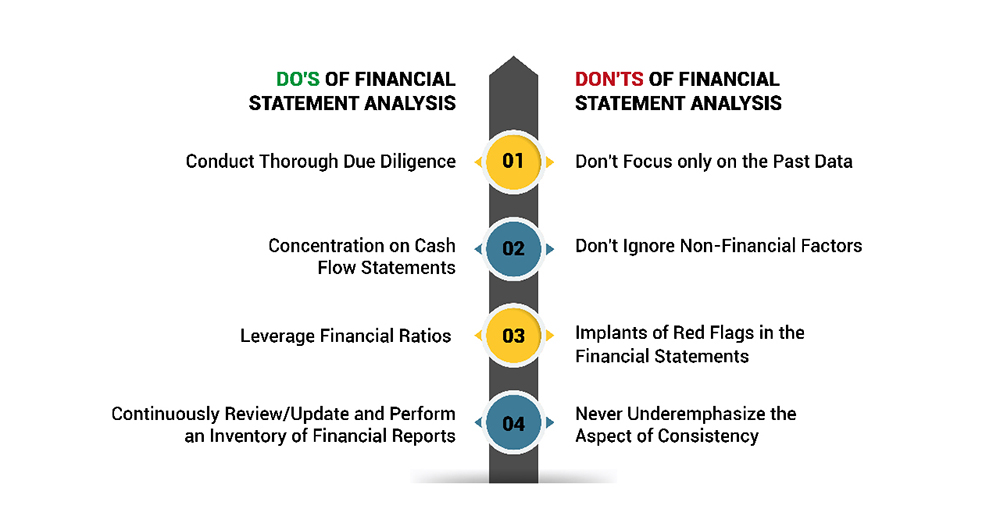

The Do's of Financial Statement Analysis for Private Equity Firms

In scrutinizing financial information of potential investments, private equity firms must follow the standard procedures to get the correct assessment measure and employ the right private equity investment processes. Here is key do's to follow:

-

Conduct Thorough Due Diligence

Potential investors must ensure they invest in projects after liaising with various parties to understand all the details to avoid massive losses. This includes careful evaluation of balance sheets, income statements, and cash flow statements to establish the actual financial position of the investment opportunity. The use of financial statements is important for risk profiles and to expose new risks and opportunities so that firms can make the right investment decisions.

-

Concentration on Cash Flow Statements

Cash flow statements are important when evaluating the financial position of a firm and its operations. These inform how efficiently a company uses cash to finance operations and expansion. Since the working capital measures how well a company can generate some money from its operations to sustain and develop more investment, focusing on cash flows is of the essence to private equity firms. Some markers that need to be examined are operating cash flow, capital expenditure and change in working capital.

-

Leverage Financial Ratios

Financial ratios are the best and fastest way to compare companies' performances. Information on profitability can be obtained from the return on equity (ROE), information on financial stability from the debt-to-equity ratio, and information on liquidity from the current ratio. These ratios assist private equity firms in formulating an investment decision meant for a specific company. Through these metrics, firms develop appropriate action plans consistent with their investment strategies and the vision and mission of the company about value creation.

-

Continuously Review/Update and Perform an Inventory of Financial Reports

Maintaining the genuineness and realism of the balance sheets and other statements is imperative. Reviewing client's financial reports and updating records periodically enhances the credibility of financial reports and is considered by investors. Auditing involves an examination of the business's account balances, distinguishing between proper and improper measurements to establish conformity to set accounting practices. This practice protects against frauds in financial reporting and facilitates the achievement of the transparency factor, which is essential in handling ester relations.

Such practices are helpful for private equity firms in improving their capacity to make efficient decisions about the investment portfolio, manage risks, and, therefore, foster the achievement of private equity value creation.

The Don'ts of Financial Statement Analysis for Private Equity Firms

Examining the financial statements is essential for private equity firms; however, there are some potential problems to consider. These mistakes could harm investment choices and private equity value creation. Here's a detailed look at what not to do:

-

Don't Focus only on the Past Data

Historical data helps analyze past trends. However, it should not be the sole determinant of investment decisions. This is somewhat limited since it needs to consider the present state of the market and potential developments. Therefore, private equity firms must use forward-looking indicators and industry trends to get the whole picture. Such data may not capture the present and emerging trends in business or markets, which are crucial for determining future outcomes and returns.

-

Don't Ignore Non-Financial Factors

Qualitative assessments should support financial statements. This means that non-financial factors, including management ability, market standing, and industry outlook, are equally important in determining a firm's real worth. These aspects should be noticed because their absence can lead to a partial assessment. For instance, a firm with good financial status may have poor leadership or an unstable market position, and this implies that the financial statements only show part of the problems that the firm is likely to experience.

-

Implants of Red Flags in the Financial Statements

Certain things in a company's financial statements should raise concern and alarm that may be detrimental to the investment. Some known red flags are problems related to revenue recognition, high debt levels, and disparities in cash flows. To avoid such issues, the following signs should be recognized. For instance, a sharp increase in revenue or abnormal accounting activities may indicate manipulation or business issues, affecting the success of private equity investment strategies.

-

Never Underemphasize the Aspect of Consistency

Financial reporting is an essential part of analysis, and thus, it should be consistent. The absence of consistency or frequent changes in accounting policies may hide actual performance and hinder year-to-year comparisons. Such situations raise concerns about an organization's internal controls or reporting procedures. It is therefore crucial to ensure the comparability of financial statements and compliance with the standard and accounting practices in assessing the creation of private equity value.

These are potential pitfalls that, if avoided, private equity firms can boost their analysis and develop better investment decisions that, in the long run, help create value.

Case Studies: Financial Statement Best Practices in Action

Using real-life examples may help us understand the use of financial statements in private equity strategies. Let us take an example of a private equity firm that analyzed the cash flow statements before investing in a tech startup. The firm focused on cash flow instead of profit, which allowed it to notice the lack of liquidity, make a better investment decision, and achieve private equity value creation.

Another example is a firm that used financial ratios to predict the future performance of a manufacturing company. Financial ratios, including debt to equity and return on equity, indicated the company's financial soundness and expansion prospects, thus leading to a profitable investment.

Key Takeaways:

-

Applying due diligence through financial statements can help avoid the following risks.

-

Cash flow analysis is essential in evaluating a company's cash position, liquidity, and financial position.

-

Financial ratios will help one predict the future profitability and efficiency of the financial management of a company.

These cases show the potential payoff of using the most effective financial statement analysis techniques for private equity investments.

Conclusion

Private equity firms must understand the various elements of financial statement analysis to facilitate effective investment strategies and deliver improved value creation. Thus, it is advisable that firms should pay attention to the quality of financial reporting in terms of accuracy, consistency, and completeness and avoid the pitfalls mentioned to improve decision-making and investment returns. Continued attentiveness and rigor in economic analysis are crucial to maintaining long-term success and gaining competitive edges in the private equity market.