Introduction

The Federal Reserve's rate cut represents a turning point for financial markets, explicitly affecting private equity operations in changing economic environments. The declining interest costs will transform how private equity firms establish interest rates through impacts on their fundraising processes and subsequent dealmaking and valuation assessments. This article examines the impact of rate cuts on private equity valuation and their transformational effects on acquisition methods and exit possibilities while revealing adaptive strategies during economic transition.

The Fed’s Rate Cut: Context and Rationale

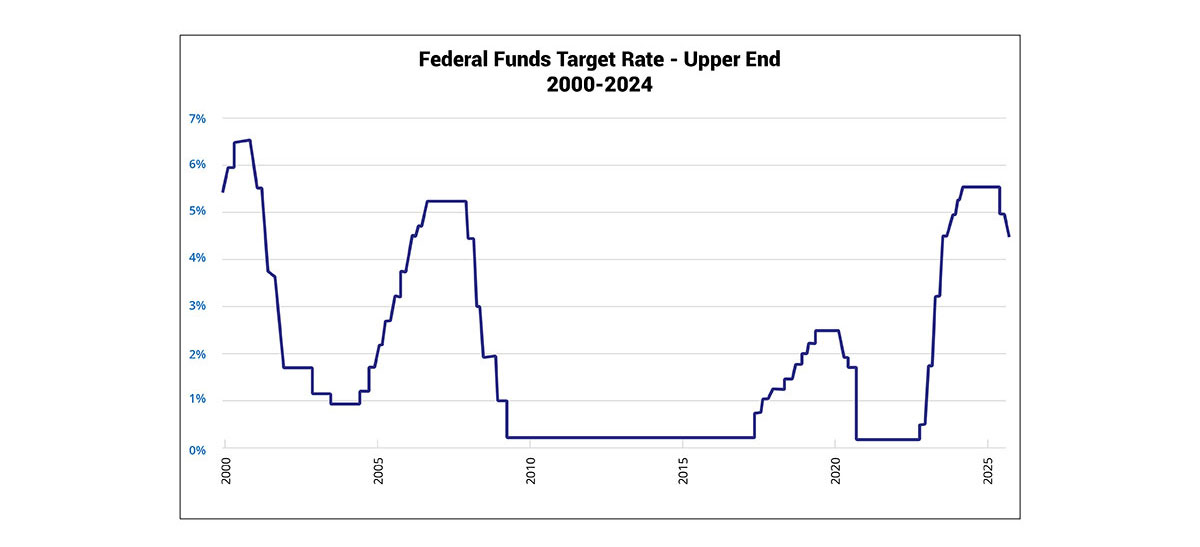

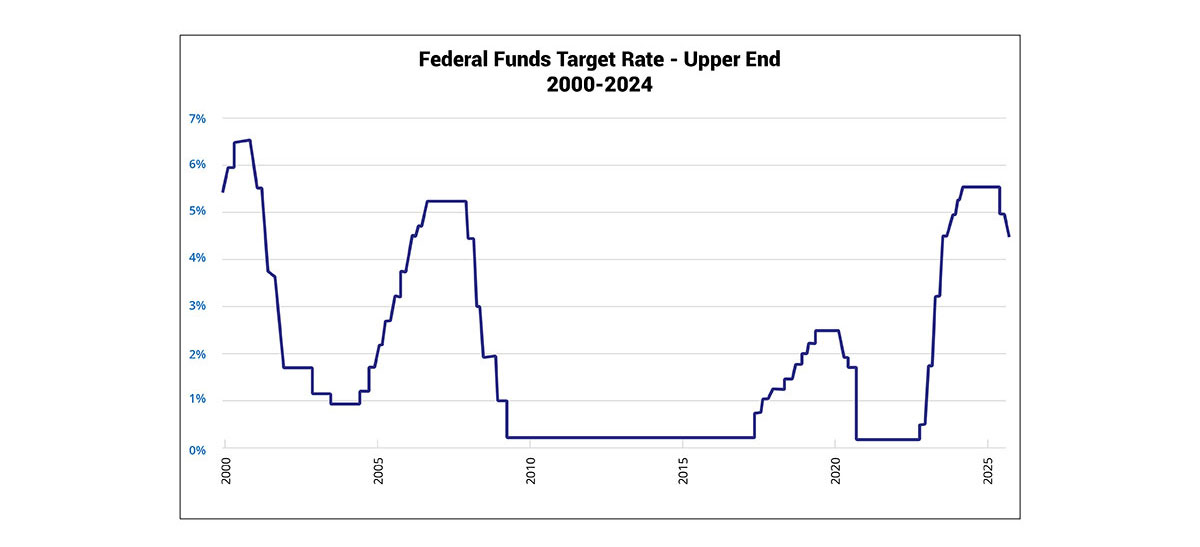

The Federal Reserve cut its federal funds target rate by 0.25% in December 2024 to create a range from 4.25% to 4.50%. After eleven consecutive rate increases between March 2022 and July 2023, the Fed finally decreased rates in December 2024. there are several key economic factors that influenced the Fed's actions:

-

Inflation Trends: Inflation continued above the Fed's preferred level of 2% despite improving since reaching its peak in 2022. In November 2024, inflation numbers from the Personal Consumption Expenditures (PCE) price index indicated 2.5% growth.

-

Labor Market Dynamics: Unemployment rates keep declining in the U.S., showing job sector stability. The 4.2% unemployment rate indicated labor market health during November 2024.

-

Economic Growth: Economic growth moved forward vigorously throughout the 2024 third quarter, reporting 2.8% growth.

The Federal Reserve's interest rate reduction demonstrates its plan for managing continuing inflation alongside maintaining economic development needs. Federal fund rate reductions from the Fed drive increased borrowing and investment, resulting in economic growth and expansion. The central bank closely monitors economic conditions, although it recognizes high inflation in an active job market. The Federal Reserve has announced a rise in caution regarding additional rate cuts, which will occur based on data performance and achieving its dual economic targets for maximum employment and price stability.

Source: U.S. Federal Reserve, January 29, 2025

Impact on Fundraising and Capital Deployment

Private equity fundraising and capital deployment are facing challenges due to the Federal Reserve's recent reduction in interest rates.

Enhanced Fundraising Prospects:

-

Increased Investor Appetite: When interest rates drop, private equity becomes more attractive as more investors seek higher returns than standard fixed-income investments.

-

Competitive Edge for Mid-Sized and Smaller Firms: Smaller and mid-sized private equity firms are more attractive because lower borrowing expenses enhance investor preference.

Capital Deployment Dynamics:

-

Cost-Effective Leverage: Private equity firms achieve more cost-effective acquisition financing because interest rates have decreased.

-

Improved Portfolio Company Cash Flows: Lower borrowing expenses enable better cash flow performance among portfolio businesses, enabling reinvestment and expansion opportunities.

-

Favorable Exit Environment: Lower interest expenses and strengthened cash flows provide an ideal setting for successful exits that reward private equity sponsors and limited partners.

Effect on Deal Structuring and M&A Activity

Private equity interest rates and M&A and deal structuring strategies experience substantial consequences from the Federal Reserve's current reduction of interest levels.

Influence on Acquisition Strategies:

-

Enhanced Borrowing Capacity: Private equity firms find acquisition financing more accessible thanks to declining interest expense. Firms exploited lower borrowing costs through increased leveraged buyouts after this debt rate cut became possible.

-

Shift in Deal Preferences: Adjusted expenses from financing enable private equity firms to consider expanding acquired businesses through larger and potentially riskier acquisitions because high leverage now presents less risk.

Financing Model Adjustments:

-

Debt vs. Equity Considerations: The favorable terms of debt financing allow firms to choose debt-heavy financial structures rather than equity-based approaches in low-rate environments. Organizations integrate this approach to improve returns but are highly sensitive to changing interest rates.

Competitive Dynamics:

-

Intensified Market Competition: Lower financing costs provide entry opportunities for additional companies to conduct mergers and acquisitions. High competition levels between firms lead to upward asset price movement and reduced potential return rates.

-

Valuation Pressures: The expanding number of market participants creates greater demand for desirable targets, driving up their valuation cost points and making it harder for companies to find suitable and affordable deals.

Sector-Specific Opportunities:

-

Industry Beneficiaries: The healthcare and technology industries have experienced increased M&A investments due to their ongoing growth and enduring business stability. Attractive market conditions have led private equity firms to invest deeply in these areas.

Valuation Adjustments and Exit Strategies

The Federal Reserve's recent action to decrease interest rates has significantly impacted private equity firms across private equity valuation processes and end-of-investment plans.

Valuation Adjustments:

-

Enhanced Valuations: Lower interest rates lower funding costs for companies, which decreases their acquisition expenses. Portfolio companies will experience increased purchasing power because of these conditions, thus leading to price increases and, ultimately, improved valuations.

-

Improved Cash Flows: Decreased interest expenses strengthen portfolio companies' cash flows, making them more attractive to potential buyers.

-

Revised Discount Rates: Reducing interest rates decreases valuation model discount rates, increasing present value calculations for projected cash flow streams.

Exit Strategies:

-

Favorable Market Conditions: The rate cut enhances economic performance through specific market changes facilitating business exits.

-

Strategic Sales: Decreased borrowing costs make acquisitions more accessible to strategic buyers, so private equity firms expand their chances of acquiring merchandise portfolio companies.

-

Initial Public Offerings (IPOs): The combination of market growth caused by lower rates invites improved equity value, allowing potential Initial Public Offerings so private companies could consider this an exit strategy.

-

Secondary Buyouts: Low interest rates are an excellent time for private equity firms to acquire new enterprises and expand their business portfolios.

Risks and Challenges in a Low-Rate Environment

The Federal Reserve's rate reduction creates new possibilities regarding private equity interest rates, simultaneously generating various uncertainties that investors must manage. Accomplished investors must understand these limitations to keep their returns dependable while preventing misuse of a low-interest-rate system.

Key Challenges include:

-

Potential Overvaluation and Asset Price Inflation: Lower debt costs result in more competing companies bidding on deals, pushing asset prices higher and causing potential market overvaluation. Because of this phenomenon, investors are more likely to experience reduced exit profits.

-

Tighter Deal Margins: The growing marketplace competition leads firms to take reduced margins for successful deals yet impacts on their overall profitability.

-

Increased Use of Leverage: Organizations accepting cheap debt financing may develop excessive debt,putting them at risk during market declines or when interest rates rise unexpectedly.

-

Reversal of Market Optimism: Market valuations and debt expense could quickly decrease when the Fed raises interest rates following inflation growth or economic transformation.

-

Sector-Specific Risks: Interest rate fluctuations can cause sudden market turbulence, affecting the price stability of vulnerable industries such as real estate or infrastructure.

Comparing the Impact on Growth Equity vs. Buyout Firms

Private equity interest rates induced by the Federal Reserve affect buyout firms and growth equity funds differently because these sectors manage capital differently, including exposure choices with debt instruments. The two industries use reduced private equity interest rates differently due to wide-ranging economic strategies concerning capital allocation risk profiles and investment returns.

Impact on Growth Equity Firms

-

Growth-stage companies find it easier to secure funds because interest rates fall, which decreases their capital cost.

-

High-potential companies benefit from these firms prioritizing revenue growth over limited profitability while getting access to lower-cost financing options.

-

Valuation values increase because reduced discount rates increase the projected earnings forecasts.

-

Better IPO exit possibilities appear more appealing to investors in public markets due to reduced financing expenses.

Impact on Buyout Firms

-

Organizations engaged in buyouts depend substantially on debt funding for their acquisitions, so decreased private equity valuations improve the availability of purchasing opportunities.

-

The availability of inexpensive leveraged buyouts lets firms compete more actively for acquisition targets, which may trigger higher acquisition prices.

-

Debt-heavy transactions become achievable through leverage, enabling firms to structure financing that utilize greater debt levels.

-

The decision to accept high-leverage acquisitions requires an examination of future interest rate risks because sudden upward adjustments could lead to portfolio fragility.

The improved capital access model becomes available to growth equity firms simultaneously with increased LBO opportunities for buyout firms. The sustainably low interest rates produce challenges and opportunities that business organizations must handle.

Long-Term Implications and Strategic Adjustments

The Federal Reserve's most recent rate reduction brings multiple long-term benefits for private equity firms, which demand proactive strategic frameworks to exploit future financial opportunities.

Strategic Adjustments:

-

Revaluation of Investment Strategies: Lower borrowing expenses could lead investment firms to raise leverage levels within acquisition deals while expecting improved fiscal performance. Potential financial risks, which correspond to higher debt holdings, must be addressed.

-

Focus on Interest Rate-Sensitive Sectors: Industry sectors sensitive to interest fluctuation patterns, such as state and utility, promise investment potential at low interest rates.

-

Adjustment of Return Thresholds: Private equity firms adapt their return expectations under low-rate conditions because alternative investments deliver lower bond returns, which makes equity investments comparatively more appealing.

-

Exploration of Alternative Financing: The combination of mezzanine financing and private credit allows firms to enhance optimized capital structure while developing mitigation strategies for interest rate market volatility.

Conclusion

Private equity faces a difficult balance between new possibilities and complex issues. Lower borrowing costs create better deal activity and valuation outcomes, though they also competition and increase the potential for overvaluation. Growth equity funds find capital at reasonable rates, but buyout firms operate in more constrained financial environments. Organizations must maintain adaptable tactics by synchronizing their investment commitments and asset sale plans with market sector changes. Modifying operations based on evolving regulations and monetary policy transformations results in sustainable business achievements.