Private equity funds have gained immense popularity in the world of finance and investment. They play a pivotal role in financing businesses, facilitating growth, and delivering substantial returns to investors. However, understanding the intricacies of private equity fund structure can be quite challenging, especially for newcomers to the field. In this comprehensive guide, we'll break down the fundamentals of private equity funds, their structures, different types, benefits, and much more.

What is a Private Equity Fund?

A Private Equity Fund is a collective investment vehicle that pools capital from various investors, such as institutional investors, high-net-worth individuals, and even pension funds, with the aim of making investments in private companies. Unlike publicly traded stocks, private equity funds invest in privately held companies that are not listed on public stock exchanges. The primary goal of these funds is to generate substantial returns over the long term by actively participating in the management and growth of the portfolio companies.

How are Private Equity Funds Structured?

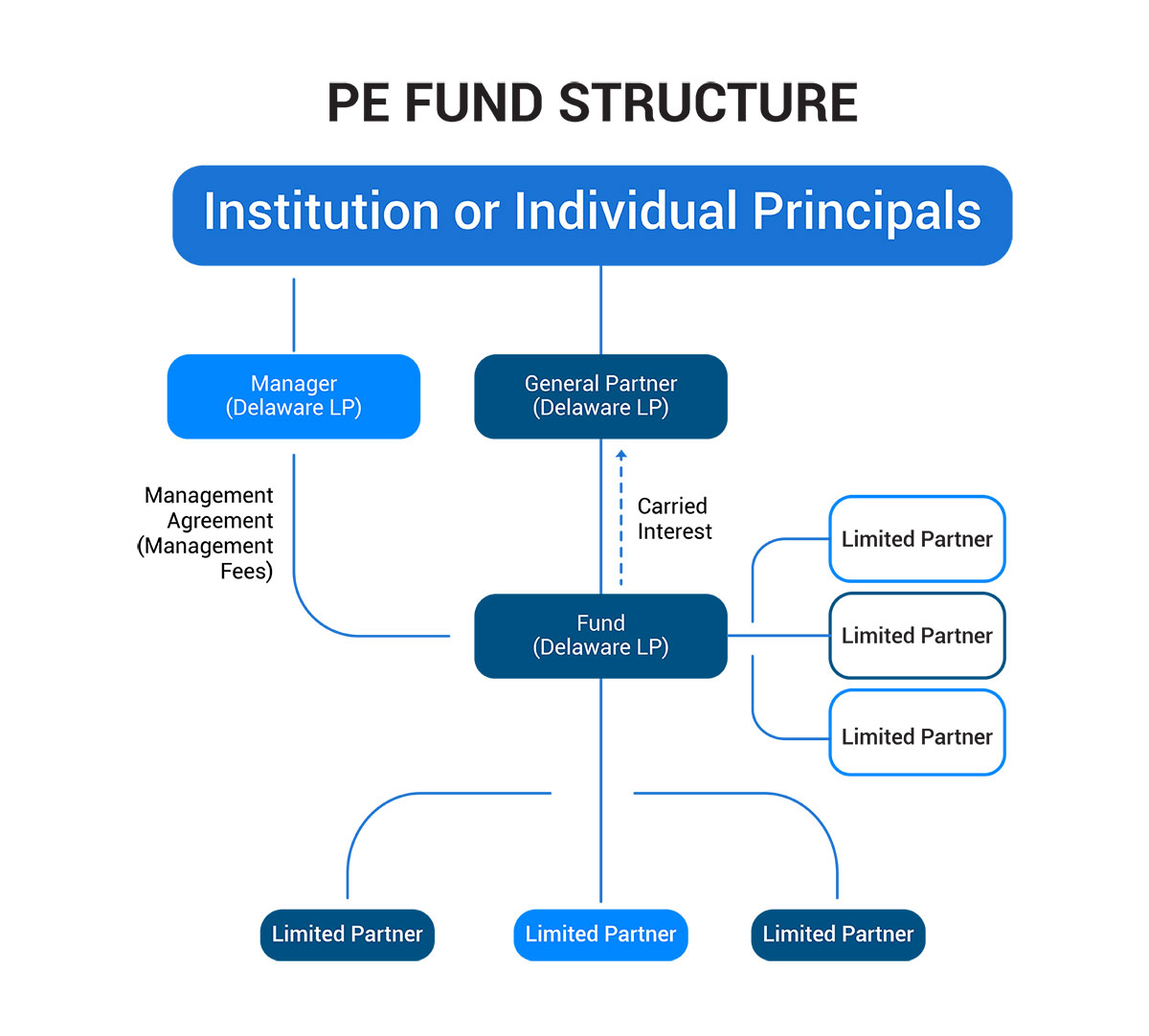

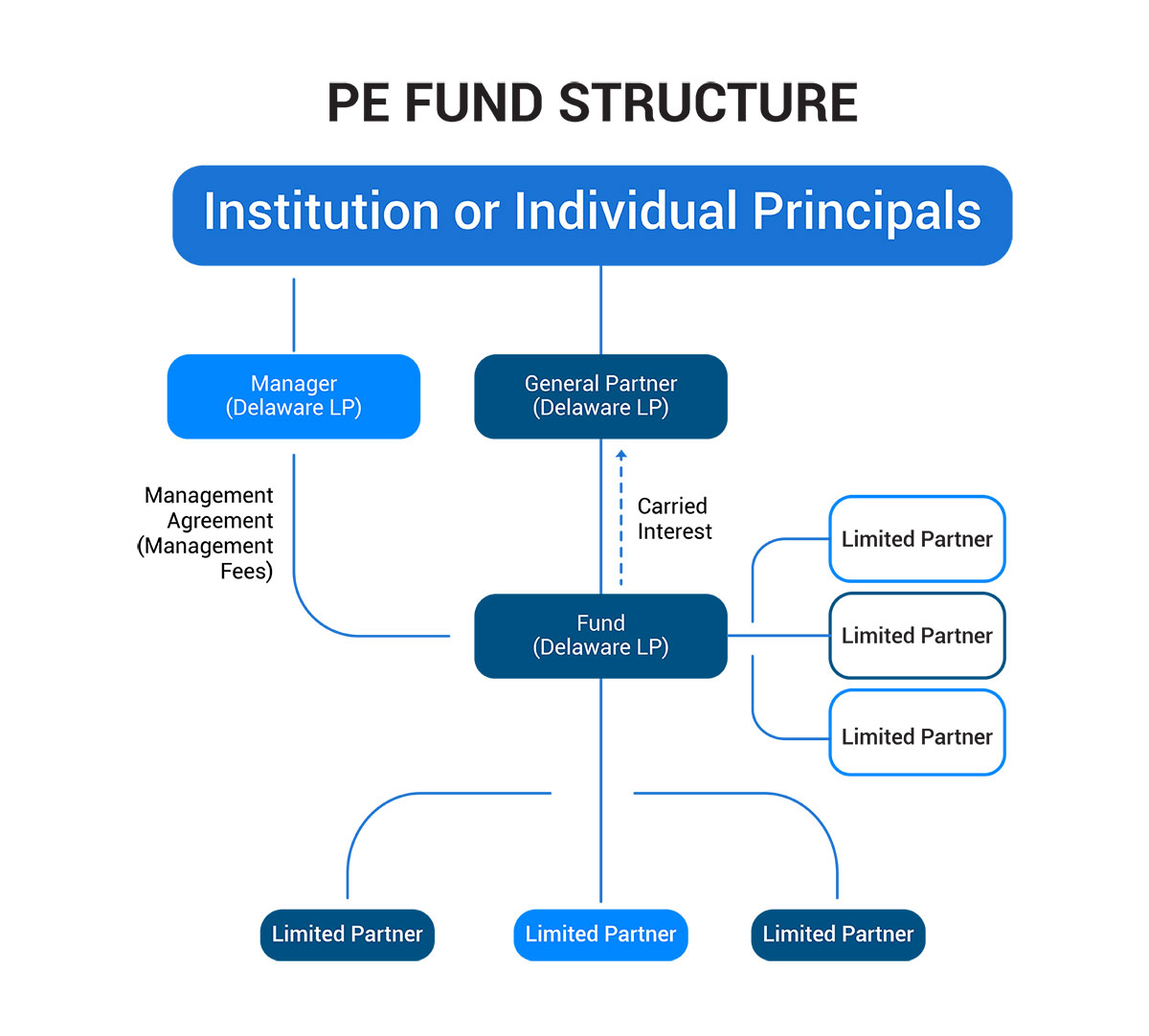

The structure of a private equity fund is crucial in determining how it operates and how returns are distributed among investors. Here are the key components of a typical private equity fund structure:

- General Partner (GP): The General Partner is typically an investment firm or a group of individuals responsible for managing the fund. They make investment decisions, select portfolio companies, and oversee the day-to-day operations. GPs also contribute their own capital to the fund, aligning their interests with those of the limited partners.

- Limited Partners (LP): Limited Partners are the investors who provide capital to the fund. They have limited liability, meaning their financial exposure is limited to the amount they have invested in the fund. LPs are passive investors and rely on the expertise of the GP to make investment decisions.

- Fund Structure: Private equity funds are typically structured as limited partnerships. The GP acts as the general partner of the limited partnership, while the investors become limited partners. This structure provides tax advantages and limits the liability of the LPs.

- Investment Period: Private equity funds have a specific investment period during which the GP actively seeks and makes investments in portfolio companies. This period is typically several years long.

- Harvesting Period: After the investment period, private equity funds enter the harvesting period. During this phase, the GP works to improve the performance of portfolio companies, increase their value, and ultimately sell them for a profit.

- Profit Distribution: Profits generated from the sale of portfolio companies are distributed among the limited partners. Typically, GPs receive a share of the profits as well, often in the form of carried interest, which is a percentage of the fund's profits.

Types of Private Equity Funds

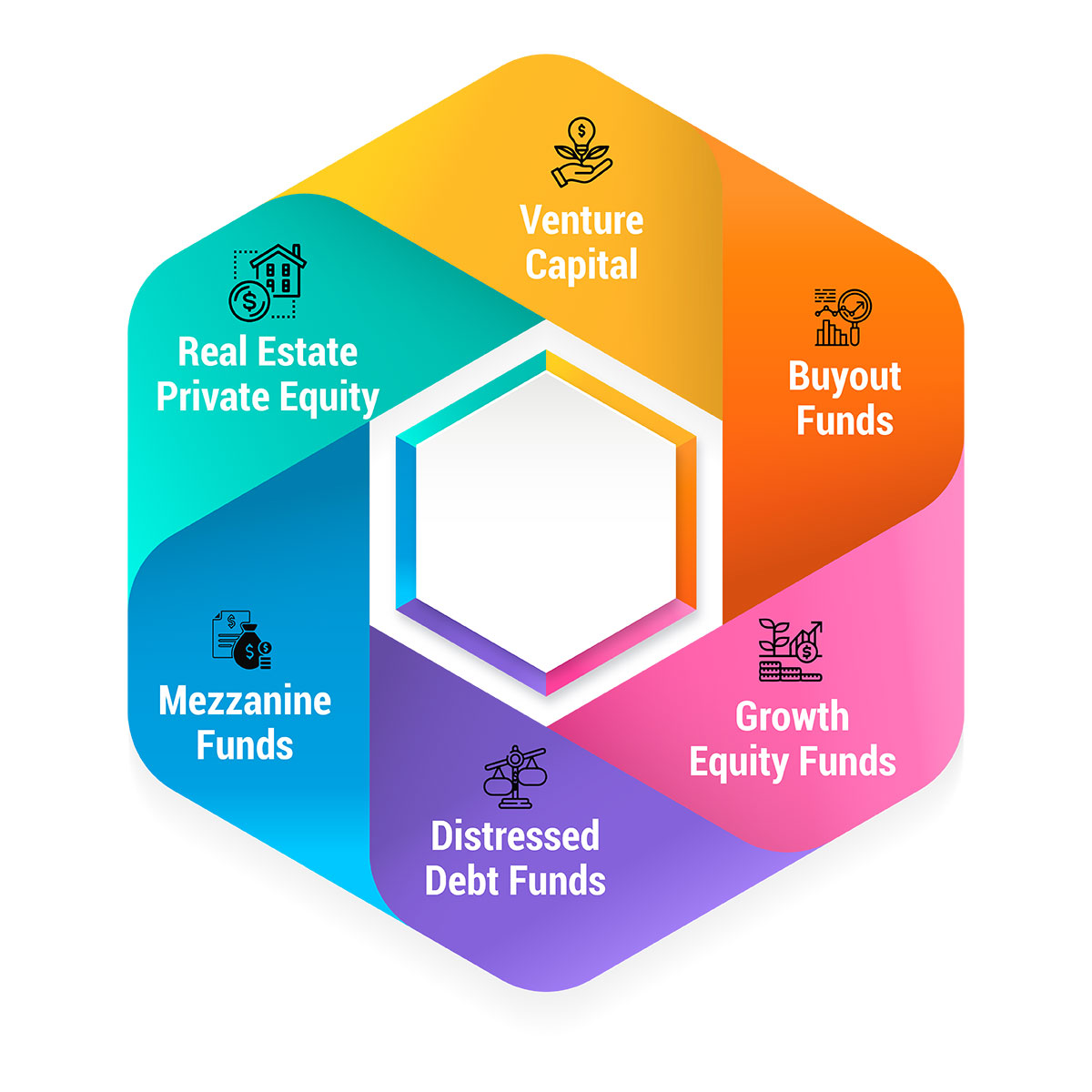

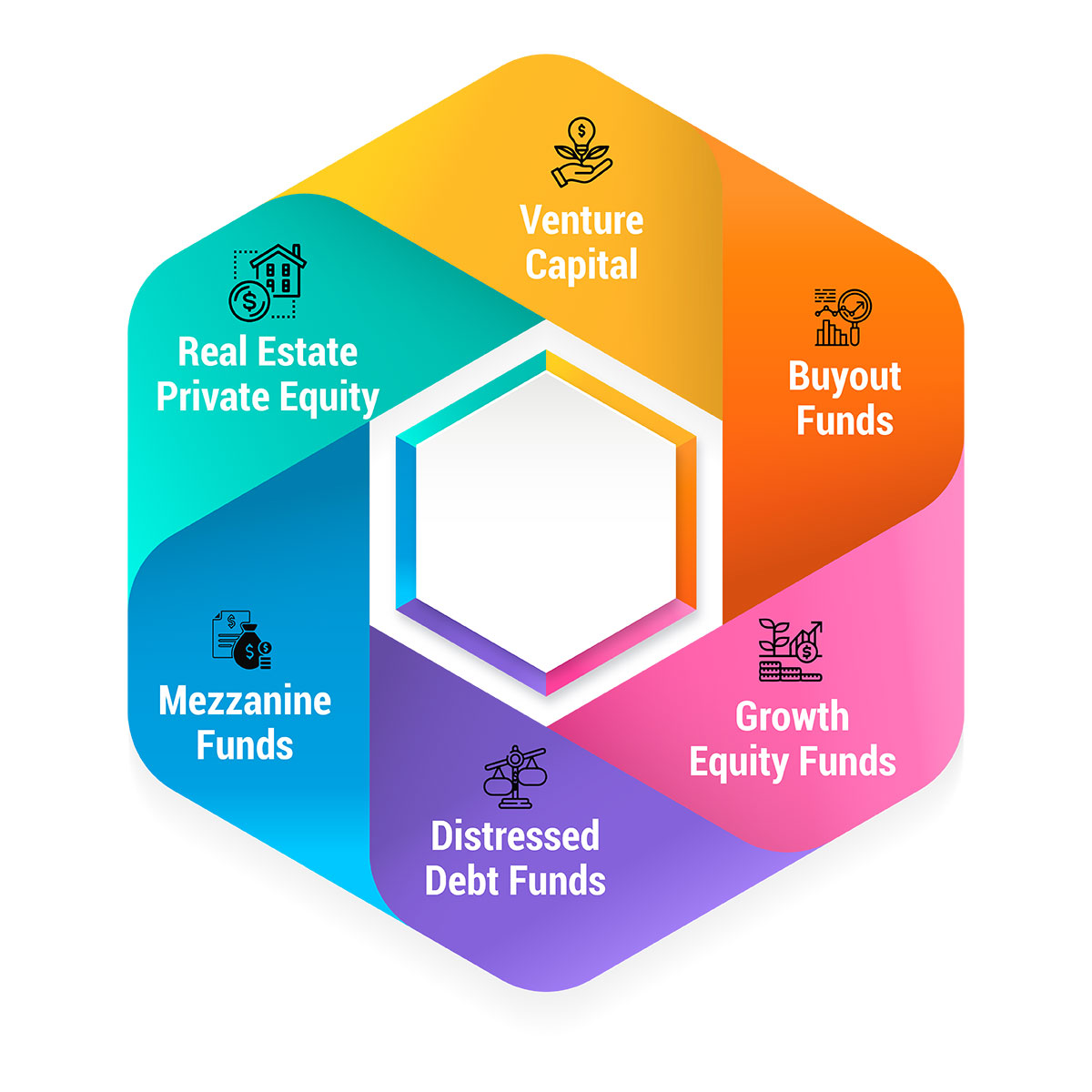

There are several types of private equity funds, each with its own investment focus and strategy:

- Venture Capital: Venture capital funds invest in early-stage startups with high growth potential. They provide funding to companies in exchange for equity ownership. Venture capital is known for its high-risk, high-reward nature.

- Buyout Funds: Buyout funds acquire established companies with the aim of improving their performance, increasing their value, and eventually selling them at a profit. Leveraged buyouts (LBOs) are a common strategy employed by buyout funds.

- Growth Equity Funds: Growth equity funds invest in companies that have already achieved a certain level of success but require additional capital to fuel their growth. These funds often take minority equity stakes in companies.

- Distressed Debt Funds: Distressed debt funds specialize in investing in the debt of financially troubled companies. They aim to restructure the company's operations and finances to turn it around and generate a profit.

- Mezzanine Funds: Mezzanine funds provide a combination of debt and equity financing to companies. They are often used to support acquisitions, buyouts, or growth initiatives.

- Real Estate Private Equity: Real estate private equity funds focus on investing in real estate properties and developments. They can be involved in various aspects of the real estate market, from residential to commercial properties.

Benefits of a Private Equity Fund Structure

Investing in a private equity fund offers numerous benefits for both investors and the broader economy, making it an attractive asset class. Let's delve deeper into these advantages:

-

Diversification: Private equity funds provide an opportunity for investors to diversify their portfolios effectively. By investing in a private equity fund, investors gain exposure to a diverse range of companies across various industries and stages of development. This diversification helps spread risk and reduce the impact of poor performance in any single investment. For individuals looking to balance their portfolios, private equity can be a valuable addition.

-

Active Management: One of the distinguishing features of private equity is active management. The general partners (GPs) of private equity funds are actively involved in the operations and strategic decisions of portfolio companies. This hands-on approach allows GPs to identify opportunities for growth, implement operational improvements, and enhance the overall performance of these businesses. As a result, investors may benefit from higher returns compared to passive investments in public markets.

-

Potential for High Returns: Private equity investments have the potential to deliver significant returns, especially over the long term. Since private equity funds typically have longer investment horizons than publicly traded stocks, they can focus on creating sustainable value in portfolio companies. The illiquid nature of these investments can lead to higher returns compared to more liquid asset classes, such as stocks and bonds.

-

Economic Growth: Private equity funds play a vital role in fostering economic growth. By providing capital to businesses, private equity funds support job creation, innovation, and expansion. This capital injection can be especially crucial for small and mid-sized enterprises (SMEs) that may face challenges accessing traditional financing options. As these businesses grow, they contribute to the overall economic development of regions and industries.

-

Alignment of Interests: The structure of private equity funds is designed to align the interests of the GPs with those of the limited partners (LPs). GPs often invest their own capital in the fund, demonstrating their commitment to its success. Additionally, GPs typically receive a share of the profits, known as carried interest, which is tied to the fund's performance. This incentivizes GPs to make sound investment decisions and actively work to maximize returns for LPs. The alignment of interests between GPs and LPs helps ensure that everyone is working toward a common goal: generating strong returns.

-

Impact on Underperforming Companies: Private equity funds often specialize in turning around underperforming or distressed companies. By injecting capital, implementing strategic changes, and improving operational efficiency, private equity can revitalize struggling businesses. This not only benefits investors by potentially increasing the value of their investments but also preserves jobs and strengthens the overall business ecosystem.

-

Access to Expertise: Investing in a private equity fund provides investors with access to the expertise and experience of seasoned investment professionals. GPs typically have a deep understanding of specific industries or sectors, allowing them to make informed investment decisions. This expertise can be invaluable for LPs who may not have the resources or knowledge to assess individual investment opportunities effectively.

The benefits of a private equity fund structure extend beyond the potential for high returns. Diversification, active management, economic growth stimulation, and alignment of interests are some of the key advantages that make private equity an appealing investment option. However, it's essential for investors to carefully evaluate their risk tolerance, investment goals, and the specific private equity fund they choose to ensure it aligns with their financial objectives.

Conclusion

In conclusion, understanding the private equity fund structure is essential for anyone looking to invest in this asset class. Private equity funds play a vital role in the financial landscape, providing capital to businesses and delivering attractive returns to investors. By grasping the fundamentals of how these funds are structured and the various types available, investors can make informed decisions and potentially benefit from the opportunities they offer.

FAQs

-

Q1: What is the difference between a hedge fund and a private equity fund?

A hedge fund primarily focuses on actively managing a diversified portfolio of investments across various asset classes, including stocks, bonds, and derivatives, with the goal of generating returns for investors. In contrast, a private equity fund primarily invests in privately held companies, often with the intention of actively participating in their management and increasing their value before exiting for a profit.

-

Q2: Can individuals invest in private equity funds?

Yes, individuals can invest in private equity funds, but they often need to meet certain eligibility criteria, such as being accredited investors or having a high net worth. Most private equity funds target institutional investors and high-net-worth individuals due to the significant capital requirements and illiquid nature of the investments.

-

Q3: What is carried interest in private equity?

Carried interest, often referred to as "carry," is a performance fee paid to the general partner (GP) of a private equity fund. It is typically a percentage of the fund's profits and is designed to align the GP's interests with those of the limited partners (LPs). Carried interest is usually paid to the GP after LPs have received their initial capital back and a preferred return.

-

Q4: Are private equity investments risky?

Private equity investments carry a degree of risk, especially given the illiquid nature of these investments and the potential for business volatility. However, they also offer the potential for high returns, and risk can be mitigated through careful due diligence, diversification, and selecting the right type of private equity fund that aligns with an investor's risk tolerance and objectives.

-

Q5: How can I invest in a private equity fund?

To invest in a private equity fund, you typically need to identify a fund that matches your investment goals, meet the eligibility criteria set by the fund, and commit capital to the fund. This often requires contacting the fund's general.